The market has fallen sharply this year, and investors have seen losses. Question: Can defensive stocks help hedge against risks? What are their advantages? Should I consider buying them? If yes, should I immediately fill my entire portfolio with defensive stocks? Defensive stocks help protect the portfolio from heavy drawdowns. They fall into the category of save-haven assets together with certain currencies and gold.

What are defensive stocks?

In unstable times, investors are in no hurry to part with defensive stocks. Such securities sink less, and some could grow even in a bear market. But there is also a downside. When the economy is developing, the growth potential is much lower. Defensive stocks are securities of stable companies that make a profit regardless of the state of the economy or overall stock market.

As a rule, this is a business related to essential goods and services, which are always in demand. For example, if a person struggles financially, they may give up on their vacation or a new car, but they won’t probably cut down on medical expenses, food, or electricity.

One can’t name particular features to define a defensive stock. There could be many criteria. But, there are some shared features — a huge market cap, regular dividends, and stable fundamentals. Defense companies have stable profits and dividends. Usually, these are companies related to utilities, medicine, and essential goods. Their financial flows do not depend much on the economy. There is a constant demand for their products.

Which assets best protect a portfolio from a market crash?

Defensive stocks are less volatile than the general market and fall less during a crisis. On the other hand, low volatility also means low upside potential. Therefore, defensive stocks underperform in a rising market. And if you build a portfolio of defensive stocks only, it will be a more conservative strategy and low profits.

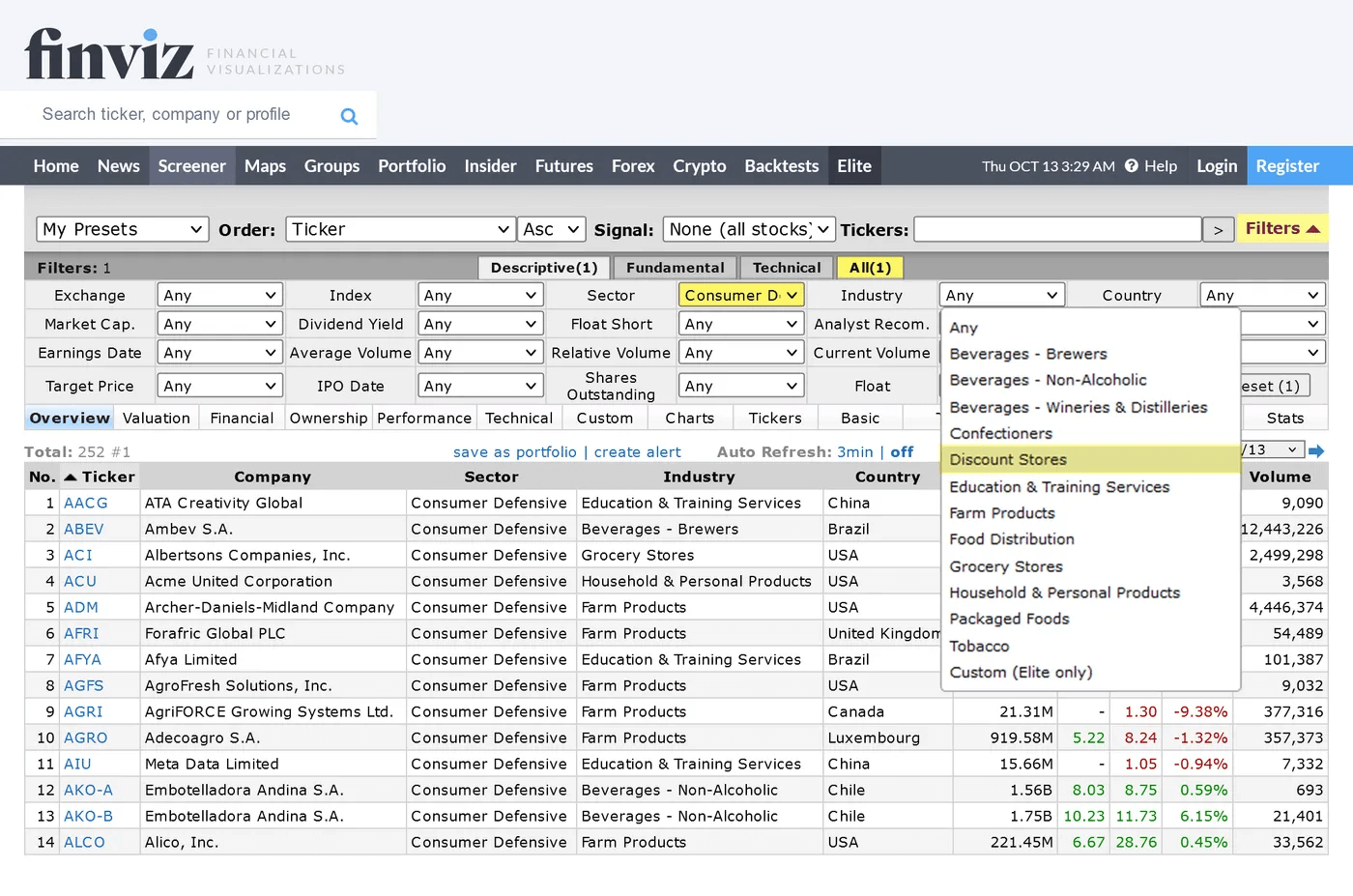

You can use screeners to sort stocks and find defensive ones. In the Finviz screener, for example, you can sort companies by sector and industry. For example, you can select discount stores:

Enjoy trading and earning money on a day-to-day basis!

Open a trading account and trade currency pairs, crypto, stocks, indices, etc. If you’re engaged in day trading, long-term trends don’t influence your trades. You don’t need long-term forecasting and long-term strategies. This goes for currency, stocks, and other assets!