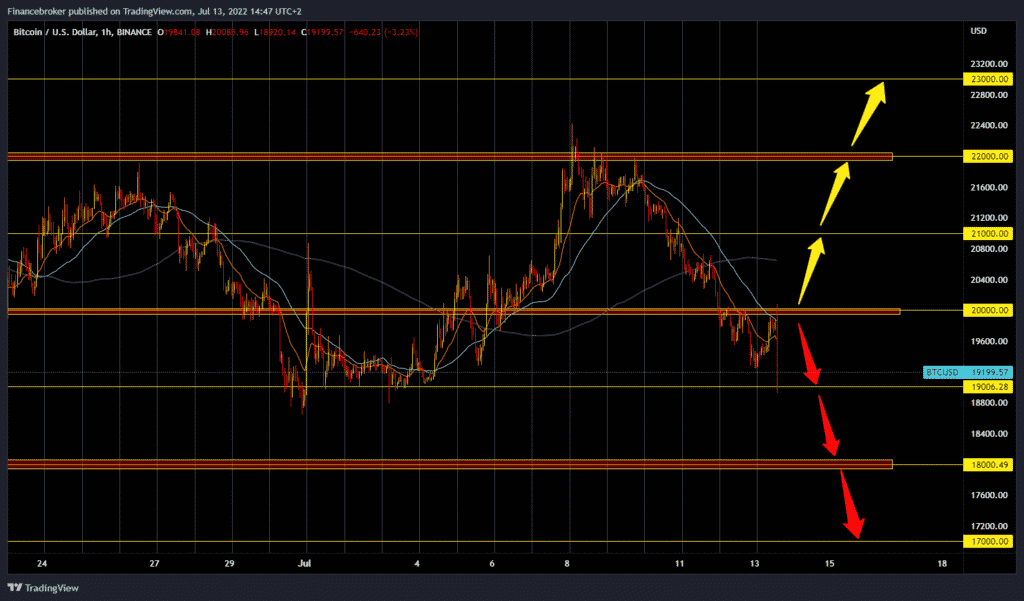

Since the beginning of the day, the Bitcoin price has been recovering from yesterday’s low of $19,240. We have already climbed up to $19880 and will soon test the $20000 level again. If the price of Bitcoin rises above and sustains for a certain period, then there would be an opportunity for continued recovery. The next target is the $21000 level, the place where it would be good to see the following holding of the price of Bitcoin. If we succeed in that, we would have a chance to see a further continuation towards the $22000 resistance zone of last week.

We need a negative consolidation below the $20,000 level for a bearish option. After that, the price would move towards the $19,000 July support zone, and the potential lower targets are the $18,500 and $18,000 levels.

The price of Ethereum continues its bearish trend, and today’s obstacle is the $1100 level. Inflation data in the United States is at a record high level, a sign that the Fed will soon raise its interest rate. The price of Ethereum is already close to retesting the $1000 level, and if the fear continues, we will see a price break below. Our next target supports at $900 from the middle of June. If we stay above $1000 now, we could see a new bullish impulse.

Market overview

Crypto miners in Kazakhstan under new tax hit. The President of Kazakhstan signed the Draft Law on the Application of a Differentiated Tax Rate Based on the Energy Consumption of Crypto Miners on July 11. The new bill amended the state law on taxes and other mandatory payments to the budget. Tax rates start as low as 1 KZT per kilowatt-hour (approximately $0.002) and increase based on the amount of electricity consumed for mining during a given tax period.

Even mining farms that use renewable energy sources cannot escape the new tax law, and even though they have the lowest tax rate, they will still pay 1 tenge per kilowatt-hour. Kazakhstan’s cold climate and rich coal mines made it suitable for mining activities. As of August 2021, Kazakhstan accounts for 18.1% of the global hashrate, making it the second country with the highest mining activity.