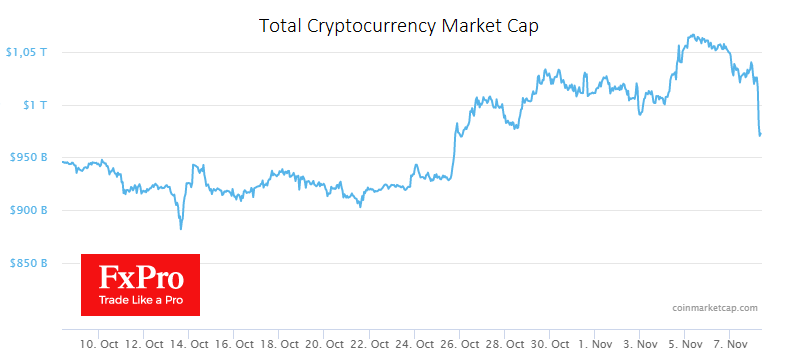

The crypto market has lost over 5% in the last 24 hours, pushing capitalisation back below $1 trillion. The steep fall in FTT affected Bitcoin and Ether and has pulled a significant market spectrum. Bitcoin is now trading at $19.8K, with the most substantial losses coming in the Asian session, filled with algorithmic traders, pushing the price back to $19.4K at one point. It is noteworthy that a sell-off did not follow the sell-off in the first and second cryptocurrencies in the markets.

Once again, we are forced to guess whether crypto reflects the internal risk attitude of the financial markets or whether we have seen a short-term technical sell-off. In the former case, market sentiment will worsen during the day. In the second, BTCUSD will redeem during the day and further confirm the market's reversal to growth.

According to CoinShares, investments in crypto funds declined last week after a slight increase the previous week. Outflows amounted to $16m compared to inflows of $6m a week earlier. Bitcoin investments fell by $13 million, and Ethereum rose by $3 million. Investments in funds that allow shorts on bitcoin fell by $7 million. Investors have shown a lack of enthusiasm over the past eight weeks, CoinShares noted.

News background

Former MicroStrategy head Michael Saylor called bitcoin a "hope" for Lebanon, whose national currency has fallen 96% against the dollar, and inflation has reached triple digits. The Middle Eastern country has been in a deep financial crisis since 2019. Twitter's new owner, Elon Musk, plans to postpone temporarily or entirely shut down the development of some of the projects announced by the previous administration, including, reportedly, work on a cryptocurrency wallet. The news has hurt Dogecoin, which has been growing in hopes of becoming the social network's digital currency.

According to Reuters, UK bank Santander will block transactions on cryptocurrency exchanges in 2023 to protect consumers from fraud. Mining companies are being forced to sell off cryptocurrency mining equipment at a massive discount to cover losses from a falling market, The Wall Street Journal reported.