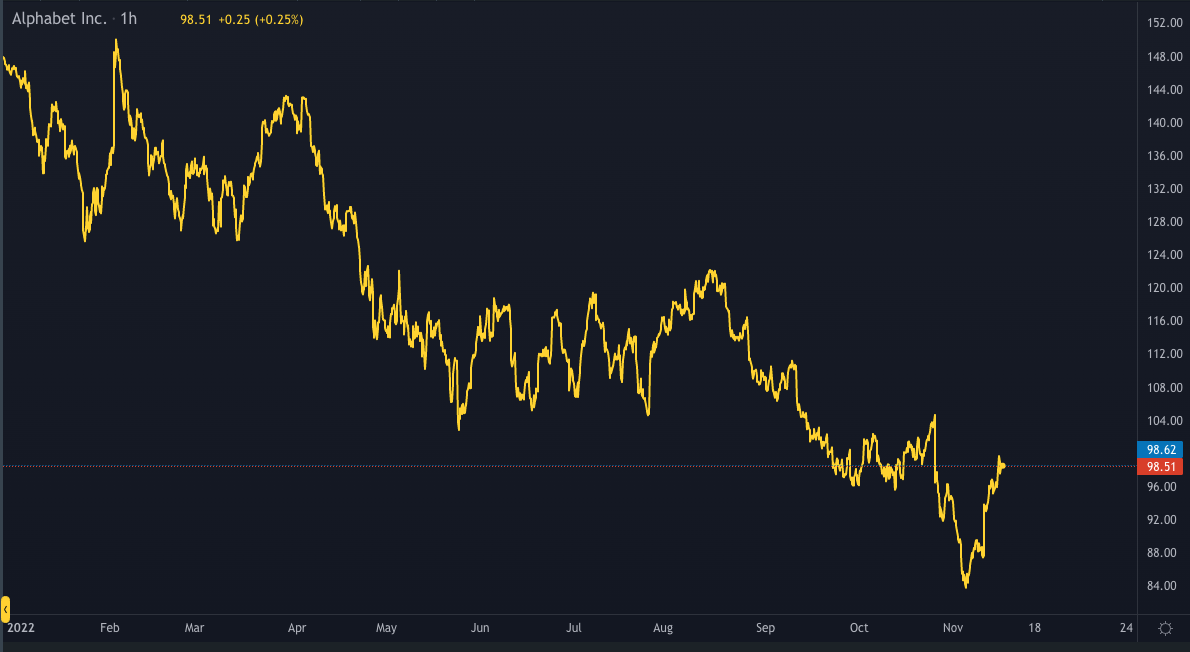

After a long and bearish year for Alphabet Inc, the GOOGL chart shows a possible reversal. Is it just a brief resistance along the downward trend, or is there something substantial behind the bullish price move? 2022 saw a drop in Alphabet’s performance, as well as the stock prices. GOOGL fell from a healthy $148 (USD) to the current $98. But this week we saw the shapings of a reversal, which means attention is growing and perhaps sentiment too. Year-over-year, revenue increased by 6% to $69 billion, despite YouTube’s 2% drop to $7 billion. Profit suffered the most, coming in at $17 billion, a decline from last year of 27%. When overall revenue is up but profits are significantly down, cost is usually the culprit, and Alphabet is spending money like there’s no tomorrow.

In less than a year, Alphabet has hired 37,000+ people, raising the worldwide employee number to 186,779 people as of 2022-Q3. That’s a 25% increase in just one year. But why? Since Google has already achieved world dominance, what more are they cooking up that would require such an increase?

Investors are unhappy and already calling for a staff cut, and there’s a good chance that it’s just around the corner. Big companies parallel a practice that’s common for professional bodybuilders. The idea is to bulk up, get big, then cut the fat. It’s not unusual for a company to bloat the workforce, then remove the dead weight, effectively refreshing the workplace while keeping the pillar resources. If Alphabet is in the bulking up phase right now, we might expect them to cut the fat when the economy hits a low point. No better time to reduce costs. Which brings us to another point.

A coming recession has been the theme of 2022, and yet here we are in Q4 and still no crash. And, Alphabet is expanding its workforce like never before. Does this mean Alphabet believes the recession isn’t close? Given the trillions of data points that Google can access and analyze, you would assume it was in a position to forecast a downtrend. But how would a recession affect Alphabet?

Google advertising in decline

Alphabet, Inc relies on Google advertising for revenue. In fact, ads alone account for 80% of Alphabet’s revenue. But this means Google is not recession-proof. When any company’s profit and performance struggles due to external factors, such as an economic downturn, the first thing to cut is usually the advertising budget. Marketing costs are a quick and easy option to reduce when cash flow is in question, and they are easy to switch back on. If every company scales back on its ad budget all at once, ad bid prices become much cheaper, and Google Ad revenue falls.

Worldwide, ad budgets have been falling over 2022, which surely contributed to Google’s profit deficit. If a downturn appears, global marketing spend will take a dive and Google will feel it.

Should you trade GOOGL?

If the bullish run continues, traders might not want to buy in at the mid-price. If a drawback comes in the next few weeks, that might be a good entry point. The real question is, what is Alphabet planning? If the massive hiring is for something top secret, the reveal will probably send GOOGL to the moon. If there’s no master plan, mass staff dismissals will appease the investors, reduce costs, and fuel positive sentiment, which will likely help GOOGL.

The last thing to think about is Alphabet as a global entity embedded in our society. Alphabet has the fourth largest market cap at $1.275 trillion. It has a firm grip on the world’s internet usage and exposure, and nothing has changed on planet Earth that would threaten the future of Google.

Unlike Zuckerberg and Musk, Larry Page and Sundar Pichai are not getting attacked about questionable business practices – at the moment. There’s a long list of reasons why GOOGL will be around for the foreseeable future, and most likely as strong or stronger than it is today. Trading GOOGL is not a complicated decision to make, but the timing is. Watch GOOGL like a hawk and see if the bullish trend makes a drawback.