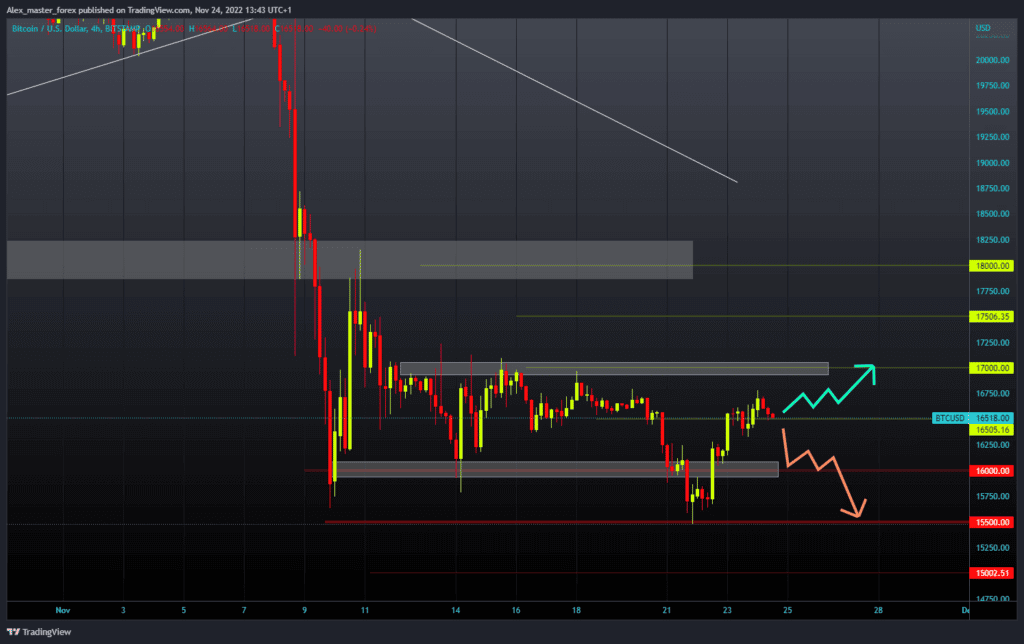

Bitcoin price is slowly climbing, forming a new weekly high this morning at the $16750 level. This week’s new high was this morning at the $1215 level. Bitcoin price is slowly climbing, forming a new weekly high this morning at the $16750 level. Since then, we have been in a minor pullback to the $16,500 level, and now we will try to find new support here for further recovery. Yesterday’s low was at the $16300 level, which could be our limit for determining the future trend. For a bullish option, we need a positive consolidation and a new test of the $16750 level. A break above and subsequent bullish impulse could take us to the $17000 resistance level.

The previous time we were there was on November 15. For a bearish option, we need a negative consolidation and a drop below yesterday’s low. If we stay down there for longer, it will increase the bearish pressure, and we will see a further drop in the price of Bitcoin. Potential lower targets are the $16,250 and $16,000 levels.

Ethereum analysis

This week’s new high was this morning at the $1215 level. The price was not long there, and now we see a pullback to the $1195 level. Now we are monitoring how the current consolidation will take place, whether it will start a further decline or consolidate around the $1200 level. For the bearish option, we need a continuation of this negative consolidation and a drop to yesterday’s support zone around the $1150 level.

A price break below would intensify the bearish flow, which could lead to a continuation of the descent to the next lower support around the $1100 level. for a bullish option, we need a positive consolidation and a move above the $1200 level. Then we need to hold up there and continue the growth of the price of Ethereum with the next impulse. Potential higher targets are the $1225 and $1250 levels.