Crude is currently on track to record its fourth straight week in the greens, resuming its upward movement and increasing the gains made after the production cut announcement of OPEC. We have to note that the market worries for the supply side of the commodity and the tightness of the oil market may have been the main contributor to its rise. On the flip side market worries for a possible recession in the US economy seem to have started to grow also worries for the demand side of oil. In this report, we aim to shed light on the catalysts driving WTI’s price, assess its future outlook and conclude with a technical analysis.

The situation in the US oil market

US oil reserves seem to have been on the rise slightly this week. It was characteristic that the API weekly reading showed an increase of was of 0.377 million barrels, a reading similar to the EIA release of an increase of 0.597 million barrels. The releases tended to imply that production was able to catch up to demand levels after two consecutive weeks of drawdowns, yet analysts tended to note that the increase of oil reserves was due to another release from the US Strategic Petroleum Reserve (SPR). Hence we continue to view the US oil market as rather tight. Please note that the US Government has expressed a desire to replenish the SPR soon, hoping also to refill the SPR at a lower price.

Should the US Government actually proceed with the refill of SPR that would provide additional demand for oil adding additional strain to the US oil market, given also that the Baker Hughes oil rig count showed another reduction of active oil wells in the US.

OPEC’s cuts

Last week we highlighted the production cuts announced by OPEC+, yet for the time being it seems that Saudi Arabia maintained the supply levels to Asia for May. It should be noted that Saudi Arabia had pledged an additional production cut of 500k barrels per day. We see the oil production cut announcement as another sign of the distance between the US and Saudi Arabia, something that in conjunction with the financial needs of the Saudi Kingdom may push oil prices even higher. It should be noted that OPEC’s monthly report, which was released today tends to highlight downside risks regarding the oil market, in the summer months.

Practically the oil-producing cartel seems to worry about an easing demand in the US, as the economy may suffer a hit from the Fed’s monetary policy tightening. Also, the reopening of China, may not have delivered the expected increase in oil demand, at least not yet. These worries could provide reasons for OPEC to maintain or even deepen further the low oil production levels.

The demand side worries

It’s characteristic that OPEC’s monthly report sites “It should be noted that potential challenges to global economic development include high inflation, monetary tightening, stability of financial markets and high sovereign, corporate and private debt levels,” and that “The impact of the recent reopening of China has still not been sufficient to reverse the declining trend in global refinery intakes,”. Yet, China’s crude oil imports were on the rise, with Reuters citing a 22.5% increase for March in comparison to a year earlier.

There are also worries for the demand side in the US which tended to intensify as the Fed’s March meeting minutes revealed that Fed staff, is expecting the US economy to fall into a “mild recession” during the year. Such a recession may exactly lower oil demand from the US setting oil prices under pressure.

It should be noted that the US central bank is still not over with monetary policy tightening and may intensify the hit on the US economy. Given the lagging effect of monetary policy tightening on the economy, we may expect the worse yet to come. Please note that economic activity in the US manufacturing sector showed another contraction for the month of March while the expansion in the Chinese manufacturing sector may be marginal for the same month.

Technical Analysis

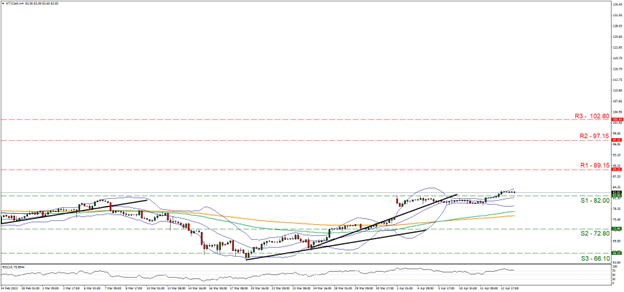

WTI’s price edged higher in the past few days being finally able to break the 82.00 (S1) resistance line, now turned to support. Given the commodity’s price action and the fact that the RSI indicator is currently above the reading of 70, implying a rather bullish sentiment on behalf of the market, we tend to maintain a bullish outlook for the commodity’s price. Please note though that WTI’s price seems to be nearing overbought levels and may be ripe for a correction lower. WTI’s price rose yet stabilised in the past 20 hours after hitting on the upper Bollinger band, allowing for little room for the bulls to play, in another sign of possible stabilisation.

- Support: 82.00 (S1), 72.80 (S2), 66.10 (S3)

- Resistance: 89.15 (R1), 97.15 (R2), 102.80 (R3)

Should the bulls maintain control and extend their influence we may see WTI’s price rising and reaching if not breaching the 89.15 (R1) resistance line. Despite the distance between the S1 and the R1 being quite wide, WTI’s price was able to cover such distances easily within a week, in the past. Should the R1 be broken we note as the next possible target for the bulls the 97.15 (R2) resistance level, which has not seen any price action since August last year. Should the bears take over, we may see WTI’s price reversing direction, breaking the 82.00 (S1) support line, paving the way for the 72.80 (S2) support level.