Gold, often regarded as a safe haven asset, recently made headlines by surging past the $2000 per ounce threshold. While this move is decisive and notable, it also brings to the forefront multiple headwinds that could impact its future trajectory. At the culmination of last week, gold confidently broke the $2000 barrier, a significant psychological mark. This comes after a substantial rally of roughly $200 from its price of $1810 on October 6th. Unsurprisingly, this rally has led to profit-booking sentiment, with speculators keen to capitalize on their gains.

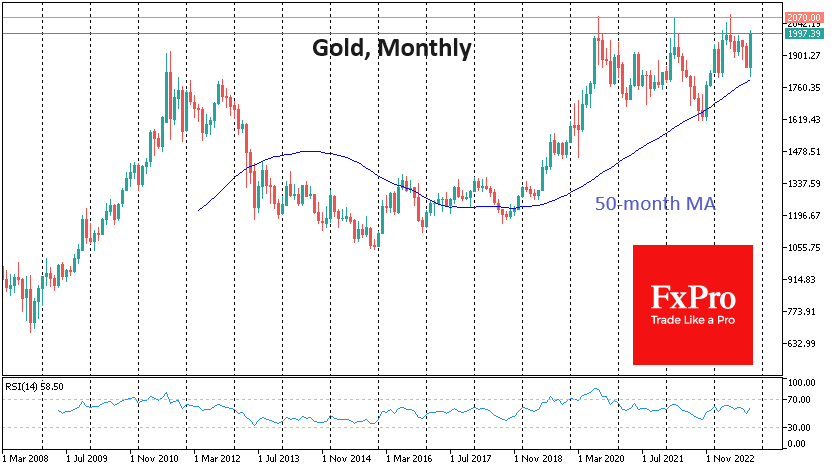

From a technical standpoint, gold's daily Relative Strength Index (RSI) indicates an overbought situation, positioned at the 70 mark. Even a temporary dip below this threshold earlier last week failed to initiate a marked correction, thanks to the swift return of buyers who propelled the price to new highs towards the week's end.

In the past three years, gold has managed to cross the $2000 benchmark thrice. On each of these occasions, it has ascended to around $2070 before undergoing a pullback. Historical data from 2020 and 2021 witnessed gold retracing to sub-$1800 levels, while 2022 saw it approach $1620.

Identifying Patterns: A Bullish vs. Bearish Outlook

The recurring patterns in gold's price dynamics draw parallels to a distorted, inverted head and shoulders structure. Typically, this pattern is seen as bullish and could hint at gold potentially soaring to nearly $3000 per ounce, although this monumental move might span a couple of years. However, one might argue that history is more likely to favor a bearish trajectory.

The gold trends observed during 2011-2012 serve as a case in point. During that period, gold struggled to firmly consolidate above the $1800 mark. A mix of monetary policy shifts and a less-than-optimistic macroeconomic landscape caused a prolonged decline, dragging gold to a low of $1055 over three years.

Factors to Consider: Bonds, Inflation, and Monetary Policy

In the present economic climate, the lucrative yields offered by government bonds make a compelling case against gold. Growing indications of the gold market nearing its peak could catalyze a shift in active capital from gold to bonds—especially given the virtually non-existent default risk associated with US and major Eurozone government bonds.

An essential factor to weigh in is the trend in inflation. Recent indicators suggest a slowing down of inflation rates. While gold has traditionally been viewed as a hedge against inflation, this perspective seems to be waning, especially among retail investors.

Furthermore, global monetary policy dynamics are evolving. As central banks pivot from aggressive rate hikes to a more cautious stance, a policy reversal seems imminent. This looming change boosts the allure of long-dated bonds, posing a direct challenge to gold.

In Conclusion

While gold's recent sprint past $2000 is undoubtedly newsworthy, its future direction remains shrouded in uncertainty. A complex interplay of historical patterns, global monetary policies, inflation rates, and bond yields will shape its trajectory in the coming months and years. Investors and analysts would do well to keep a keen eye on these multifaceted influences.