How to Predict a Forex Market Direction with Technical Analysis?

Forex market is changing, and changing cyclically. It means that usually there are such situations on Forex when the price behaviour becomes as predictable as possible. And if we can predict the price, then we can earn on the market. One question remains: on what basis can we predict the movement of the market?

What is technical analysis?

And here we comes to the technical analysis. JustForex team is helping you to look into that manner. Technical analysis is the prediction of price movements based on the analysis of the historical movement of the price chart. The basic principles of technical analysis were published by Charles Dow in a series of articles in The Wall Street Journal, 1900-1902. And although it was based on observations of the stock market, the theory he created works fine on the Forex market. The basic are three postulates:

- Market (price) takes into account everything. In the current quotation and market movement, all tendencies, sentiment of participants and other factors that may influence the formation of the current price are already taken into account.

- History repeats. Dow’s observations have shown that market formations, such as the alternation of peaks and lows, are relatively stable and tend to repeat over time.

- Price trends are constantly present and complement each other. The price does not move in a random way, and at each moment of time, there is a prevailing movement: up, down or sideways.

Based on this, we can conclude that technical analysis is the universal means for predicting prices in the future.

So how to apply technical analysis to predict the price direction?

From theory to practice. There are many tools for predicting prices using technical analysis. But we wanted to draw your attention to the most popular and effective technical analysis instruments.

Linear tools

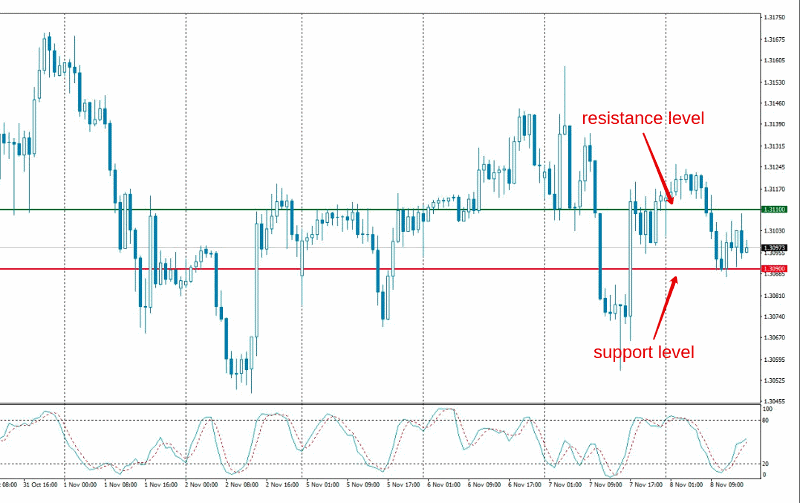

Linear technical analysis tools are represented by a set of lines: vertical, horizontal and trend. Vertical lines serve as a good guide to the beginning of a new trading session and mark the release of critical news reports. Horizontal lines allow you to draw the trend price channel (support and resistance lines). Breaking these levels is usually a sign of a trend change in the Forex market. Trend lines allow assessing the current trend.

In the graph below, we show support and resistance levels using the red and green lines:

Indicators

It is a universal tool that allows you not only to automatically build various lines, waves and levels on a currency pair chart, but also determines necessary parameters such as market condition, the direction and strength of the trend, and even alerts you to the upcoming reversal.

Indicators can be considered as the primary tools for technical analysis. Based on the recommendations of the professionals, the most effective are: Moving Average, Bollinger Bands, Stochastic Oscillator, MACD histogram, RSI.

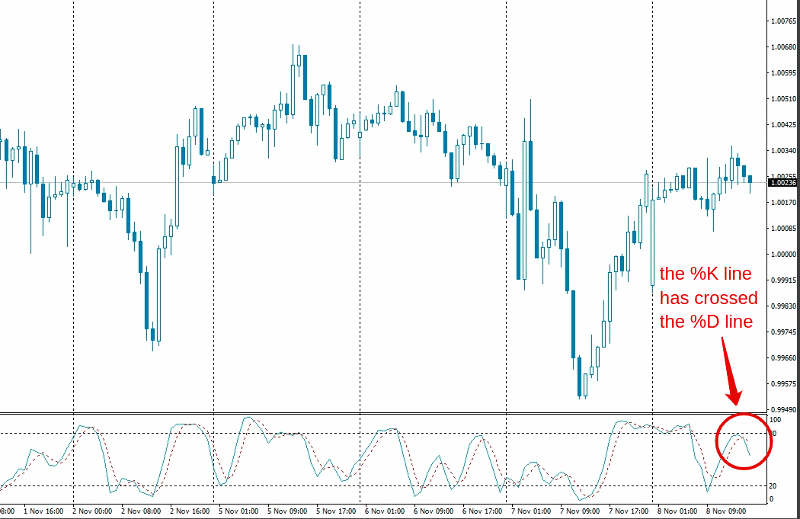

Let's look at an example: how Stochastic Oscillator works. It is located below the graph and consists of two curved lines: the %K line (solid one) and the %D line (dashed one), which move up and down within the vertical scale from 0 to 100%. From levels 20 and 80 there are two horizontal levels, below and above which oversold and overbought zones, respectively, are located.

The main signal to enter the market is the intersection of the %K and %D lines. So, if the solid line crosses the dashed one from the bottom up, then you need to open a buy order, if from top to bottom - a sell order. In the chart below, we see that the %K has crossed the %D line from top to bottom, and this is an excellent signal to open a short position.

It is the simplest example of using indicators. Each of them has many signals and applications. JustForex team recommends you to learn how to apply them before putting into practice.

Technical analysis patterns

Technical analysis patterns or chart patterns gives a possibility to analyze and supplement your analysis qualitatively. As you know, charts of currency pairs follow certain trends. So with the help of patterns, it is possible to predict both the continuation of the trend and its reversal.

As a rule, ten basic figures of technical analysis are applied: Triangle, Head and Shoulders, Double Top, Wedge, Triple Bottom, Triple Top, Double Bottom, Flag, Rounding Bottom, Pennant. For each of them, there are rules for entering the market.

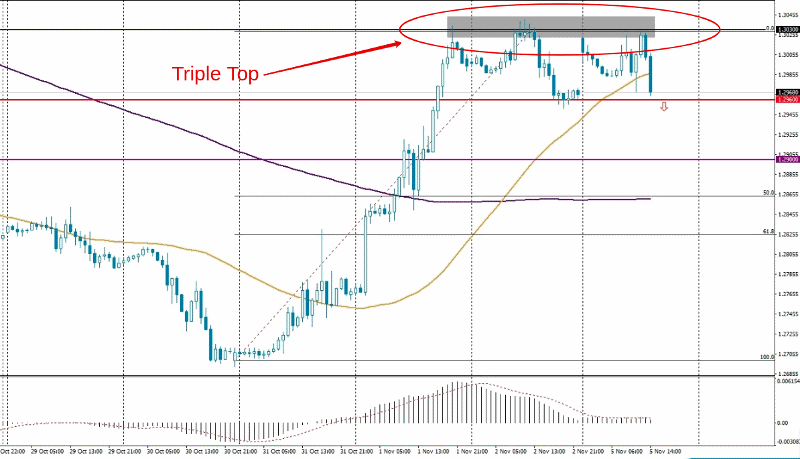

Let's look at the example of Triple Top. Triple Top is a figure of technical analysis of financial markets, including the Forex market, which is formed after a long uptrend and indicates a possible reversal of the trend.

If the price falls below the support level (a particular deviation is acceptable), the formation of the model is considered complete. A sell signal appears, and the trend direction is expected to change. So, as you can see, technical analysis presents plenty of ways how to use its tools in practice and predict price movements. All is in your hands.