The international currency landscape is undergoing a subtle yet significant transformation, as evidenced by recent movements in the US Dollar and the ensuing repercussions on the EURJPY pair. The US Dollar, often viewed as the bellwether of global economic sentiment, exhibited weakness following the recent release of the ADP employment data. This report has cast some doubt on the Federal Reserve's earlier inclination to hike interest rates later in 2023. This development seemingly provided an avenue for the Japanese Yen to stage a comeback.

However, it's imperative to approach this with caution, given the line-up of economic data expected throughout October, which will invariably shape the Bank of Japan (BOJ)'s strategies. A testament to the Yen's resurgence is its ascension past the 149.00 mark against the dollar, distancing itself from near-yearly lows. The Yen also experienced a brief surge to 147.28 earlier in the week, a move that many in the trading community ascribe to hints of governmental intervention.

Dissecting BOJ's Actions and Market Speculation

Recent insights from the BOJ's money market data have revealed a conspicuous absence of yen buying operations, especially during the currency's slump to 150.00 against the dollar the previous week. Financial corridors are rife with speculations about alleged intervention by the Japanese authorities, as markets continue to grapple with these unconfirmed claims.

A report by Reuters suggests a unique approach by the BOJ: potentially only monitoring rates during the New York trading session. This could have precipitated a sell-off of USDJPY by prominent institutions. In the midst of these swirling market theories, Shunichi Suzuki, the Minister of Finance, has voiced his vigilant stance on currency movements.

August's inflation metrics mirrored the economic slowdown in other geographies, potentially throwing a wrench in the BOJ's policy formulations. However, other indicators like the quarterly Tankan showcased a predominantly positive sentiment, and retail sales defied expectations with a robust performance. Governor Ueda, since assuming office in April, has underscored the role of wage hikes in navigating the path out of the prevailing lax monetary policy framework.

Technical Dissection

In the realm of technical analysis, the USDJPY pair presently displays a neutral intraday bias. Sideways trading dynamics seem to be the order of the day, and any dip below 147.28 might tilt the scales towards a more profound bearish stance. A firm breakthrough at the 144.44 support will be crucial for confirming this bearish trend reversal.

EURJPY: Trends and Indicators

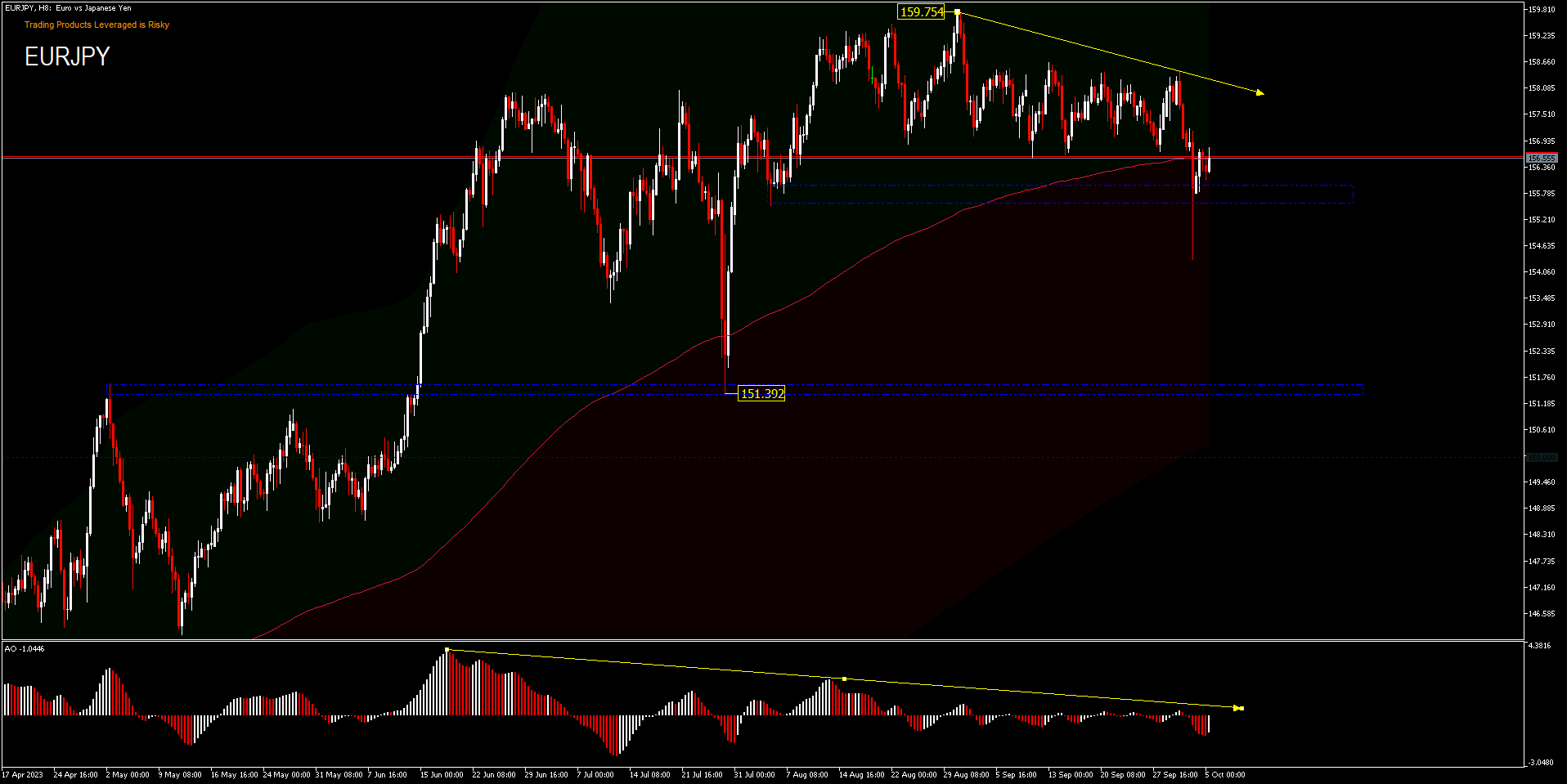

The EURJPY pair presents an analogous pattern. The pair touched a zenith of 159.75 on 30th August, its most robust performance since February 2007. As it oscillates around the 156.50 mark, market participants are deciphering implications of rumored interventions. The EURJPY dynamics also seem tethered to the EURUSD pair's softness, having been in a consolidation phase since June's end. The 151.39 support level is poised to play a pivotal role in shaping the pair's trajectory.

Economic Data and its Implications

Recent economic data emanating from the Eurozone hasn't markedly shifted the needle. A silver lining was the upward revision of the September Eurozone S&P composite PMI, albeit by a marginal 0.1. In contrast, August witnessed a slump in retail sales, which underperformed expectations. Furthermore, the August Producer Price Index (PPI) witnessed a record drop, which might tilt the European Central Bank's policies towards a more dovish stance.