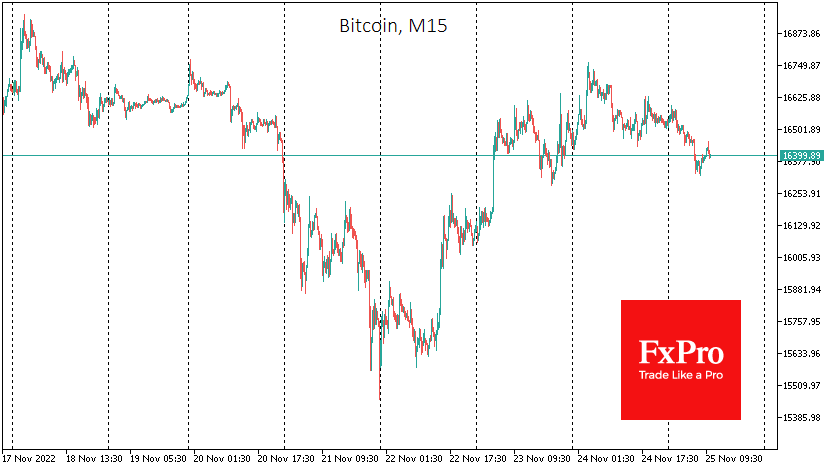

Bitcoin failed to build on the gains, rolling back to the levels of two days ago, losing 1.2% in the past 24 hours to $16.5K. Global markets have been quiet due to US holidays and few meaningful economic publications, allowing the cryptocurrency to continue balancing in a tight range for almost two weeks. The cryptocurrency market's capitalisation fell by 1% to $827bn overnight. Without a solid positive stock index performance, crypto has nowhere to draw strength for future purchases.

Bitcoin has failed to exploit the inverted head-and-shoulders pattern fully. Perhaps the reason for that is the lack of big players due to the holidays. However, the chances are high that it is still because of the ongoing cautious selling in the sector: the big players continue to reduce their positions, probably forgetting about it again for a couple of years.

News background

The New York Times reported that the troubled cryptocurrency lender Genesis Global Capital is not ruling out bankruptcy. Genesis has hired investment bank Moelis & Company to explore options, including filing for insolvency. Ripple chief technology officer David Schwartz said the community was unlikely to learn a lesson from the FTX collapse and would be cautious going forward. Changpeng Zhao, head of Binance, allowed for the possibility of buying FTX assets. In an interview with Bloomberg, he said that some of them could still be saved.

The 10,000 BTC stolen from the Mt.Gox exchange, which has been dormant for seven years, is on the move. Ki Young Ju, a crypto analyst and head of CryptoQuant, made the announcement. In doing so, he commented that it was criminal money. The transaction was the largest since August 2017.