Companies may occasionally, conduct share splits, this is when the company lowers the price of its shares by splitting each existing share into more than one share. Companies usually carry out a share split for the purpose of lowering the individual share price. Stock splits increase the number of outstanding shares, however, they do not change any single holder’s proportion of ownership. In other words, existing shares are not diluted.

How do Share Splits work?

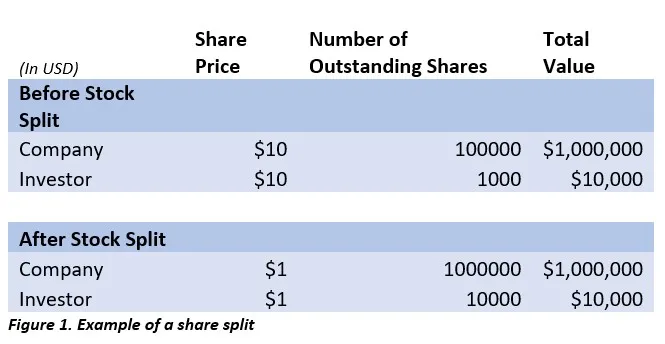

Let’s say that company A has 100,000 shares outstanding and each share trades for $10. An investor or trader owns 1,000 shares. Company A announces a 10:1 share split. This means that for every share an investor owns, he or she will receive an additional 10 shares. Therefore, they will receive 10,000 shares after the split.

Example of a share split

As you can see from figure 1, the total value of the shareholders ownership does not change with the increased number of shares, and nor does the total value or market capitalization of the company changes, both remain unchanged.

“the underlying strength of the company is a primary driver of elevated prices”

Why do Companies Issue Share Splits?

Companies usually decide to engage in share splits when they believe their share price is too high relative to their peers. In essence, a share split reduces the price of a company’s share price, which makes it more accessible for retail investors to buy the stock, which also helps makes the company more liquid.

A BofA analyst stated, “the underlying strength of the company is a primary driver of elevated prices”. Once the split is executed, investors who have wanted to gain or increase exposure may start to rush for the chance to buy. Most importantly, on a psychological level, it also helps fuel the perception or belief that investors can now own more shares of a company than they previously did.

Price Performance after the Split?

Even though a share split does not affect the company’s value, since it is purely cosmetic, many studies have proven that share splits often lead to higher performance in share price. In two separate studies that were done on over 1,000 shares in 1996 and 2003, the Chairman of the Finance Department at the University of Illinois, concluded that share splits lead to an outperformance of the benchmark index S&P 500 by 8% during the year following the split, and an outperformance of 12% in the following three years. The opposite of a share split is a “reverse share split” we will discuss in the next blog. Stay posted!