After brushing aside a hotter-than-expected CPI report last week, investors betting on an imminent pivot by the Fed were emboldened on Friday from a very soft set of producer prices. The final demand producer price index edged up year-on-year in December but the figure of 1.0% fell short of the 1.3% reading anticipated, while core PPI eased more than expected.

March rate cut back in play

It seems that the markets don’t think that the CPI components such as shelter costs that boosted prices in December will keep headline inflation elevated for too long, with the PPI data reinforcing the view that underlying price pressures in the US economy continue to ease.

- Fed rate cut expectations go into overdrive after soft US producer prices

- Bond yields slip, but dollar little changed and mixed earnings weigh on stocks

- Focus shifts to Chinese growth and global inflation trends this week

Year-end rate cut expectations soared to more than 165 basis points after the data, while the odds that the Fed would commence its rate-cutting cycle as early as March rose back above 80%. The biggest threat to upsetting these dovish expectations this week are Wednesday’s retail sales numbers should December prove to have been a strong month for the US consumer. However, there is also a risk that Fed officials may try to rein in the aggressive bets when they take to the podium in the coming days, starting with Governor Waller on Tuesday.

Dollar resists slide in yields

Treasury yields came under renewed pressure as investors upped their predictions of how many times the Fed would slash rates this year. The 10-year yield ended Friday at 3.95% - a more than one-week low. But with US markets closed on Monday for Martin Luther King Day, the yo-yo action in the Fed fund futures market didn’t spark the usual fanfare in the equity and FX spheres.

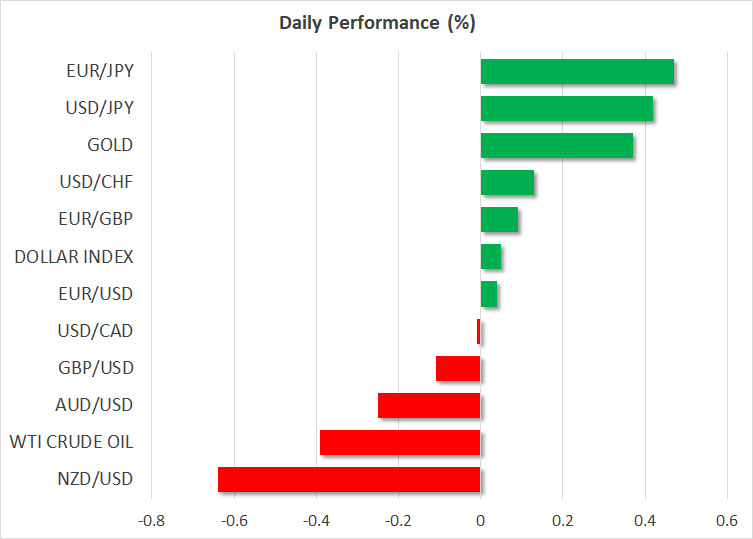

The US dollar has been crawling higher for the past two sessions with more buyers stepping in today in European trading. One explanation why the greenback isn’t tracking yields lower is the fact that other central banks are also expected to sharply lower their borrowing costs this year, so yield spreads haven’t narrowed that significantly in favour of other majors like the euro.

China GDP and inflation data eyed

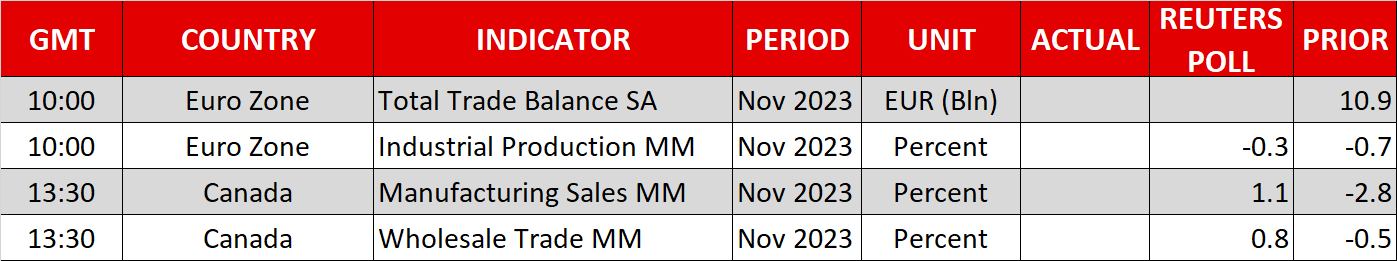

But there could also be some caution at the start of the new trading week amid China reporting its fourth quarter GDP estimate on Wednesday and a number of countries publishing CPI data, including Canada, Japan and the UK. China’s central bank kept its medium-term lending rate unchanged on Monday, disappointing many investors who were anticipating a small cut. It’s possible that policymakers will opt for alternative policy measures to boost growth such as a further reduction in the reserve requirement ratio, which may come after the GDP report, especially if it misses expectations.

Both the aussie and kiwi are underperforming today, while sterling is also trading lower ahead of some key UK releases this week, most notably, the latest inflation numbers on Wednesday.

Stocks struggle for direction as earnings fail to set the markets alight

In equity markets, stocks in Asia and Europe were muted on Monday following an underwhelming performance on Wall Street on Friday. The major US banks kicked off the Q4 reporting season with a mixed bag of earnings. More big bank earnings are due tomorrow with the likes of Goldman Sachs and Morgan Stanley.

With some doubts creeping in about the prospects of some of the Big Tech names as well, this earnings season has gotten off to a shaky start. But perhaps the biggest danger is that when rate cuts are so heavily priced in, there’s limited room for additional boosts from this department, so any disappointment in earnings could be quite damaging for Wall Street bulls.