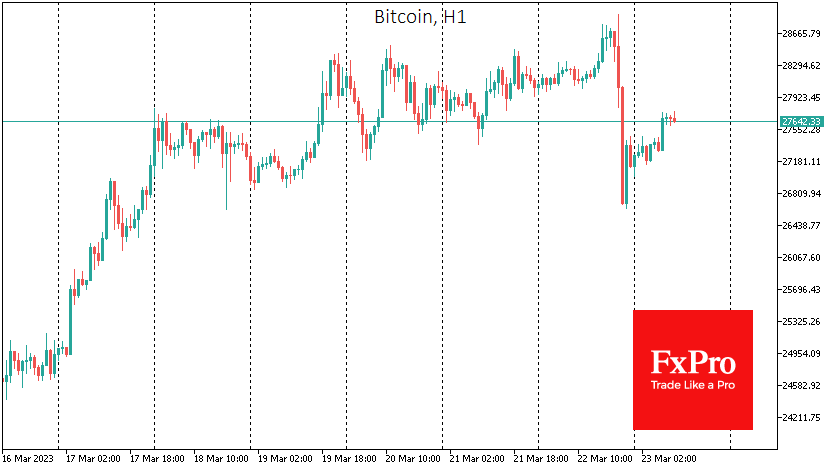

Bitcoin had a smooth climb on Wednesday, only to plunge into the abyss. The top cryptocurrency soared to $28.9K immediately after the Fed's comments but tanked almost 8% from its high of $26.6K after Yellen's remarks. It was a panic sell-off following the stock indices, whose losses were triggered by the Treasury head saying that full deposit insurance was not on the table.

The fact that BTCUSD has already recovered more than half of its losses suggests that cryptocurrencies are distancing themselves from the stock market's problems. Comments from top financial officials disrupted a nice short-term technical picture - a triangle forming. However, a sell-off at the end of the day allowed the market to let off steam and clear local overbought conditions. The return of buyers on the dip below $27,000 and near previous local lows suggests that the market remains bullish.

XRP jumped 20% on the increased likelihood of a settlement in the SEC case against Ripple. In a similar case involving the sale of the VGX token to the Binance.US exchange, a judge rejected the SEC's request that the token is a security. This precedent hasn't gone unnoticed by Ripple's lawyers.

News background

Real Vision CEO Raoul Pal says that ideal conditions are now in place for bitcoin to take its place alongside gold as a true safe-haven asset. BTC could reach $50K within a year amid the banking and economic crisis in the US, Pal suggested. Cryptocurrencies do not meet stated use cases and pose general risks to investors and financial stability, according to the president's annual economic report to Congress. Claims that crypto assets are an effective means of savings and payment do not stand up to scrutiny, the report's authors say.

CNBC reported that Swiss banks are facing an enormous flood of US cryptocurrency banking requests, citing insiders. This has been influenced by Switzerland's decision to accept digital assets as a legal part of the financial system and create a "Crypto Valley" region with tax incentives for core companies.

Telegram added support for Tether (USDT) transfers. Users can now send leading stablecoins to each other directly in Messenger chats.