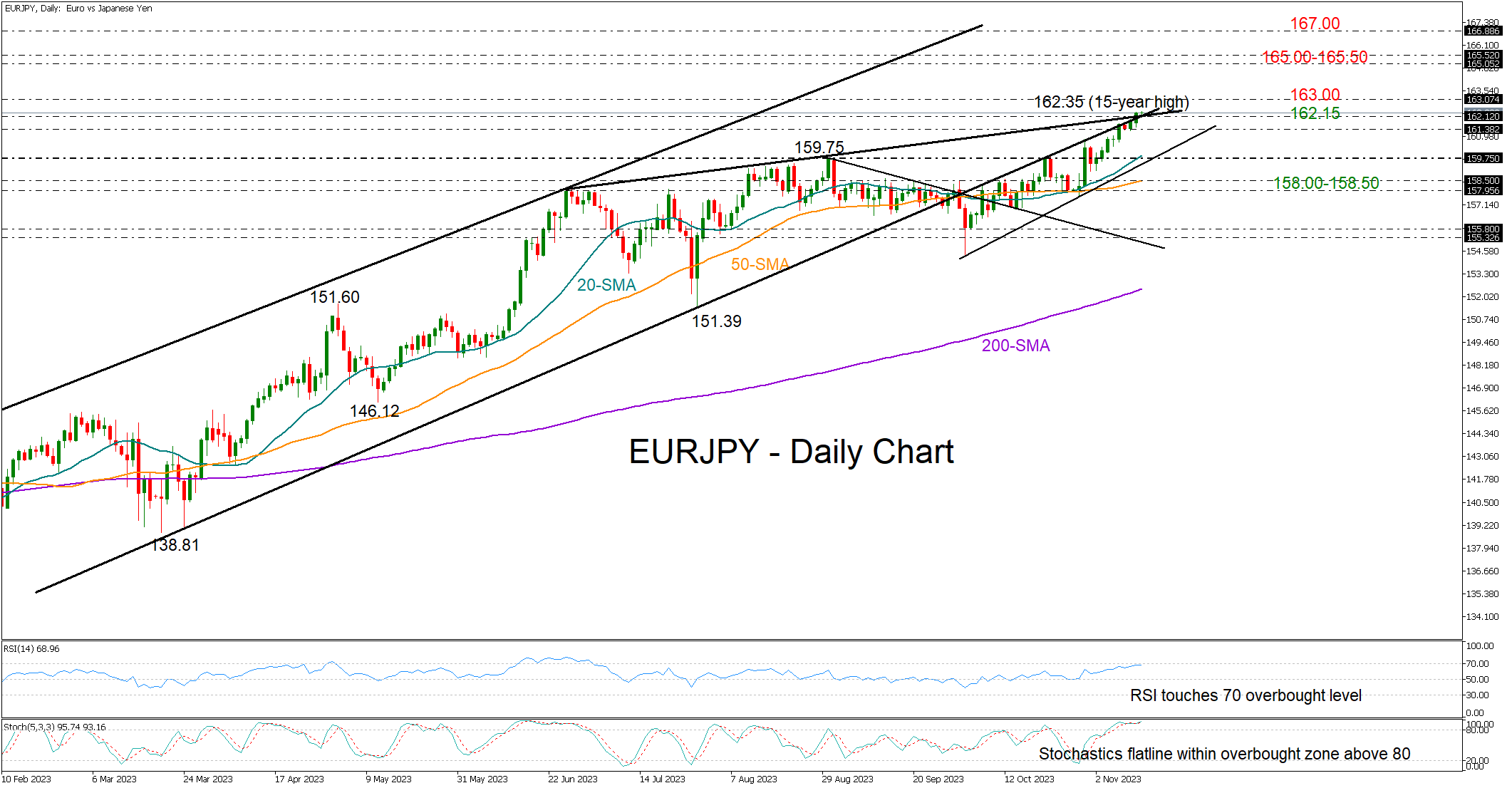

As the EURJPY pairing continues its impressive ascent, reaching levels not seen since August 2008, investors and traders alike are met with a mix of enthusiasm and caution. The pair's recent surge to a high of 162.35 on Monday marks a significant milestone, eclipsing the previously established cautionary trendline zone, albeit by a slim margin.

This upward trajectory, while appearing robust, is not without its potential pitfalls. The emergence of overbought signals from key indicators such as the Relative Strength Index (RSI) and the stochastic oscillator casts a shadow of doubt, signaling a heightened risk of a possible negative reversal in the market trend.

Looking ahead, market analysts are closely monitoring the 163.00 level, a significant barrier that previously curbed bullish momentum back in August 2008. Should the bulls manage to break through this formidable resistance, we could witness the pair advancing towards the 165.00-165.50 zone, a constraining area last active between June 2007 and August 2008. Beyond this, the 167.00 level emerges as a potential new target for the pair's upward movement.

Conversely, a retraction below the 162.00 mark could signal a shift in the current trend. The base established last week at 161.35 may provide a buffer against further declines towards the previous high of 159.75 and the 20-day simple moving average (SMA). Should the pair fall below this tentative support trendline, seen in October at 159.45, it would likely neutralize the current bullish short-term outlook, potentially triggering a bearish correction towards the 50-day SMA and the 158.00-158.50 restricted territory. A breach of this last line of defense could precipitate a more aggressive downward spiral.

The Balancing Act: Sustaining Momentum Amid Risks

In summary, for the EURJPY pair to maintain its upward momentum and attract fresh buying interest in the short term, it is crucial for it to sustain strength above the 162.00 mark and, ideally, break above the 163.00 resistance. However, traders must remain vigilant as the risks of a downward reversal have not completely dissipated. The market landscape is delicately balanced at this juncture, with every new high bringing both potential for gains and heightened risk, necessitating a cautious and well-calculated approach from investors and market strategists.