Bitcoin fluctuates around $30K and has crossed that line daily in one way or another over the past 12 days. A 3.5% increase in the day’s results on Thursday turned into another pullback on Friday morning. Ethereum has strengthened by 3.5% in the past 24 hours, finding itself pegged at $2000.

Other altcoins in the top 10 gained between 0.4% (Solana) and 5.5% (XRP). Total cryptocurrency market capitalisation, according to CoinGecko, rose 3.1% overnight to $1.28 trillion. The Bitcoin Dominance Index rose 0.1% to 44.8%. By Friday, the cryptocurrency fear and greed index is unchanged at 13 points (“extreme fear”).

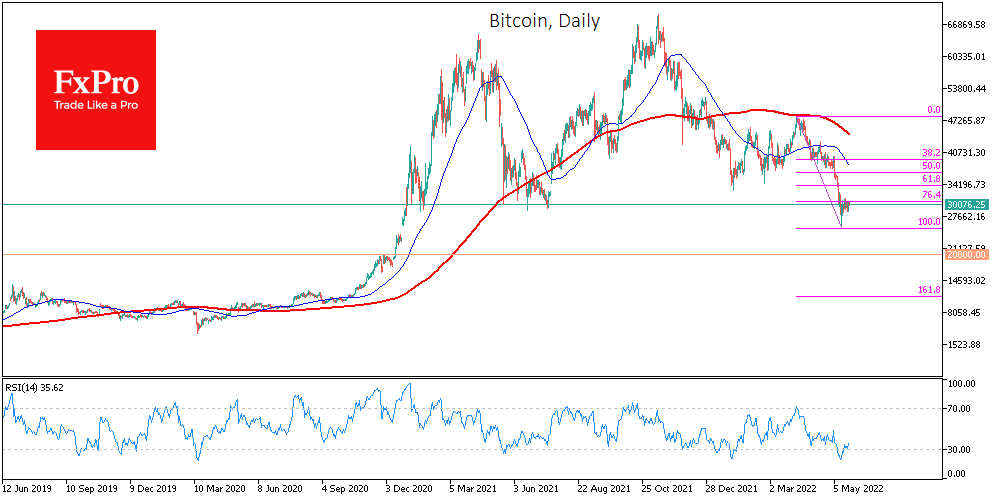

Bitcoin and the entire cryptocurrency market’s protracted tug-of-war promises to resolve with a strong move in one direction. However, there is hope for both bulls and bears. The latter has a minor advantage, as we saw this area touch down from above in January and June-July 2021. But now, all the fighting is concentrated below. Among the crypto news that caught our eye: MicroStrategy CEO Michael Saylor said his company would buy bitcoin at any price until it reached a million dollars.

Bitcoin’s drop below $30,000 last week came after a large volume of the cryptocurrency entered exchanges. According to IntoTheBlock, traders have sent around 40,000 BTC to exchanges since May 11. According to an audit report by accounting firm MHA Cayman, USDT stable coin issuer Tether Holdings Limited reduced its reserves in the commercial papers by 17%, improving the quality of its funds.

The Ethereum development team said it would migrate the Ropsten test network to the Proof-of-Stake (PoS) consensus algorithm on June 8 2022. According to the legislation, SEC chief Gary Gensler has warned that the regulator is ready to take new measures against unregistered cryptocurrency companies.

The US Commodity Futures Trading Commission (CFTC) believes that amid a rise in cryptocurrency crime, the watchdog must strengthen regulation of digital assets to crack down on fraud and manipulation.