The EURJPY currency pair has emerged as a focal point in the forex market, following recent developments from the Bank of Japan (BoJ) and the subsequent shifts in the technical landscape. On Tuesday, the EURJPY witnessed a surge to the vicinity of the 159.00 mark. This accelerated movement was triggered primarily by the BoJ's decision to maintain its yield curve control at a steadfast 1.0%.

However, what caught the market's attention was the bank's softer tone, permitting yields to breach the aforementioned threshold. This nuanced approach contrasted with market expectations that the BoJ might set a higher target, possibly in the 1.25-1.50% range.

Approaching Key Levels

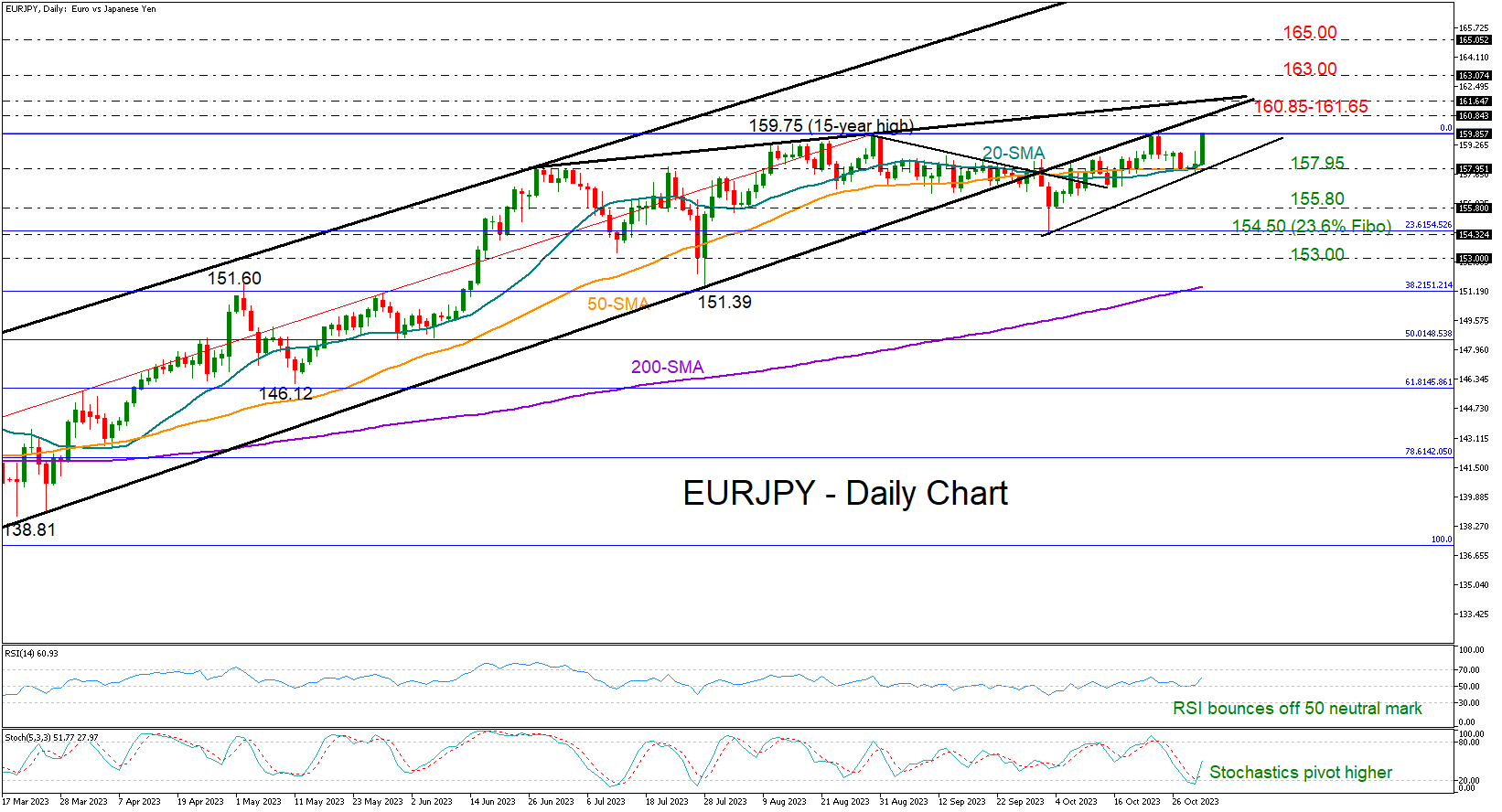

As the dust settles, the EURJPY is nearing August's 15-year peak at 159.75—a significant level that previously acted as a dampener to bullish fervor. However, the immediate challenge for the pair lies slightly ahead, within the 160.85-161.65 trendline territory. Should the bullish momentum persist, the pair might target the 163.00 resistance. An even more vigorous push might be halted at the significant psychological level of 165.00, a threshold not breached since the financial turmoil of 2008.

Technical Indicators Point North

Adding depth to the analysis, technical indicators such as the RSI and the stochastic oscillator have swung upwards, reinforcing the bullish sentiment. However, the journey north is not devoid of potential pitfalls. A retracement below the confluence of the 20- and 50-day SMAs, situated at 157.95, might act as a catalyst for the bears, directing attention towards October's low point of 155.80. If bearish momentum gains ground, the pair could be directed towards the 23.6% Fibonacci retracement level of the preceding upward swing at 154.50, followed by the 153.00 support.

Concluding Perspective

While the EURJPY's recent moves oscillate within a neutral spectrum, its trajectory is laden with potential turning points. The bolstered technical signals offer a glimmer of optimism for bulls. Yet, for a more definitive shift in the narrative from neutrality to bullishness, the pair would need to confidently breach the 161.65 resistance. As traders and analysts watch with bated breath, the evolving interplay of fundamental news from central banks and technical thresholds promises to keep the EURJPY at the forefront of market discussions.