The Forex market is one of the most volatile and lucrative markets in the trading landscape. Worth an absolutely unfathomable $6.5+ trillion a day, it dwarfs its closest competitor (stocks) by a significant margin. Despite offering plenty of opportunity for shrewd traders, the risk of loss of capital is very real. Given the cut-throat competition — especially for day traders — you simply must use all the tools at your disposal if you're to turn a consistent profit.

Apart from a sound strategy, which is just a given, you'll also need to seize every single advantage available to gain the upper hand against those who would like to get their hands on your hard-earned deposit. "But how do I do that?" you might ask. Well, listen up because we're about to give you the rundown on perhaps the biggest ace you can have up your sleeve when trading the foreign exchange market.

Read the signs

As we've already said, volatility is the name of the game in Forex. Movements might be small, but they can end up costing you big, particularly when leverage is involved. Support and resistance levels are extremely difficult to predict in this market, which tends to lead to more speculation. This makes it very easy to pick the wrong direction and rack up huge losses in the process. For this reason, analytics is an absolute must. However, not many have the time and technical analysis skills to study the market closely enough to find perfect entry and exit points.

To be honest, even the professionals frequently get it wrong. To compound matters, the window of actionability is also extremely tight. It often requires lots of analysts working concurrently to produce something that is actually usable. In this context, it's easy to see how the deck is stacked in favour of larger institutional players. So, how can the average trader level the playing field? Well, the simple answer is trading signals.

What on Earth are trading signals?!

Trading signals take many forms, but typically they consist of news events or chart-based graphics. Their value lies in the fact that they tell us precisely what is happening in the market at a particular time and give us a clear direction of movement. They even specify suitable entry and exit points. Many even include details of any key factors liable to affect prices in the short term.

Because of the enormous volatility involved, effective use of signals is absolutely crucial to successful Forex trading. There are so many influencing factors, many of which are highly unpredictable — from worldwide supply and demand fluctuations all the way to global economic and political developments. As such, you simply must have a reliable and holistic signals service if you're to have any chance of keeping up with the foreign exchange market's ups and downs.

Manual or automatic?

No, we're not talking about cars. These are the two main types of Forex trading signals available. Let's take a quick look at what each type entails and some advantages and disadvantages of both.

Manual signals

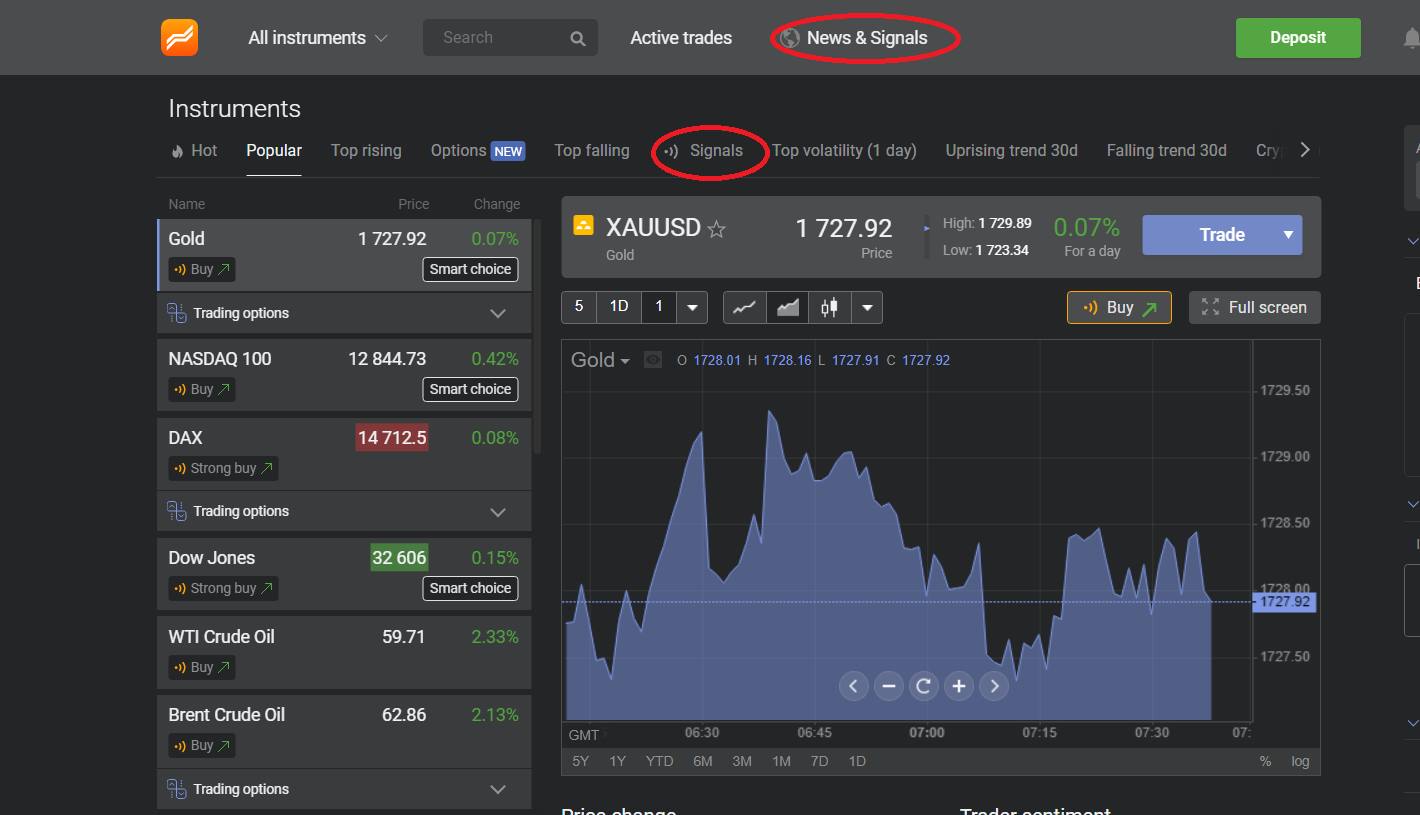

Manual signals are created by traders or senior analysts with an in-depth knowledge of the market. They usually consist of easy-to-read bulletins or annotated charts. Typically, they are universally accessible and straightforward to understand and implement. The Libertex platform includes such signals on its regularly updated newsfeed for this asset class. To access them, Libertex traders just have to click the 'News and Signals' button at the top of the page (circled red in the image below):

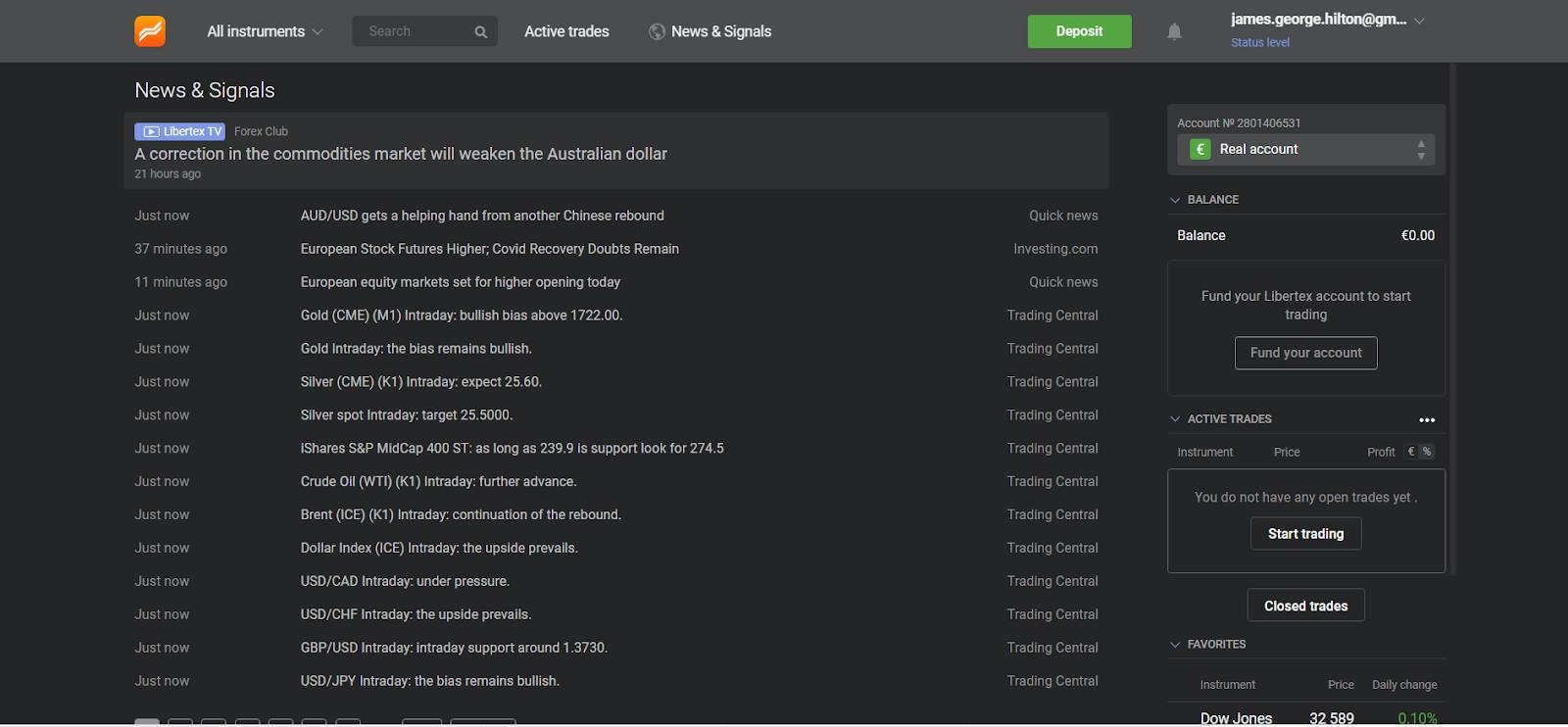

Immediately after clicking, a new window will appear showing a long list of the latest signals from a variety of sources that are updated almost every other minute (see below):

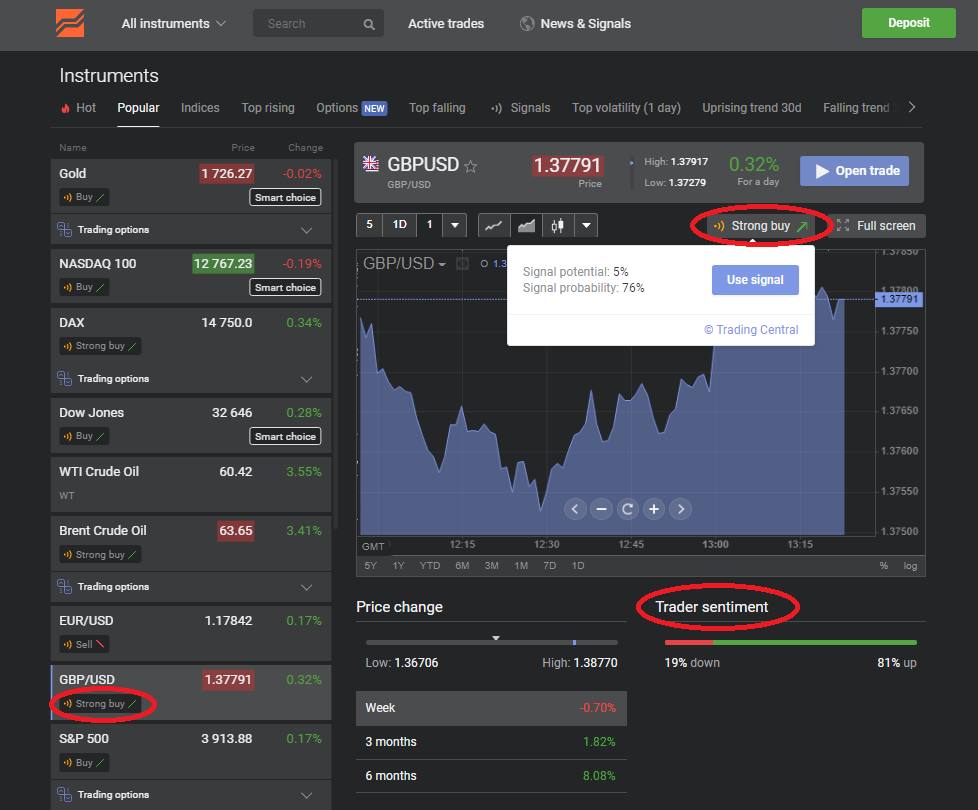

Because real people prepare them, manual signals can offer a good way for beginners to take advantage of veteran market participants' skills and knowledge. Once you see a signal you like, all you need to do is click it, and it will open automatically. That looks something like this:

So far, so good. Unfortunately, the very human dimension that makes them so easy to use can also be their downfall from time to time. Sometimes, the information can be outdated or simply misinterpreted, which is why we don't recommend relying on manual signals alone. That's particularly true for longer-term positions or higher-leverage trading.

Automatic signals

While not quite as detailed and engaging, automatic signals are generally considered much more accurate, especially over shorter timeframes. These signals are generated by powerful software suites and require quite a bit more getting to grips with than their manual counterparts.

First of all, they need some sort of data input. This can come from the trader him/herself or a third-party signals provider. After processing is complete, the software will generate a simple buy or sell signal in line with the exact market conditions at the time of generation. As such, these are not only highly accurate; they're also much more precise in terms of their timeframe and buy/sell values.

Luckily for Libertex users, they have access to both automatic and manual signals to leverage the benefits of each. Libertex's automatic signals are super-easy to use as they come embedded into each individual instrument on the platform screen. Below is an example for GBPUSD:

As we can see, right there on the chart, we have the latest rating for the relevant instrument ("strong buy" in this case). If we click this, a box appears with the signal potential (5%) and signal probability (76%), enabling us to make a quick decision as to whether the signal fits our strategy/risk tolerance. We can even open a trade using it with the click of a button by hitting 'Use signal'. It really couldn't be easier. The platform even includes another handy metric, trader sentiment, just below the chart (circled red).

Summing up

Trading is known to be rife with uncertainty, but nowhere is this more acutely felt than in the Forex market. Even experts can make very costly mistakes without a helping hand. This is where trading signals come in. Apart from providing general information about the opportunities available in the current market situation, they also help traders mitigate many of the transaction- and leverage-related risks that can end up costing them so dearly. By providing clear entry and exit points, signals can help everyone from long-term investors to swing and day traders while also allowing for constant monitoring of positions for as long as they remain open.

However, to get the most out of signals, you really need to be using a combination of the two. That's why platforms such as Libertex that integrate both varieties are so powerful. Usually, services like this don't come cheap, and not every broker out there is providing its clients with this level of added value free of charge. So, if you'd like to take your Forex trading to the next level, why not create a Libertex account today? With unbeatable leverage (30:1 on currencies) and market-beating commission all wrapped up into an award-winning, ultra-user-friendly app, Libertex is a really good option to join the ranks of satisfied traders around the world!