Choosing the right broker is a crucial step for any aspiring trader. Before committing to FXNovus, it’s important to go beyond flashy headlines or welcome bonuses. This article breaks down what truly matters — the practical, financial, and strategic elements you need to consider before opening an account.

Whether you’re new to forex or switching from another broker, here’s a comprehensive list of key insights and considerations that will help you make an informed decision.

1. Understand the Type of Trader You Are (or Plan to Be)

Before signing up, ask yourself:

-

Are you a complete beginner?

-

Do you plan to trade daily or occasionally?

-

Are you more interested in forex, crypto, stocks, or commodities?

FXNovus is best suited for:

-

Beginner to intermediate traders

-

Short-term, manual traders (scalpers, day traders)

-

Traders who prefer web-based platforms over downloadable terminals

If you’re looking for algorithmic trading, MetaTrader 5, or deep integrations with third-party tools, FXNovus may not be your perfect fit.

2. Know the Minimum Deposit Requirements

FXNovus offers multiple account tiers. Each tier comes with its own perks and minimum funding limits:

-

Classic Account: $250 (Best for beginners)

-

Silver Account: $2,000

-

Gold and Above: $10,000–$50,000

Important: Choose a tier that aligns with your risk appetite. While higher accounts offer better spreads, don’t stretch your budget just to access them.

3. The Platform Is Browser-Based (No MT4/MT5)

If you're coming from brokers that use MetaTrader 4 or 5, prepare for a shift. FXNovus uses a proprietary WebTrader platform, which offers:

-

Clean design and user-friendly layout

-

20+ indicators

-

One-click trading

-

Mobile responsiveness

While excellent for simplicity, it does not support automated strategies or custom scripts. If you’re tech-savvy or use EAs, this could be a limitation.

4. Spreads Are Fixed, Not Floating

Spreads at FXNovus don’t fluctuate wildly during market volatility. This is great for budgeting—but not necessarily ideal for news traders who rely on tight spreads during major events.

Example:

-

Classic Account Spread: Fixed at 2.5 pips (EUR/USD)

-

VIP Account Spread: Down to 0.9 pips

Pro: No surprises

Con: Slightly wider than floating spreads in calm markets

5. Commissions Are Zero—but Check Non-Trading Fees

FXNovus markets itself as a commission-free broker. But traders should be aware of the following:

-

Inactivity Fee: Charged after 60 days of dormancy

-

Withdrawal Fee: Varies by method and account type

-

Swap Charges: Overnight positions incur rollover fees

Tip: Read the fee disclosure page before committing funds.

6. Account Verification Is Mandatory

FXNovus follows Know Your Customer (KYC) protocols. Be ready to upload:

-

Government-issued ID (Passport or National ID)

-

Proof of address (Utility bill or bank statement)

-

In some cases: Proof of income/funding source

This can take 24–48 hours. No trading is possible until your documents are verified.

7. You Get Access to Educational Content—But It Depends on Account Level

FXNovus does a decent job of educating users. However, the depth of content depends on your account tier.

-

Classic: Limited access to eBooks and videos

-

Silver and Up: Full access to webinars, Trading Central signals, and advanced courses

8. Deposit and Withdrawal Methods Are Diverse, But Speed Varies

Supported payment methods:

-

Visa/Mastercard

-

Bank Transfers

-

E-Wallets (Skrill, Neteller)

-

Cryptos (BTC, ETH, USDT)

Deposits are often instant (especially with cards and wallets). Withdrawals may take 1–3 business days and require identity verification each time for security.

9. Bonuses Come with Conditions

FXNovus often runs promotions such as:

-

Deposit match bonuses (10%–30%)

-

Risk-free trades (on Silver accounts and above)

These may sound appealing but usually involve trading volume requirements before you can withdraw any profits tied to the bonus.

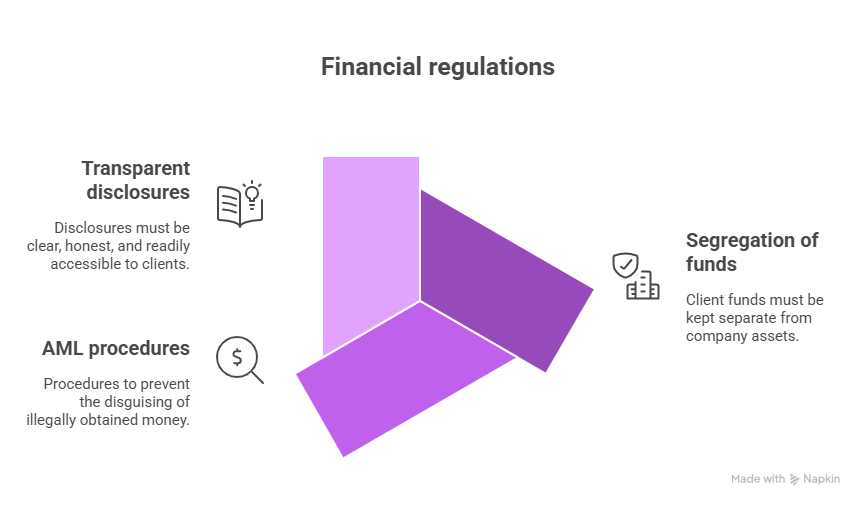

10. You’re Protected by a Regulator

FXNovus is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, under license number 50963.

FSCA offers a baseline level of protection, including:

-

Enforced segregation of client funds

-

Anti-money laundering procedures

-

Transparency in disclosures

11. Customer Support Is a Strong Point

FXNovus offers 24/7 multilingual support via:

-

Live chat

-

Email

-

Phone

Reviews consistently praise the speed and friendliness of agents—especially useful for new traders during setup or platform walkthroughs.

12. You Can Start With a Demo Account—And You Should

Before putting real money on the line, test FXNovus with a free demo account. The demo environment:

-

Mirrors live market conditions

-

Helps you learn the WebTrader interface

-

Allows you to practice strategies without risk

You can request a demo directly from the homepage—no credit card required.

Final Take: Is FXNovus Worth It?

FXNovus is a well-rounded option for:

-

New traders who want simplicity

-

Users who don’t need MT4/MT5

-

People comfortable with a $250+ minimum deposit

-

Traders who value education and fixed spreads

However, if you’re looking for micro-lot trading below $250, algorithmic strategies, or FCA-tier protection, you may want to compare it with other brokers.

Ready to Get Started?

Visit FXNovus and Open Your Account

Or take the safer route first: Try Their Demo Account.