The trading arena operates in a complex ecosystem that is constantly balancing between potential gains and inherent risks. At the core of this delicate equilibrium is the crucial concept of lot sizes. These standardized measurements greatly influence risk management in trading, especially in the volatile realm of forex. In this article, we will navigate the subtle nuances of lot sizes, exploring their definitions, their pivotal role, and their integration into effective risk management approaches.

Delving into Lot Sizes in Forex Trading

Lot sizes are standardized measurements integral to establishing uniform trade sizes within the forex market, a crucial adaptation due to the unique complexities of this financial sphere. In forex, the smallest possible movement a currency pair can experience is termed a ‘pip’. For instance, if the EUR/USD pair elevates from 1.1200 to 1.1210, it has moved by 10 pips.

In the forex domain, trading a single unit of a forex pair is not feasible or optimal, marking a divergence from stock trading norms. Hence, the forex market employs concepts like pips and lot sizes to establish uniformity and practicality.

The level of exposure you select is pivotal. A profound understanding of lot sizes and their intricacies can dramatically sway trading results. Many traders stumble due to inadequate knowledge in this area, with larger positions often resulting in more significant profits or losses. Drawing parallels to how products are priced, for example, confectionery manufacturers establish standard quantities instead of expecting customers to purchase individual items.

Various Lot Sizes in Forex

- Standard Lot (1.0 Lot). Equivalent to 100,000 units of the base currency in a currency pair, a standard lot is usually opted for by seasoned traders due to the substantial capital involved and the sizable profits or losses that can ensue.

- Mini Lot (0.1 Lot). At one-tenth the size of a standard lot, it enables traders with smaller capitals to enter forex trading and better manage risks.

- Micro Lot (0.01 Lot). With 1,000 units of the base currency, micro lots are apt for beginners or those with limited capital, offering lower risk exposure.

- Nano Lot (0.001 Lot). The smallest available lot size, it is beneficial for traders wishing to trade in extremely small increments.

The chosen lot size affects the amount of currency traded, the potential profit or loss per pip movement, and the associated risk level. Larger lot sizes offer significant profits but come with elevated risks.

The Role of Lot Size Calculators

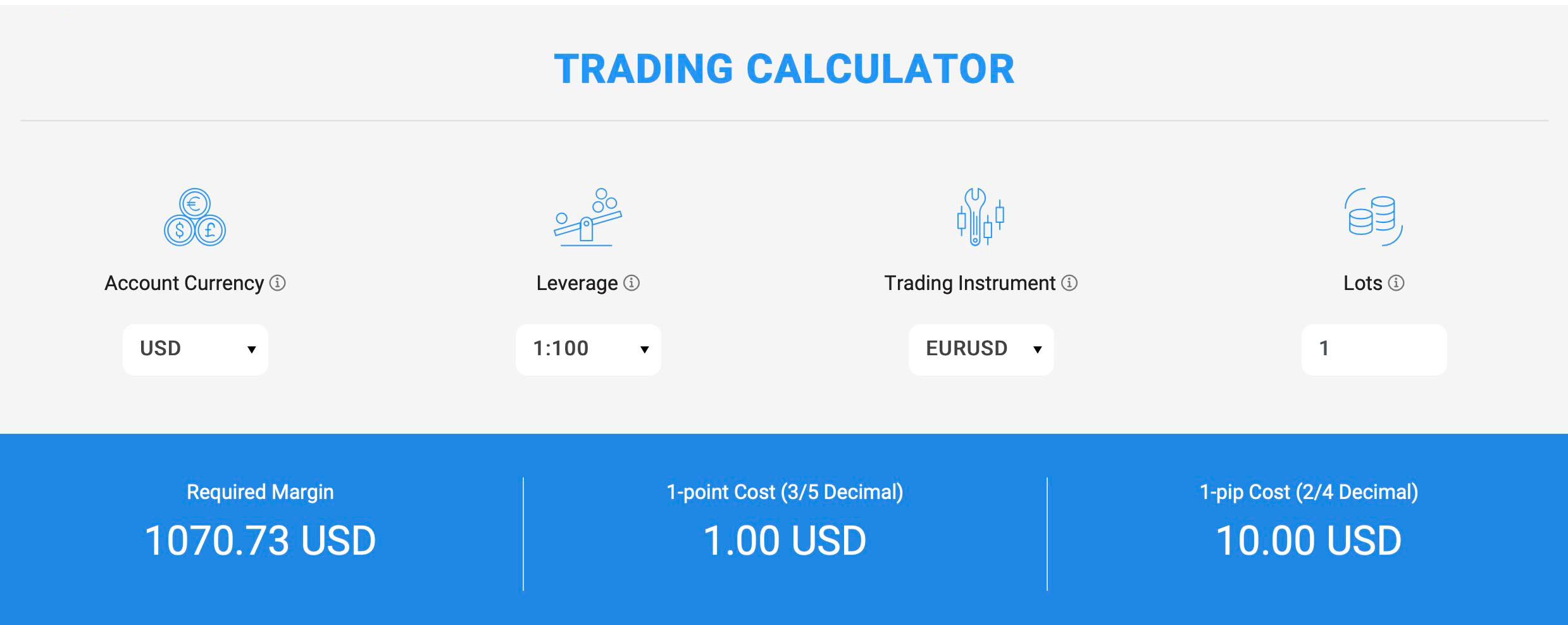

A lot size calculator is a quintessential tool for traders in the forex market to ascertain the suitable position size aligning with their risk parameters, account size, and market conditions, allowing for optimized risk management. It determines the appropriate position size in terms of lots, units, or contract sizes harmonizing with risk tolerance and trading strategy.

How It Operates:

- Input Parameters: Traders input account balance, risk percentage per trade, Stop Loss distance in pips, and the chosen currency pair.

- Calculation: It calculates the position size considering risk percentage, Stop Loss distance, and the pip value of the currency pair.

- Output: It outputs the position size in various lot sizes, giving traders a clear indication of the amount of currency being traded in a specific trade.

Lot Sizes: The Pillar of Risk Management

Lot sizes are fundamental to managing exposure and potential losses in trading, especially in forex. They allow traders to maintain consistent risk across different trades, protect their trading capital, and ensure the longevity of their trading activities. They impact position sizing, risk per trade, consistency, account preservation, leverage management, adaptability, strategy tailoring, and psychological well-being.

However, lot sizes are merely one facet of a holistic risk management strategy. Aspects like setting Stop Loss levels, diversification, and maintaining a trading journal are of equal significance.

Conclusion

Prudent risk management is the foundation of enduring trading success. A deep comprehension of lot sizes and risk control, coupled with knowledge and precision, is paramount. Striking the right balance and integrating well-thought-out lot sizing can lead to consistent and sustainable achievements in the unpredictable world of trading. Embrace this understanding as your compass in the ever-evolving trading landscape.