Bitcoin changed little over Wednesday and is trading slightly below $20K on Thursday morning, keeping the controversy at bay, which is now a defining moment for the cryptocurrency market. Ethereum lost 5.1% in 24 hours to $1090. Altcoins in the top 10 fell from 0.7% (Tron) to 8.5% (Solana). The exception was Dogecoin (+0.9%).

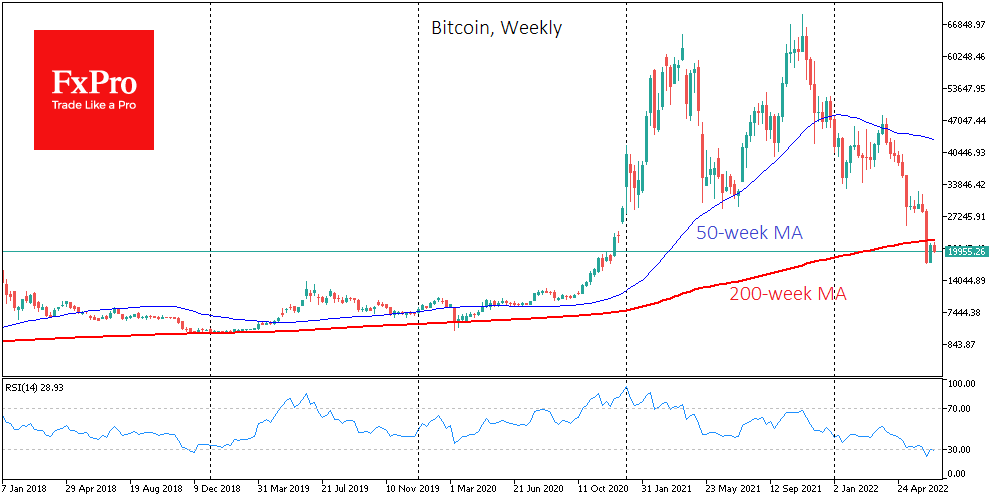

The Cryptocurrency Fear and Greed Index was down 2 points to 11 by Thursday and remains in a state of “extreme fear”. Total crypto market capitalisation, according to CoinMarketCap, sagged 2% overnight to $891bn. Market capitalisation without Bitcoin falls back to 500bn, where it briefly fell from mid-month. The hypothesis that the crypto market is holding above the highs of the previous peak continues to pass an important test. This applies to Bitcoin with its protracted test of 20k and to altcoins, whose total capitalisation is now near past peaks, at the start of 2018.

MicroStrategy has bought an additional 480 BTC at an average price of around $20,817, CEO Michael Saylor said. As of 28 June, MicroStrategy owns 129,699 BTCs purchased for $3.98bn at an average price of $30,664. Against the backdrop of the first cryptocurrency’s collapse, the company’s loss from bitcoin holdings exceeded $1bn.

A court in the British Virgin Islands has liquidated hedge fund Three Arrows Capital (3AC), headquartered in Singapore. Founded in 2012, the hedge fund had raised tens of billions in investments in the crypto market but suffered losses of at least $400m in the last year when it liquidated its stock positions.

Investment firm Cypherpunk Holdings sold all its assets in bitcoin and Ethereum amid a falling market. The total proceeds from the sale of the cryptocurrencies amounted to almost $5 million.

The current crisis in the cryptocurrency industry will benefit the industry and weed out those who don’t belong in it, American rapper Snoop Dogg said.

A survey by Alto found that nearly 40% of Americans aged 25 to 40 prefer to invest in cryptocurrencies rather than traditional financial instruments. In terms of appeal, digital assets have almost equalled equities.