As the market returns to normal and the levels of volatility are gradually reduced, gold’s price has remained within last week’s opening and closing range. Following gold’s continued ascent last week, slight fears funnelled inflows into the precious and it now appears that the shiny metal is moving in a sideways motion as the markets await further information. In this report, we aim to shed light on the catalysts driving the precious metal’s price, assess its future outlook and conclude with a technical analysis.

Gold stays near the $2000 psychological level

The wide uncertainty that had existed during the past few weeks appears to have vanished, yet the precious held its ground between last week’s opening and closing range, remaining relatively unchanged. Last Wednesday the US JOLTS Job openings for February dropped under 10 million for the first time since the 7th of July 2021. The unexpected drop highlighted that the US labour market may be losing steam and as a result weakened the greenback, as speculation of a recession increased.

Thus, given that the shiny metal is perceived to be a hedge against economic downturn, traders saw safe heaven inflows into the precious following the announcement. Furthermore, right on the heels of the JOLTS Job Openings report, the ADP Non-Farm payrolls figure was released, which supported the JOLTS figure, indicating the loosening of the tightness of the US employment market.

This resulted in gold further capitalizing against a weaker greenback and allowed the metal’s price to break above the $2000 psychological level and move towards its all–time highs. On Friday however, the narrative shifted as the Non-Farm Payrolls report recorded once again solid results. Even though the headline figure came below estimates by only 3k, in the grander scheme of things the addition of 236k during the month of March, signals that the US labor force remains tight.

More importantly, the unemployment rate eased to 3.5%, just shy of the lowest levels ever recorded and serves as another indication that the employment markets remains hot. As a result, despite the precious gaining support due to the ADP Non-Farm Payrolls and Jolts Job openings figures, the gains made by the ADP NFP figure were wiped within the next two trading sessions as the greenback gained support leading to outflows from the precious metal. Given the continued tight labour market, the Fed may have some leeway in the event that they decide further rate hikes are necessary in order to continue their fight against inflation.

Thus, with the possibility of future rate hikes back on the table given the resilient results from the NFP report, the market now foresees that the central bank will hike by 25 basis points in its next meeting on the 3rd of May, evident from the 71.4% probability from Feds Funds Futures. Furthermore, NY Fed President Williams who on Monday dismissed the notion that the Fed’s interest rate policy was behind the collapse of SVB stating that he personally doesn’t think “it was the case that the pace of rate increases was really behind the issues at the two banks back in March”.

Hence the relatively hawkish comments, facilitated traders to speculate that rate hikes are still on the agenda. It should be noted that despite the hawkish remarks made by NY Fed President Williams, the comments did not result in major fluctuations in the price of gold, which could be due to the release of the March survey of Consumer of expectations by the NY Fed where “respondents were more pessimistic about future credit availability as well, with the share of households expecting it will be harder to obtain credit a year from now also rising”. Potentially fueling continued fears of a recession in the near future thus offsetting the hawkish remarks.

The highlight of the week, however, is the widely anticipated US CPI print on Wednesday, that should provide valuable insight for traders as to the degree to which inflationary pressures still persist in the US economy. Should there be a deceleration of inflationary pressure we may see the precious metal strengthen, whereas a higher than anticipated print, could weaken gold’s price since it may signal that inflationary pressures remain persistent in the US economy. Hence, we may see the precious remain relatively stable as gold market traders await for the results of the report.

Newmont and Newcrest merger potentially setting a new record

According to Reuters, US based Newmont offered to buy Australia’s Newcrest Mining LTD for $19.5 billion, potentially extending Newmont’s control as the world’s biggest gold producer. If the merger proceeds as planned, we may see Newmont’s gold output nearly doubling against it’s rival Barrick Gold Corp as stated by Reuters. According to S&P Global Market Intelligence, the merger may allow Newmont to have a greater control over the current precious prices, as their ability to control approximately 8.9% of the world’s global gold supply, may provide leverage in future negotiations and gold outputs. Hence, the shiny metal’s price may benefit from this merger as control of global supply solidifies, hence may reduce volatility in the market.

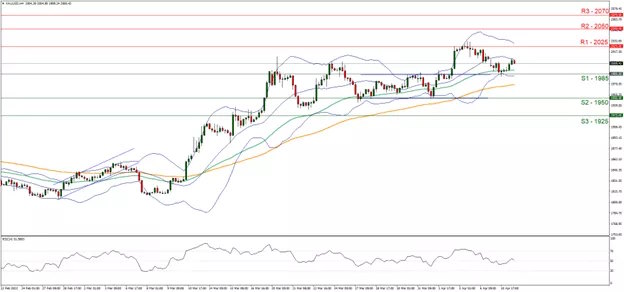

- Support: 1985 (S1), 1950 (S2), 1925 (S3)

- Resistance: 2025 (R1), 2050 (R2), 2070 (R3)

Gold’s price seems to be moving in an upwards fashion having broken above previous resistance now turned support at 1985 (S1) level. We tend to maintain a bullish outlook as long as the price action remains above the 1985 (S1) level with the RSI indicator moving towards 70. For our bullish outlook, to continue we would require price to make a clean break the above the 2025(R1) resistance level, aiming if not breaking also the 2050 (R2) resistance barrier formed on the 5th of April, that has yet to be retested. Should the bears take over, we would require a clear break below the support line of 1985 (S1) and a move towards support at the 1950 (S2) level potentially moving even lower.