Contracts for Differences (CFDs) stand out as intriguing financial instruments, offering traders the ability to capitalize on price fluctuations without actually owning the underlying assets. Operating as leveraged products, they facilitate potentially high returns from modest initial investments. However, while the allure of increased profits is palpable, the risks of amplified losses are equally tangible.

What is CFD Trading? At its core, CFD trading involves a contractual agreement between a buyer and a seller, where the buyer agrees to pay the seller the difference between an asset's opening and closing prices. It's a speculative method that doesn't involve the transfer of any physical goods or securities.

For instance, rather than purchasing physical gold, a trader might speculate on its price movements. If they believe gold's value will ascend, they can buy a CFD, and if their prediction materializes, they can then sell their CFD for a profit. The profit, or loss, is determined by the difference between the buying and selling prices.

Risks Associated with CFDs

- Counterparty Risk: The integrity of the CFD trading process hinges significantly on the reliability of the counterparty, typically the CFD provider. Since the actual asset isn't being traded, but rather a contract, a trader's exposure isn't just to market fluctuations but also to the CFD provider and their financial stability. It's imperative to assess a broker's reputation and financial strength, especially since the CFD sector isn't stringently regulated everywhere. Notably, CFD trading isn't permissible for US-based clients due to regulatory constraints.

- Market Risk: Predicting market movements is more an art than an exact science. External factors, including unexpected news, economic data releases, or policy shifts, can rapidly alter market conditions. Given CFDs' leverage, even minor price changes can significantly impact returns, sometimes necessitating additional margin payments or forcing the closure of positions.

- Client Money Risk: While legal structures in some countries mandate CFD providers to keep clients' funds separate from their own, pooling of client funds in a singular account can still occur. This setup can expose individual traders to risks if other clients in the pool default on margin payments.

- Liquidity and Gapping Risks: A paucity of trades for a particular underlying asset can render a CFD illiquid, potentially leading to additional margin demands or contract closures at suboptimal prices. Moreover, due to the inherent volatility of markets, 'gapping' can occur where a CFD's price rapidly shifts before a trade is executed, possibly leading to reduced profits or increased losses.

How to Navigate CFD Trading CFD trading isn't a one-size-fits-all strategy. It demands a nuanced approach, with a keen eye on risk management. Prospective traders should:

- Thoroughly vet CFD providers to ensure they're credible and stable.

- Stay informed about market trends and potential disruptors.

- Set clear risk thresholds and employ tools like stop-loss orders to mitigate potential losses.

- Regularly review and adjust strategies based on evolving market dynamics.

Conclusion CFD trading offers a distinctive way for traders to interact with the markets, providing opportunities for potentially significant returns. However, the amplified potential for profit is coupled with escalated risks. Successful CFD trading necessitates a clear understanding of market dynamics, meticulous planning, and a vigilant approach to risk management.

Understanding CFD Trading: From Positions to Profits and Losses

CFD Trading: Positions Unveiled When engaging in CFD (Contracts for Differences) trading, one can adopt either a long or short position.

- Long Position: A trader who believes that the value of an underlying asset will increase over time takes a long position. Example: Suppose you decide to buy a position in stock 'Kaya' currently trading at R10, expecting its price to rise. With an investment of R10,000 and a 10% initial margin, you can effectively buy 10,000 shares. If the stock's price rises to R5.10 in a fortnight, you'd have made a profit of R1,000. Remember, CFD trading carries inherent risks, and while leveraging can amplify profits, it can also amplify losses.

- Short Position: Conversely, a short position is taken by a trader who anticipates a decline in the asset's value. This could be based on various market indicators or economic predictions. Leverage and Margin in CFD Trading Leverage enables traders to open positions larger than their initial deposit by borrowing capital from the broker. It's akin to putting down a deposit (margin) to control a much larger position.

Margin is essentially the sum you need in your trading account to open a CFD position. It is often expressed as a percentage, which represents the fraction of the total trade value you must deposit. However, the double-edged sword of leverage means that while it can amplify profits, it can also magnify losses. Therefore, traders often use tools like stop losses to manage risks.

Hedging with CFDs Hedging is a risk management strategy used to offset potential losses. In CFD trading, traders can adopt both long and short positions, making it an excellent tool for hedging.

For instance, a trader looking to protect their USD investment against unexpected volatility might buy EUR/USD and simultaneously sell USD/JPY. By doing so, they can potentially offset losses if USD declines.

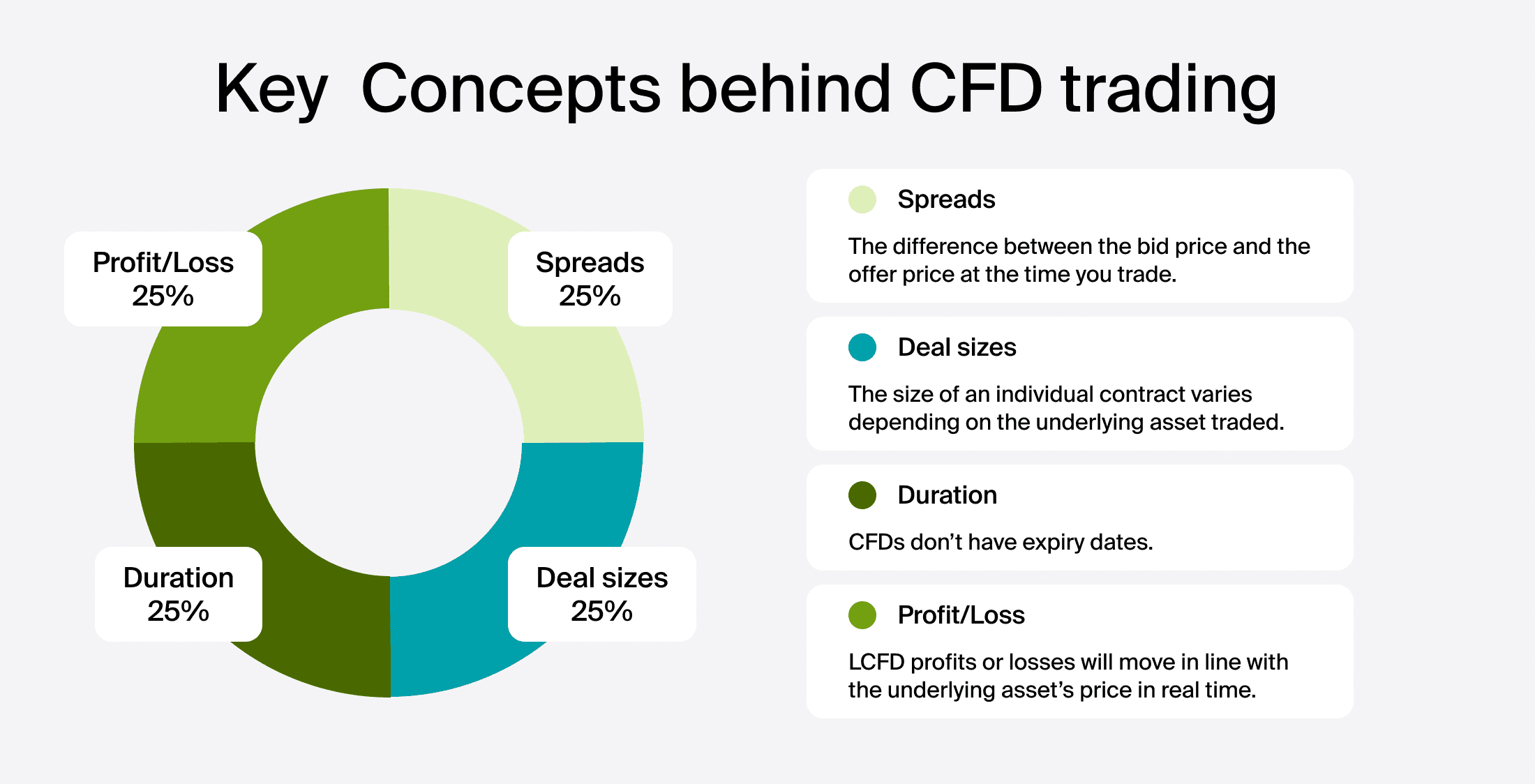

Key Components of CFD Trading

- Spread and Commission: The primary costs associated with CFD trading are the spread (difference between buying and selling price) and, occasionally, a commission. While forex and commodities often don't attract a commission, stock CFDs typically do. Remember, each entry and exit is treated as separate trades.

- Deal Size: CFDs represent contracts between investors and institutions, reflecting predictions on an asset's future value. They settle in cash, eliminating the need for physical asset transfer. Essentially, the profit or loss stems from the difference between the position's opening and closing values.

- Duration: Unlike some other derivatives, CFDs lack a fixed expiry. If a CFD references a futures contract, it needs to account for the futures' expiration. Providers usually rollover the CFD position to the next future period as the current one approaches expiry.

- Profit and Loss Calculation: Profits and losses in CFDs correspond with real-time price fluctuations of the underlying asset. To determine your gains or losses, you consider the number of contracts, the value per point of movement, and the difference between your opening and closing prices.

Formula: Profit/Loss=(total contracts×value per point)×(closing price−opening price)

In Conclusion CFD trading is a nuanced arena that offers potential rewards alongside inherent risks. By understanding its core mechanics, from long and short positions to the intricacies of leverage and margin, traders can navigate this space with greater confidence and expertise. As always, risk management remains crucial to achieving success in the dynamic world of CFDs.

Understanding CFD Trades with Comprehensive Examples

CFDs, or Contracts for Difference, are versatile financial instruments that enable traders to speculate on the price movements of an array of assets without owning the underlying asset. Traders can either profit from price increases (going long) or price declines (going short). Below we'll delve deeper into how CFD trading works with detailed examples.

Basics of a CFD Trade

A CFD position is initiated by selecting the number of contracts you want to trade. The profit or loss depends on the market movement. If the market moves in your favor, your profit increases, while the opposite leads to a loss. Profitable Scenario: Assume you predict a rise in the price of a stock from its current rate of 210 cents to 220 cents over a week. If this prediction holds true, and considering a commission of R250 upon exit, your total profit, after deducting the commission, amounts to R1,780.

Unfavorable Scenario: However, if your prediction is off and the stock price drops to 1,549 cents, you'd potentially incur a loss. In this case, the total loss, considering commission, would be R541.49.

Long CFD Trade

"Going long" is when you speculate that the price of an asset, like Chicken Licken shares, will increase.

Steps:

- Observe a share price of R165.

- The price drops to R160, prompting you to buy CFDs.

- If the price ascends to R170, selling the CFDs would secure a profit of R10 per share.

However, it's pivotal to remember trading always carries inherent risks, regardless of market analysis and predictions.

Short CFD Trade

"Short-selling" is the opposite of going long, where you bet on the price falling.

Steps:

- Starting at a share price of R165.

- When it ascends to R170, sell the CFDs.

- If it later drops to R160, buy the CFDs back. This results in a profit of R10 per share.

Margin Trading in CFDs

Margin trading lets traders amplify their exposure using only a fraction of the capital that would otherwise be required. Two crucial margin types include:

- Deposit Margin: This is a protective fund against potential losses.

- Maintenance Margin: The minimal equity amount a trader must retain after initiating a position.

The margin requirements are shaped by broker policies, asset types, and regulatory environments.

For instance, buying 100 CFDs on Chicken Licken at R135.10 requires an initial outlay of R2,702, given a 20% margin. If the stock moves to R150 and you decide to sell, the profit is R1,490.

Range of Assets for CFD Trading

With CFDs, you're not just limited to stocks. They can be used to trade:

- Shares

- Indices

- Commodities

- Exchange Traded Funds (ETFs)

CFDs are cash-settled, and the use of margin trading means investors can control a significant position with a relatively small amount of capital.

While CFDs offer a flexible and cost-efficient way to trade, it's essential to understand the risks. As with all trading forms, it's advisable to get adequately informed, perhaps seek expert advice, and have a risk management strategy in place.

The Benefits and Pitfalls of Trading CFDs

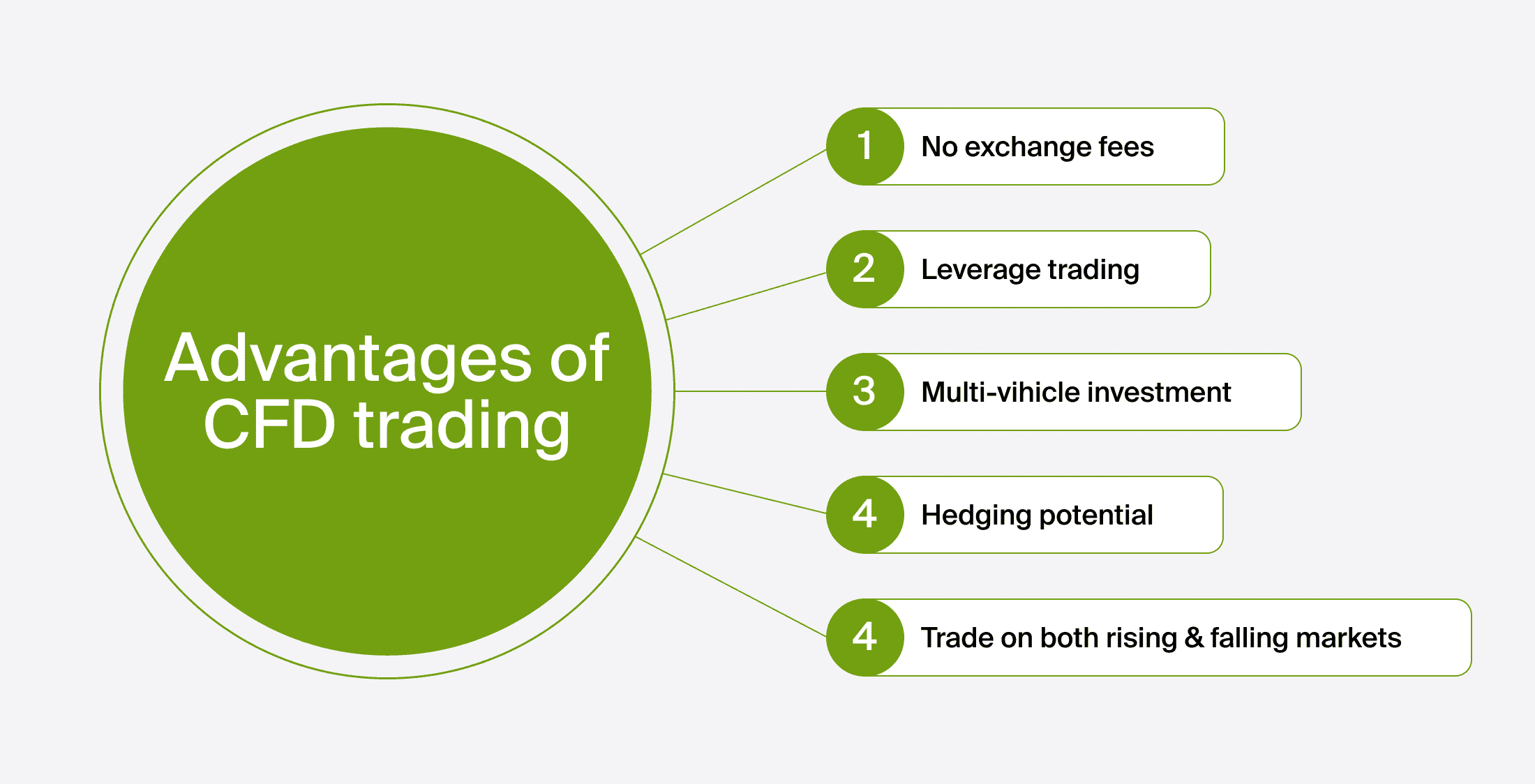

Why Opt for CFD Trading?

- Zero Exchange Fees: CFD brokers offer a wide array of order types akin to conventional brokers. These include stops, limits, and other contingent orders. While some brokers might charge for guaranteed stops, others recoup the costs in different manners. Essentially, the brokers profit when traders pay the spread.

- Leverage: CFD trading generally offers higher leverage than traditional trading. While this means lesser capital outlay and potential for bigger returns, it also means greater potential losses.

- Diverse Trading Options: Traders can invest in a multitude of financial instruments, including stock, currency, and commodity CFDs, providing a flexible alternative to standard exchanges.

- Profiting in Varied Market Conditions: CFDs allow traders to profit both in rising and falling markets.

- Hedging Capabilities: CFDs offer a versatile way to hedge, as traders can take long or short positions. With a smaller initial deposit requirement, it provides a leveraged method of hedging against market risks.

- Access to Global Markets: Modern CFD trading platforms provide a plethora of global markets to trade in, simplifying the process of finding hedging options.

Awareness of Risks in CFD Trading

- Liquidity and Margin Risks: It's crucial to maintain sufficient margins; failing to do so could result in the provider closing your position.

- Leverage Risks: While leverage can amplify profits, it can also amplify losses.

- Trade Execution Delays: Delays or lags in executing trades can sometimes occur, affecting trading outcomes.

- Spread Costs: While CFDs might seem attractive, traders need to be wary of spread costs, which can diminish profits.

- Industry Regulation: The CFD industry doesn’t enjoy robust regulation, so it’s vital to thoroughly vet a broker before initiating trades.

Costs in CFD Trading

- Spread: The difference between buying and selling prices.

- Holding Costs: Related to the storage of unsold inventory.

- Market Data Fees: Fees for accessing or trading specific market data.

- Commission: A charge applied when executing an order on certain platforms.

Strategies and Concepts in CFD Trading

- Long vs. Short Position: In a long position, a trader buys and owns shares, hoping the price will rise. In contrast, a short position involves selling shares the trader doesn't yet own, hoping the price will drop.

- Stops and Profit Targets: Traders can set stop-loss and take-profit levels to manage trades automatically without constant monitoring.

- Negative Balance Protection: This ensures that traders don’t end up owing money if a trade goes bad.

- Hedging: Hedging helps traders counterbalance potential losses in their portfolios.

Example: An investor owning 1,000 Disney shares might be apprehensive about a potential drop in the share price. By short selling 1,000 Disney shares via a CFD account, the investor can offset potential losses from the shareholding position with gains from the CFD trade.

Embarking on CFD Trading

Now that we've unpacked the nuances of CFDs, from their advantages to the inherent risks and strategies, you might be considering taking the plunge. To embark on CFD trading:

- Educate Yourself: Understand the markets, strategies, and risks.

- Choose a Reputable Broker: Prioritize security, user-friendliness, and customer support.

- Start with a Demo Account: Before trading with real money, practice on a demo account.

- Set a Budget: Determine how much you're willing to risk.

- Stay Updated: Regularly review market news and trends.

CFD trading, with its flexibility and potential for high returns, can be a lucrative endeavor. However, it's essential to approach it with caution, knowledge, and a solid strategy.

Creating and Managing a CFD Trading Account

Setting up an Account To kickstart your journey in CFD trading, you'll want to open an account with a reputable CFD broker. There are typically two account options available:

- Live Account: This allows you to deposit real money to trade on actual financial markets.

- Demo Account: Perfect for beginners, this account offers a chance to familiarize yourself with the platform's interface and practice trading strategies using virtual currency.

Choosing the Right CFD Trading Platform A CFD platform is the digital space where you'll execute your trades. Platforms vary significantly in terms of the products they offer, user interface, and jurisdictional reach, depending on their origin. Some platforms might offer a more diverse range of CFD options or superior CFD products than their counterparts. However, a platform specifically tailored for CFDs is not always essential; if your chosen broker facilitates CFD trades, their platform should suffice.

Deciding on Your Trading Methodology With your platform in place, it's time to solidify your trading plan.

Here are some factors to contemplate:

- Routine: Determine the best times to assess the markets daily.

- Trading Style: Identify if you're a day trader, swing trader, or long-term investor and the time frames you're most comfortable with.

- Strategy Creation and Testing: Develop your own strategies and test them for viability.

- Market Focus: Decide on the markets you want to trade in – be it shares, forex, or commodities.

- Risk Management: Set clear guidelines on position size, stop losses, and profit targets.

- Continuous Learning: Commit to regular reading and research to keep updating your knowledge.

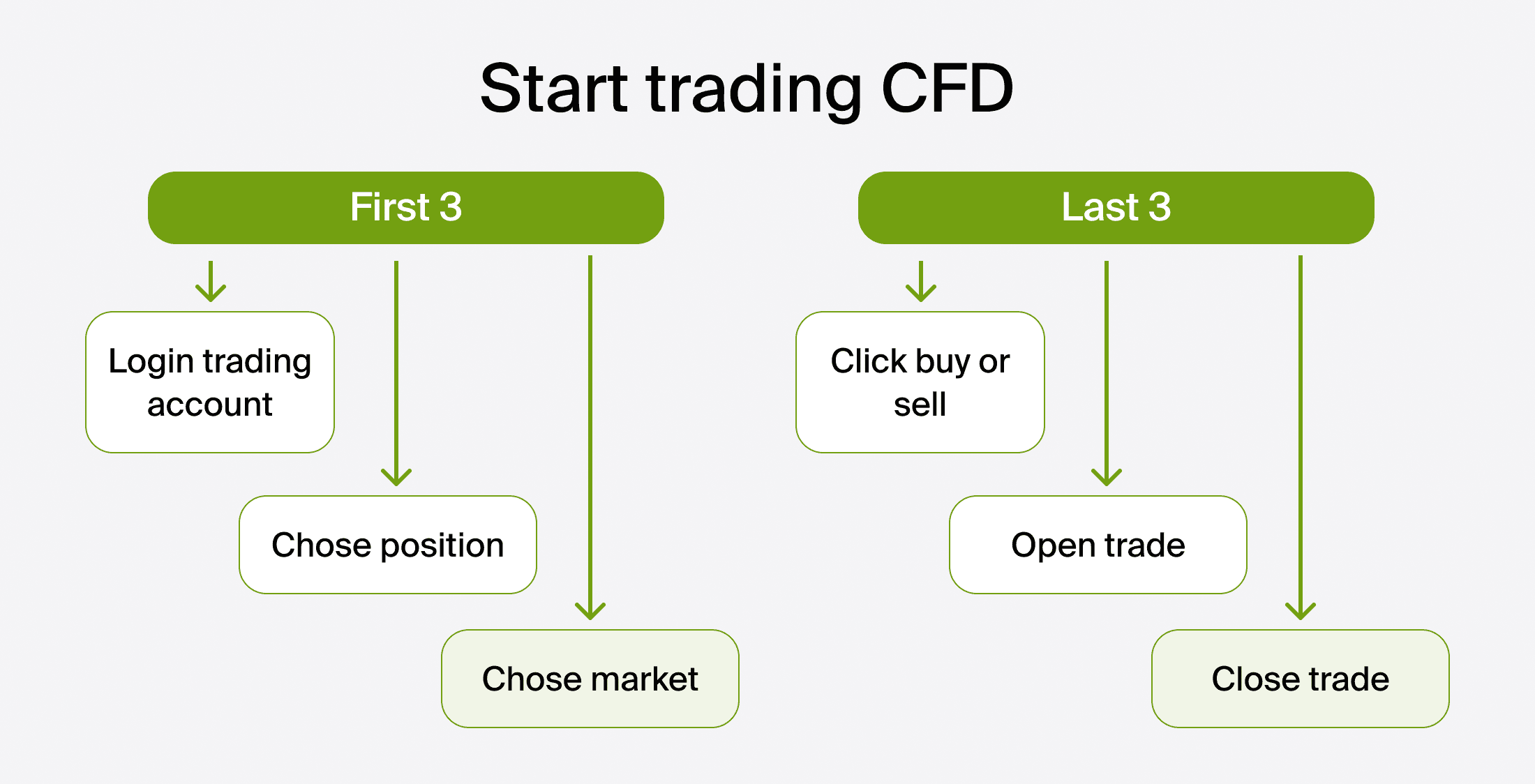

Beginning Your CFD Trading Journey It's time to put theory into practice:

- Launch your trading platform and sign in.

- Select your desired market.

- Define your position size.

- Decide to "buy" or "sell" based on your market prediction.

- Initiate the trade.

- When ready, close out your trade.

Concluding Thoughts By now, you should have a clear understanding of what CFDs are, how they operate, their benefits, and associated risks. Remember, while CFDs present opportunities for profit based on price movement, they don't require ownership of the underlying assets. However, like all investments, there are risks. Continuous learning and staying updated with the industry's latest trends is crucial.

FAQs

How do CFDs differ from futures? While both CFDs and futures belong to the financial derivatives market, their trading dynamics vary. With CFDs, traders predict asset price movements, whereas futures involve a predetermined transaction at a future date. Some notable distinctions include:

- Leverage: More common with CFDs, leverage can amplify both profits and losses.

- Physical Assets: Futures may require actual delivery of assets, unlike CFDs.

- Contract Sizes: CFDs usually have standard contract sizes, while futures vary.

- Flexibility: CFDs are generally more adaptable, catering to short-term trades, whereas futures often serve long-term investments.

- ETFs: Futures can be integrated into exchange-traded funds.

Can CFDs be traded without leverage? Yes, certain brokers allow no-leverage CFD trading. This can be especially beneficial for beginners to minimize risks. While no leverage reduces the risk intensity, it doesn't guarantee profit or loss protection.

How can CFDs be used for hedging? CFDs can serve as a hedging mechanism, counteracting risks in other investments. For instance, an investor can offset the risk of share depreciation by opening a contrasting CFD position. CFDs offer precise hedging capabilities, unlike traditional options.

What's the taxation policy for CFDs? Generally, CFD profits are treated as ordinary income rather than capital gains, meaning they aren't subject to capital gains tax. Trading losses might be deductible and can sometimes offset other income forms.