Profiting on the success of Tesla or Google… isn’t that tempting? The stock market gives you a chance at that, as well as a number of other opportunities to profit. We’ll tell you all about this goldmine so you get some insight into how to make money trading stocks. Simply put, a stock is a portion of ownership in a company. The market is filled with them, which opens the door to unlimited possibilities for trading online and making real money.

Companies issue stocks for different reasons, such as raising capital to fund side projects, expanding operations or simply generating more profit after gaining popularity. The stock market is a place where investors and traders meet to buy, sell or trade stocks of publicly held companies.

The main force driving stock prices is supply and demand. Stockholders cash in on a company’s profit in direct proportion to how much of the company they own. Let’s say, if a company issues 100 stocks and you acquire five of them, that means you own 5% of the company. If the company pays out $100 to all its stockholders in profits, you earn $5. However, this is a very basic scheme, and there are many others. The bottom line of trading is to make money on the stock market by buying at a low price and then selling (if you want to) at a higher price.

What are the stock market’s pluses?

- Transparency and safety. Buyers and sellers are assured of a fair price, since the stock market is public and regulated.

- Stability and high degree of liquidity. Stocks are generally liquid assets that can be easily converted to cash.

- High returns in practically no time. Participation in the stock market opens the potential for great and relatively quick gains compared to other investment decisions like opening a savings account with a bank.

- Easy trading process. It takes barely a few minutes to open a trade and start making money on the stock market by benefiting from price fluctuations. The main thing here is to choose a trusted broker.

- Going your own way. You can make any number of trades you want and pick any companies worth your attention. Stocks can be traded within seconds — all you need is a good internet connection.

What can be done with stocks on the stock market?

There are two main strategies to consider:

- Buy-and-hold investment. For some investments, you need to be prepared to stay patient in order to make money on the stock market. This is typically to reach specific financial goals over a long period of time (we’re talking years here) without lifting a finger after buying stocks. Those who opt for this type of passive income are usually also relying on nice quarterly bonuses called dividends, if the company in question is profitable.

- Trading stocks. When we’re talking about stocks trading, it means that stocks are purchased not as a form of investment, but as a way of making profit by taking advantage of fluctuations in stock prices — and the fluctuations depend on short-term market conditions. So, not all stock market participants are necessarily interested in owning part of a company or receiving dividends. Instead, they’re looking at how to make money trading stocks from a different angle: Seeking opportunities to open positions based on a stock price’s estimated movement in the near future.

Let’s discuss that second option in more detail.

What you need to know to start making money trading stocks

Do the research

Price movements in the stock market are governed by a variety of situational factors that are under no one’s control. If you’re looking into how to make money on the stock market, keep in mind that fundamental analysis helps to identify anything affecting an asset’s value — from global factors like the overall state of the economy to smaller triggers such as how talented a company’s management is.

So, make a habit of reading the news, as the stock market typically responds instantly. For example, in April 2022, Elon Musk became the largest stockholder of Twitter by purchasing a 9.2% stake in it. After this news broke, the company’s value rose sharply.

If you see the news right when it comes out, be quick to catch the moment, the resulting profit could be quite impressive.

Dramatic rise in the Twitter stock price this year

Since the most popular companies shown in Stocks Mode (we’ll introduce it in more detail below) on the Olymp Trade platform are often on the news, there are many opportunities for traders to turn a profit and make money on the stock market.

Use technical analysis

Stock measurement metrics are focused on a short time frame, like when a stock is expected to outperform for a week, a day or even an hour so the buyer can immediately capitalize on a market opportunity. Technical analysis can help a trader decide the right entry and exit points as well as pick the right stocks. You can find different handy chart patterns or indicators to help determine your next move. It is always beneficial to use a combination of indicators rather than relying on just one.

Olymp Trade offers a number of tools for technical analysis so you have all the instruments at your fingertips to make the right decisions. Before you dive deep into the question of how to make money on the stock market, however, it’s really important to get acquainted with the theory first, that’s why Olymp Trade offers so many training and educational materials for all those who are interested.

Don’t be greedy, but don’t be afraid

While trading stocks, fear and greed should be avoided at all costs, since these are the factors most affecting the decisions of a trader. Discipline (like following fixed entry and exit points) can stop you from acting impulsively or following the herd mentality to make money on the stock market.

Follow the market’s direction

The market is live, and its behavior cannot be predicted with 100% certainty. Occasionally, no matter how carefully you read the technical indicators pointing toward a bull market, they can still be wrong. If the market is clearly moving outside your expectations, it’s better to call it a day and stop your trade to prevent bigger losses.

Trading stocks with Olymp Trade

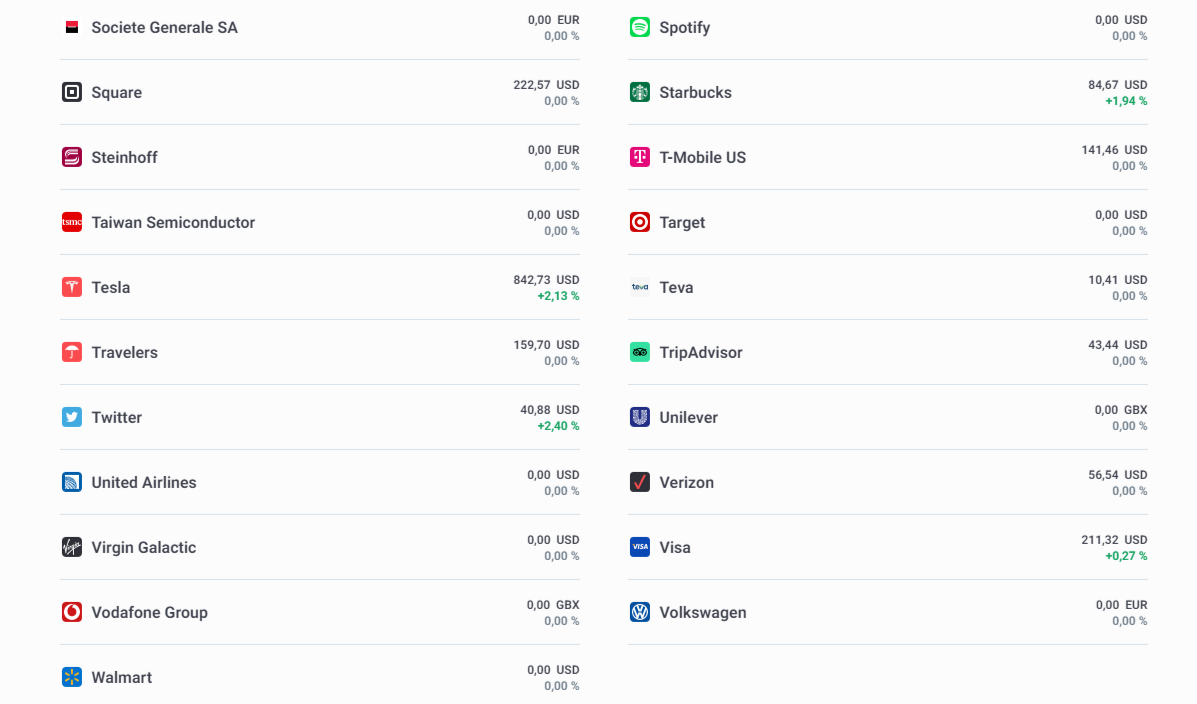

Olymp Trade offers ways to profit from stock trades and make money on the stock market if you choose Stocks Mode. There are now over a hundred different stocks from across the globe to choose from on the platform. Stocks include real giants — blue chip companies such as Meta (Facebook), BMW, Starbucks and others — contributing billions of dollars to the market cap. Stocks Mode offers an extended list of stocks that are unavailable in other modes on a platform, like Forex and Fixed Time Trading modes, where you can also trade stocks.

The wide range of stocks offered on Olymp Trade

Benefits of Stocks Mode

- No high commissions. Olymp Trade sets no commission for trading in this mode other than the sale success fee. It is calculated as a percentage of the income received by a trader (the value differs from stock to stock, but it is usually a tiny fraction of a percent). If you lose, you won’t have to pay anything — no fee is charged.

- Trading on a trend. Stock markets are usually trending markets, where price is generally moving in one direction. All you need to do to make money on the stock market is find a strong rising trend. From there, the market will do everything by itself. You can either buy and hold these stocks, or sell them sooner once the price rises to fit your expectations.

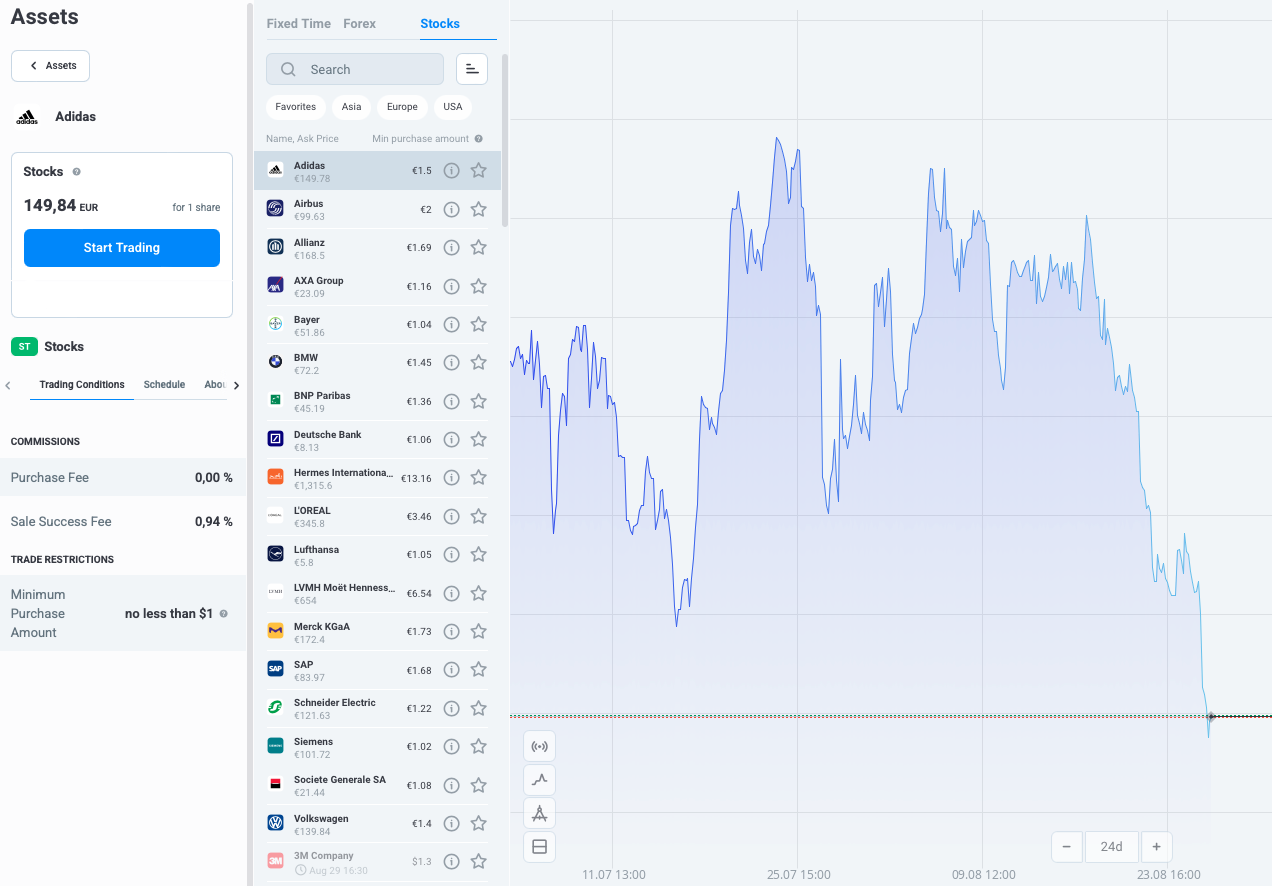

- Easy and straightforward algorithm. Olymp Trade’s Stocks Mode offers an intuitively clear interface that is easy to deal with even if you’re seeing it for the first time. The chart shows the real market’s movements, so all you have to do (after you’ve read some news and learned about the strategies) is push one of the two suggested buttons: Up or Down.

How does Stocks Mode work for you to make money on the stock market?

In this mode, we’re trading units. The price of the unit is relative to the price of a selected stock, and profit is derived from price increases. If a stock’s price goes down, that doesn’t necessarily mean that you have lost out from the trade. You only lose if you sell a stock at a lower price than you purchased it at. So don’t be in a hurry to get rid of a stock, sometimes it’s wiser to wait it out. Try to predict the trend using different indicators and strategies.

To open a trade, you need to select a stock and make sure the balance in your account is enough to fulfill the minimum trading amount (which is as low as $1). Let’s say Adidas is trading at €149 per stock. You don’t need to buy the whole stock to start the trade, just a fractional unit of 1% (or €1.49) is enough.

Trading stocks in Stocks Mode is possible on any budget

Once the trade is opened, you can see it in your portfolio. If the price movement prediction was correct — congratulations, you are on the right path! Now you may either hold your stocks to use them for further gains if the upward trend seems stable, or sell them for a sure profit.

It makes sense to diversify your investments by opening positions on different stocks. Try various approaches, engage in trading a range of stocks and watch your profits tick upward.

Trade smart

If you’re really interested in how to make money on the stock market, take advantage of available resources such as professional articles right here on Official Olymp Trade Blog, the guidelines right on the platform, the Help Center, or video reviews on our YouTube channel and continue sharpening your trading skills.

Build a strong trading portfolio by applying the different strategies you can master on Olymp Trade to make money trading stocks, and secure yourself a solid passive income.