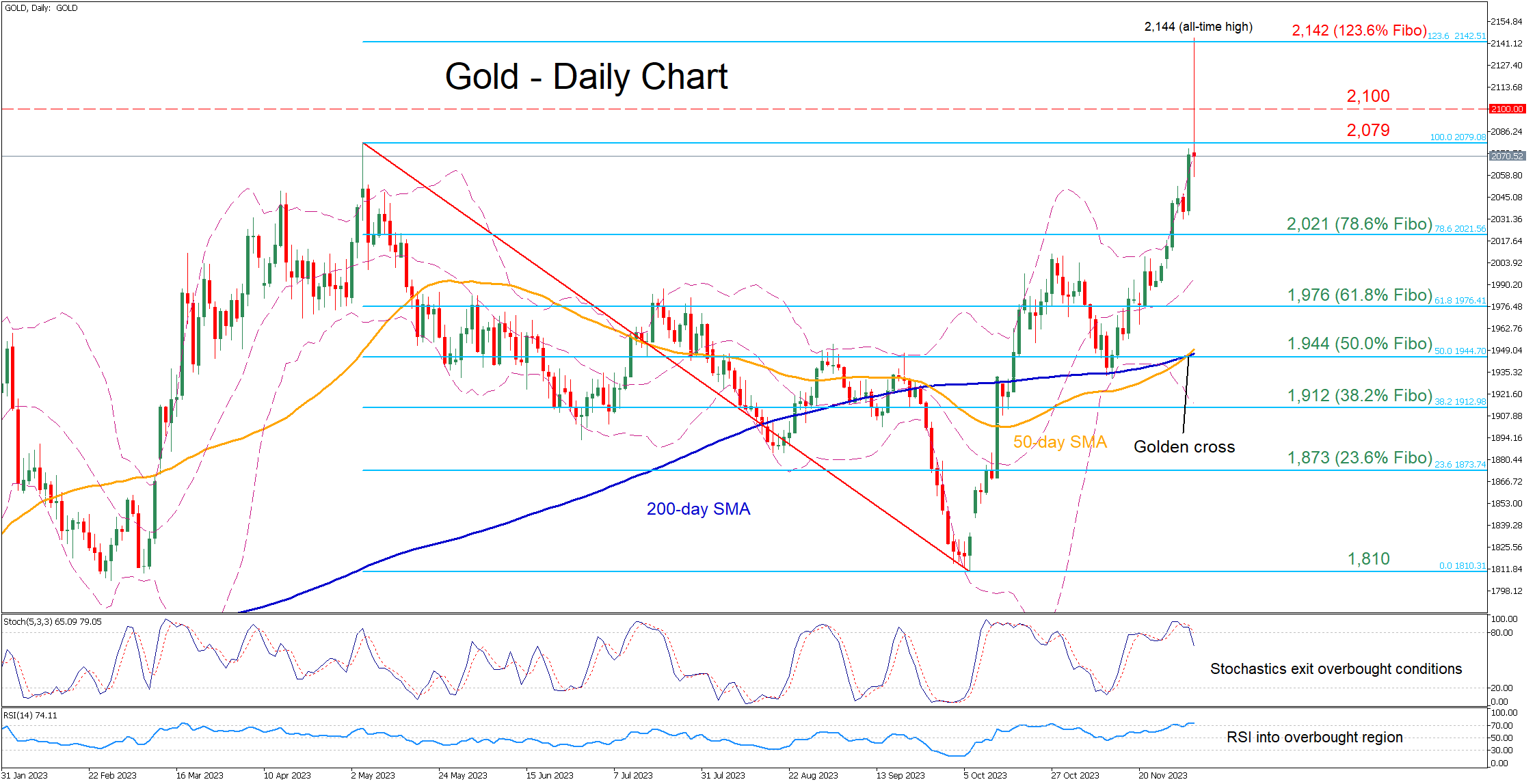

Gold experienced a significant surge on Monday, reaching a record peak of $2,142 per ounce. This milestone follows a robust uptrend that began around November 10, when gold prices rebounded off the crucial 200-day simple moving average (SMA). However, this rally proved to be short-lived as gold failed to sustain its gains, eventually falling back below the previous high set in April.

Technical Indicators and Potential Retracements

Current momentum indicators suggest that gold's recent advance may have been overstretched. As these indicators begin to show signs of easing from overbought conditions, a pullback in gold prices appears likely. The first key level to watch is the 78.6% Fibonacci retracement of the $2,079 to $1,810 downleg, which sits around $2,021. If gold slips below this threshold, the next potential support levels are at the 61.8% Fibonacci retracement at $1,976 and the 50.0% Fibo level at $1,944.

On the other hand, if gold bulls manage to reignite the upward momentum, the first significant resistance level could be the April peak of $2,079. Breaching this level might pave the way towards the psychological barrier of $2,100. Beyond this, gold could aim to retest its recent all-time high of $2,144, which is in close proximity to the 123.6% Fibonacci extension.

The swift surge to a new high, followed by an equally rapid retracement, raises questions about gold's immediate market trajectory. An important factor to consider is the recent formation of a 'golden cross' between the 50- and 200-day SMAs, which is often seen as a bullish signal in technical analysis. This development could potentially refuel the rally, but investors and traders will need to closely monitor the interplay between these technical signals and broader market dynamics.

Gold's journey to a record high and its subsequent retracement highlights the volatile nature of the precious metal's market. With technical indicators pointing to a possible overextension and key Fibonacci levels providing potential support and resistance zones, the market's direction in the near term remains uncertain. The recent golden cross formation adds another layer of complexity, potentially signaling a resurgence in bullish momentum. Market participants will likely stay vigilant, watching for signs that either confirm a continuation of the uptrend or indicate a deeper pullback.