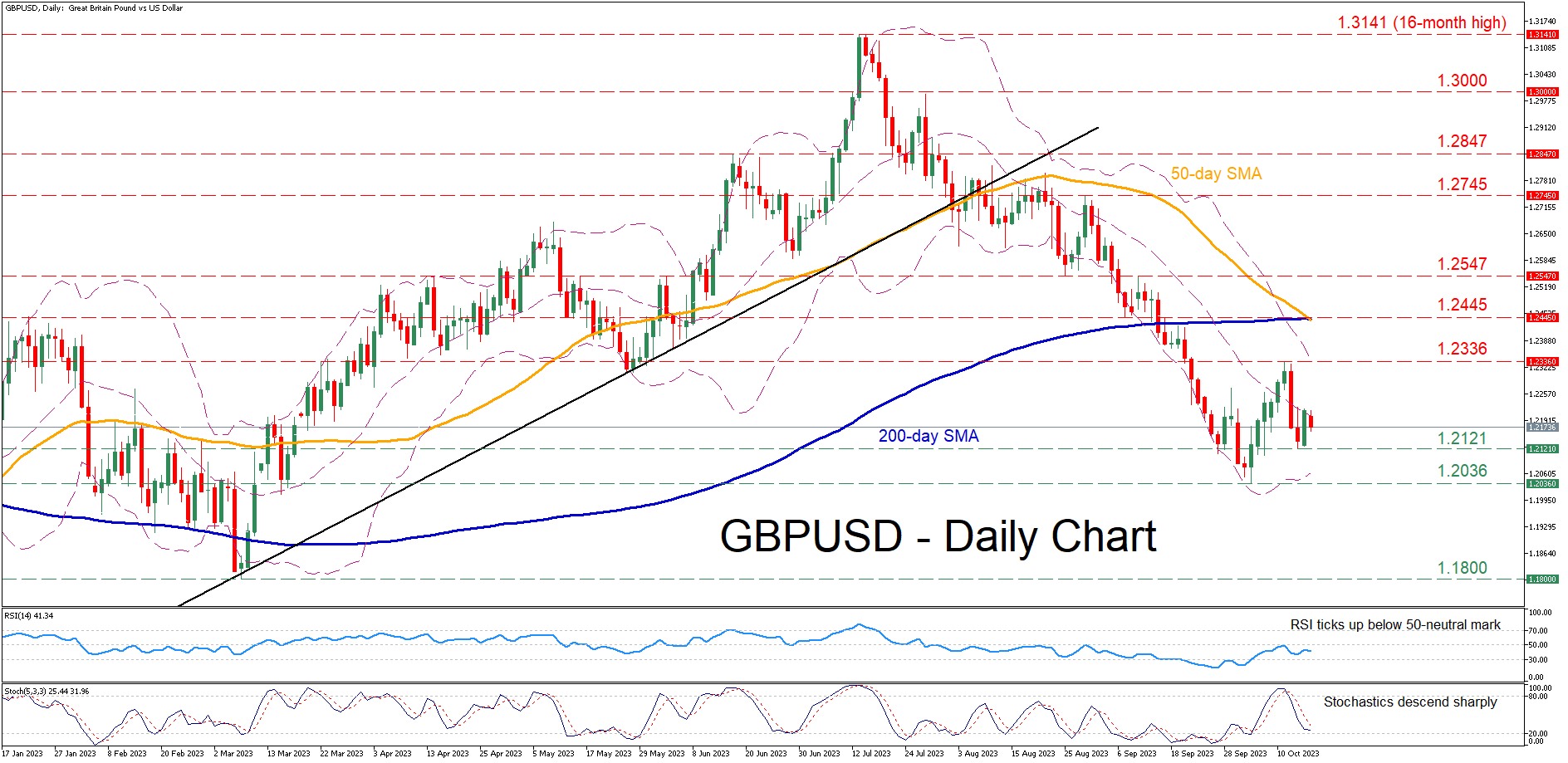

From its zenith in mid-July, the GBPUSD currency pair has grappled with significant downward momentum, echoing sentiments of uncertainty in the markets. The currency recently experienced a slight reprieve from its relentless slide, rebounding from a stark seven-month low. However, this uplift was ephemeral, and the pair couldn't muster enough strength to consolidate a moderate recovery. Delving deeper into the technical realm, GBPUSD's trajectory since its 16-month high of 1.3141 illustrates a pattern marked by consistent lower highs and lower lows. This progressive regression casts doubt over the pair's immediate future. Furthermore, when we scrutinize contemporary technical indicators, the Relative Strength Index (RSI) and the stochastic oscillator both convey a bearish inclination. This not only dims the prospects of a bullish turnaround but also dampens the morale of those optimistic about a prolonged recovery.

As we project potential pathways for GBPUSD, should its current bearish momentum persist, the currency might soon confront the freshly established support level at 1.2121. Breaching this threshold might intensify the descent, with the seven-month nadir of 1.2036 looming large as the next potential pitstop. If the pair fails to muster support at this juncture, it could be propelled further downward, possibly gravitating towards the low established in March, situated at 1.1800.

However, the financial markets are a realm of endless possibilities. If bullish sentiments manage to resurface, prompting traders to rally behind the GBPUSD, we might witness an ascent targeting the recent resistance domain at 1.2336. A decisive break beyond this boundary could position the pair to challenge the formidable resistance belt that spanned December and January, pegged at 1.2445. Notably, this level aligns seamlessly with the intersections of both the 50- and 200-day simple moving averages (SMAs) — a convergence that underscores its significance. If the pair manages to transcend this realm, the subsequent resistance beckons at 1.2547, a level that has historically played a dual role, serving as both support and resistance in prior months.

In summing up the GBPUSD's current landscape, while the pair made valiant attempts to stem its slide, the gravity of its decline proved overpowering, truncating its recovery. The looming question on market participants' minds now is: amidst this backdrop of uncertainty, do the bulls have the tenacity to mount a counter-offensive?