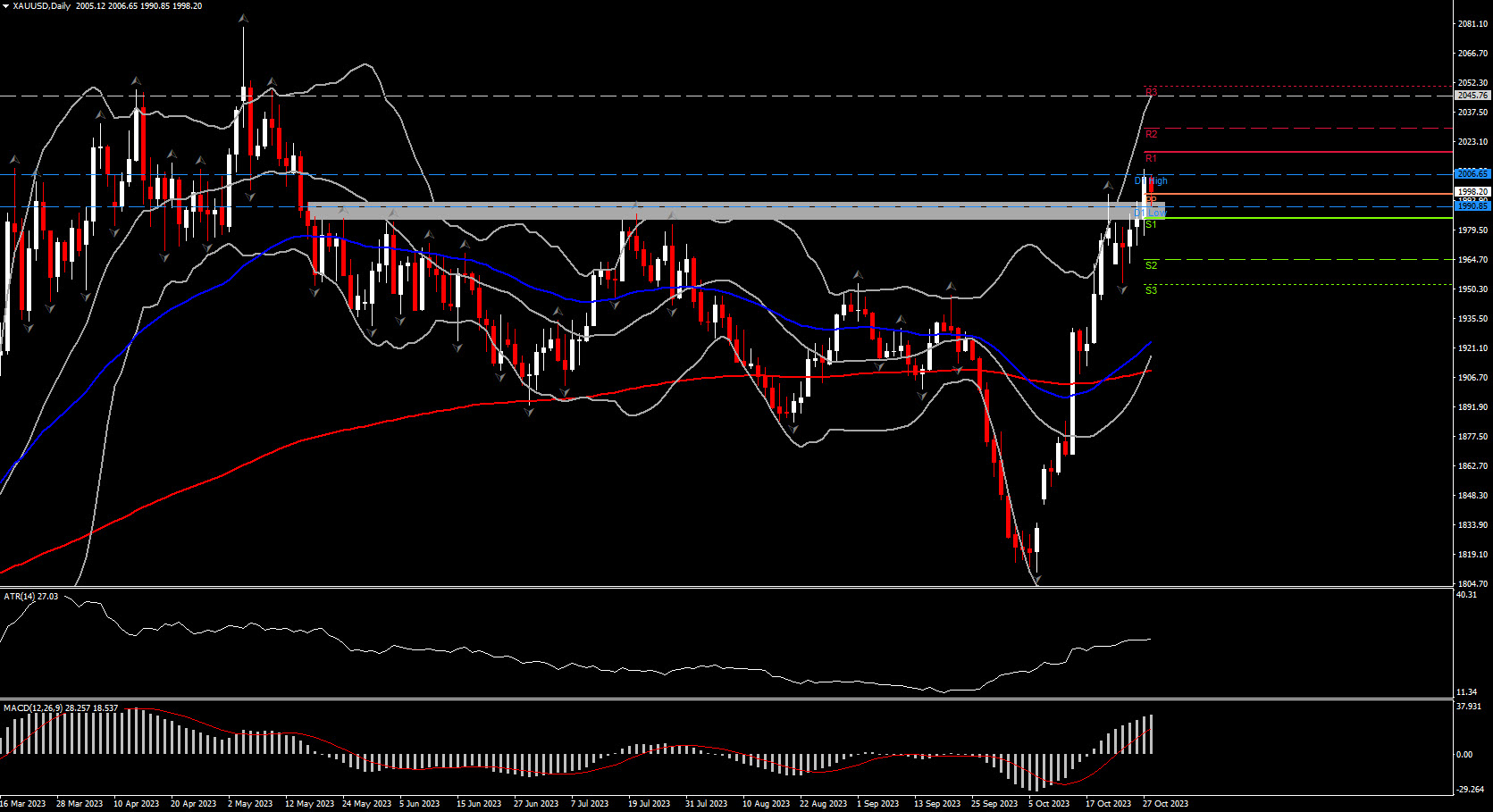

The international economic stage is currently overshadowed by heightened geopolitical tensions, primarily stemming from the Middle East. The renewed clashes between Israel and Hamas have rekindled concerns and sparked significant movements in global energy and precious metals markets. The precious metals sector is witnessing a notable surge, with gold crossing the significant $2,000 threshold, settling at $2,002.29, a rate unseen since May.

Several factors have contributed to this upward trend, with increased risk aversion owing to geopolitical uncertainties playing a pivotal role. The ongoing strife in the Middle East has amplified gold's allure as a safe-haven asset. Furthermore, the global investment community is keenly anticipating the Federal Reserve's forthcoming declarations, which are expected to significantly shape market trajectories.

Oil Markets Face Mounting Pressures

While the past week saw a slight stabilization in oil prices, the ongoing unrest in the Middle East has reintroduced volatility. Presently, USoil is valued at $84.07 per barrel, marking a decline of 1.7%. In comparison, its counterpart, Brent crude, is pegged at $89.05 per barrel. Though the start of the week painted a picture of relative stability, the potential exacerbation of the Israel-Hamas standoff looms large over market sentiments. In a concerning projection, the World Bank suggests that major disruptions, reminiscent of the 1973 Arab oil embargo, could catapult prices to a staggering $150 per barrel. Even minor disturbances could see prices inching towards the $93-102 bracket.

Natural Gas Market Experiences Whiplash

The natural gas sector is encapsulated in a web of volatility. US markets have seen a dip in gas prices, while Europe, especially regions like the Netherlands and the UK, is grappling with soaring rates. Multiple factors are driving these price fluctuations. The decision by Egypt to halt natural gas imports, coupled with Israel's suspension of gas extraction from its Tamar field, has magnified concerns over potential supply gaps. There are also rising apprehensions about the safe passage of Qatari Liquid Natural Gas (LNG) vessels through the strategically vital Strait of Hormuz.

Offering a semblance of assurance, Norway’s state-operated energy conglomerate, Equinor, conveyed optimism regarding European gas supplies. Despite grappling with diminished supplies from Russia, Equinor's CEO emphasized that the enterprise has adeptly navigated maintenance-related challenges, restoring oil and gas output to regular levels.

Looking Forward

The global financial arena remains in a state of heightened vigilance. Investors worldwide are closely tracking the evolving geopolitical narrative, especially developments centered in the Middle East. The region's stability, or lack thereof, is poised to profoundly influence energy markets and precious metal valuations in the forthcoming period. The world watches with bated breath, hoping for resolutions and stability.