Sometimes you realize that you fell into a rut and your trading got boring. You've lost that passion and drive, you’re not excited like at the very beginning when you were making your first steps in trading. It all just got dull. But you really need an adventure! You want to make a lot of money, enjoy your life and love what you do. Isn’t trading about all of that? In this article, we will explain why we believe that “fun” trading is actually unhealthy and share 5 tips to make your trading more conscious and effective.

But first, let’s answer the following question: Why we get bored?

Our brain is constantly working, it can’t do anything, so it’s always looking for ways to entertain itself, i.e. you. We are wired this way, that’s why we:

- Listen to music

- Watch movies

- Play games

While doing it, we can simultaneously talk on the phone or send funny texts to a friend. We’ll do anything to avoid boredom and bring those serotonin levels up. Yes, avoiding boredom and apathy is in our nature. When we get bored, we become sad and feel bad. But did you even notice that all great ideas and solutions manifest themselves in the moments of solitude and tranquility?

When we need to solve a complex, incomprehensible problem, we turn off the music and movies, ask everyone to leave the room and leave us alone with our thoughts? It’s all about focus. Focus is essential for programmers, designers, musicians. Focus is also essential for traders:

How to focus on the essentials: 3 best ways

All great traders unanimously agree: you need to give yourself 5-10 minutes to tune in to trade:

- Remove all distractions, put your phone in silent mode

- Take some deep breaths, Inhale and exhale 5-10 times

- Go through your trading plan once again, revise your trading strategy, think about your expectations and plans for each instrument you’re about to trade/

Focused? Got in the zone? Well, now you can hear us out. Let’s debate why trading is so boring at times, and why it should be that way!

Do you deserve your money or not?

That’s a tricky question. «Well, I’ve earned this money, so I deserve it». And, consequently: «If I lost money, it means I’ve made a mistake».

Yes, our life experience suggests that it’s right to think that way. However, if you think about it, trading can be rather counterintuitive. For example, how about the fact that you can only earn from trading if others lose their money?

Well-deserved money

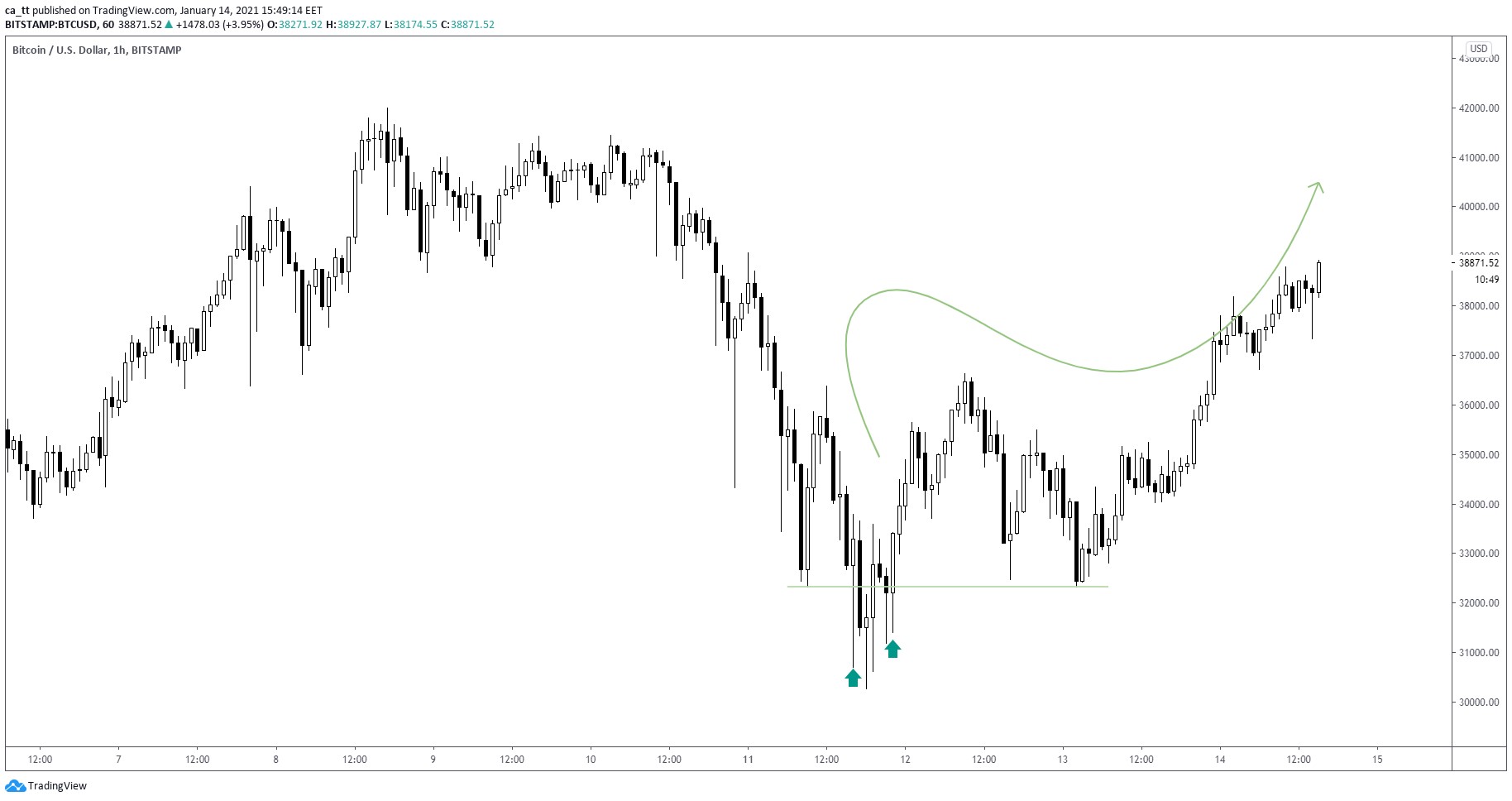

In fact, the money you deserved is the money you made by sticking to your trading plan. Say, you analyzed the chart and said, “Bitcoin is trading around $30 000, and it’s overbought. So I need to short it.”

So, Bitcoin reaches the $30 000 mark and keeps rising, but you get no signals to enter the market. Then, it climbs to $35 000. Still no signals for market entry. BTC rises to $40 000, slows down and enters a sideways range on an hourly time frame. You get anxious, read over your trading plan/strategy, set alerts and wait for the market entry signal:

If when trading you:

- Focus

- Plan ahead

- Do not enter the market without a clear signal

- Follow the rules of your trading strategy

Congratulations! You earn your money rightly, and you deserve it. And even if you lose from time to time, it’s still ok, it’s just how trading works. No business brings you constant profit, sometimes you make mistakes, learn from them and grow even stronger.

No discipline, no profit

You can’t build your business without discipline and consistency. We’re serious. Do you really think that Warren Buffett, George Soros, even the chatty one Mike Novogratz follow their plans and strategies, and you don’t have to? Maybe that’s why you still don’t have a brand new Bentley parked in your garage, huh?

To hell with your discipline! Are you sure? Let’s see what Warren Buffet thinks about it: «We don’t have to be smarter than the rest. We have to be more disciplined than the rest» (с)

Weaknesses and strengths of a strategy

We bet you don’t know all the strengths and weaknesses of your strategies. You probably know some of them, but not all of them and not thoroughly. For example, institutional traders like to take money from retail traders using false breakouts:

Did you know that a false breakout can happen at:

- Support/Resistance Zones

- Intraday high/low

- Any technical analysis pattern

- Consolidation zones

So many variations. Besides, during the false breakout a wide variety of candles can appear. All this must be taken into account. You should not only consider and create different modifications of your strategy, but you must be able to make money from them.

That’s where the boring part begins:

- Open a test or a demo account

- Close a couple of trades. Avoid any emotions, both positive from winning or negative from failing.

- Record your results to your trade journal…

From this article, you should understand one thing:

Profitable trading is boring trading

Trading currency pairs, cryptocurrency and stocks is no different from working at the office. You sit down at your desk, focus on the task, and start working. You learn something new and hone your skills, you set goals and take stock of what has been achieved.

All these boring things will bring you massive profits and trading success. Are you ready to start?