Support and resistance levels are paramount concepts, pivotal in navigating Forex and various financial markets. These levels underpin myriad trading strategies and form the foundational framework for numerous indicators and advisory bots in the trading ecosystem. To grasp these concepts thoroughly, we will delve deeper into their fundamental principles and real-world applications.

Fundamental Insights

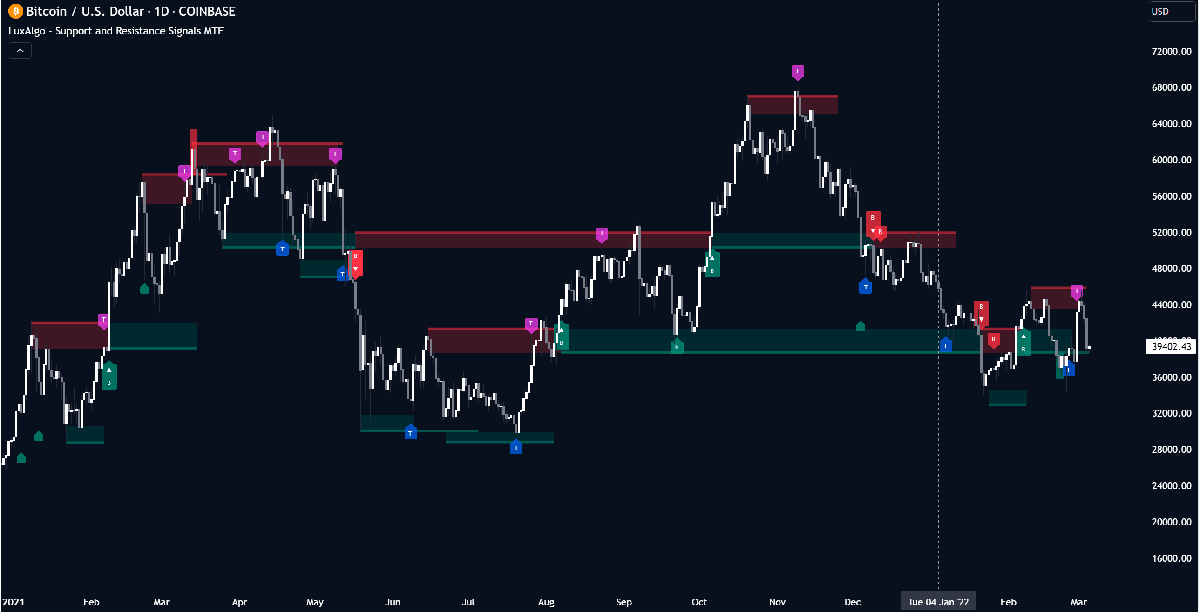

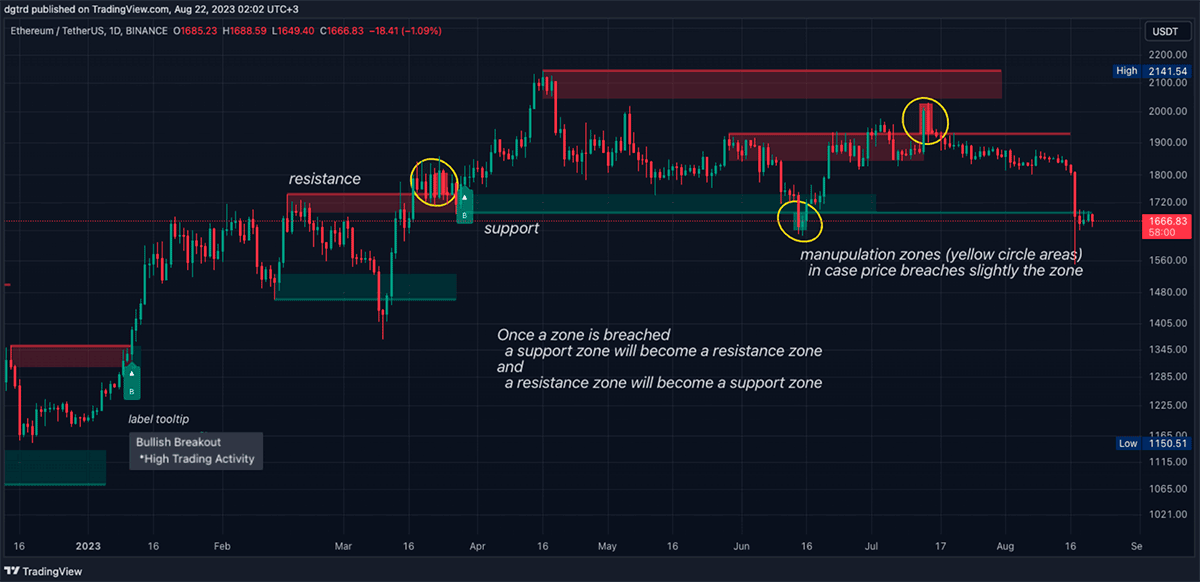

Support and resistance levels act as the critical barriers delineating the price range in which an asset oscillates. These barriers can be represented as horizontal, sloped, or curved lines. The asset's price trajectory often undergoes alterations upon interacting with these limits.

- Support Level: It is the price threshold at which assets tend to experience upward momentum due to the predominance of bullish buyers mitigating further depreciation.

- Resistance Level: Contrarily, it is the juncture at which bearish sellers gain predominance, frequently inducing a downward price reversal.

Analytical Precision and Probabilities

The verbiage ‘often’ and ‘may’ are intentionally used to emphasize that price reversals at these junctures aren’t absolute. Prices may pierce through support levels, descending further, or surpass resistance levels, ascending continuously. The likelihood of rebounds or breakthroughs classifies levels as robust or frail, elaborated further subsequently.

Delineation: Zones versus Levels

Support and resistance are articulated through zones rather than precise levels, offering a nuanced understanding of price dynamics. For example, the EUR/USD pair could reverse around the 1.1500 mark, establishing a zone of fluctuation. These zones' breadth is influenced by the asset involved, the timeframe observed, and prevailing market volatility.

Real-world Illustrations

Currency Pairs:

- EUR/USD Pair: The zone can range between 20-50 points on a daily chart (D1).

- GBP/USD Pair: The inherently volatile nature might lead to zones around 30-60 points.

- USD/JPY Pair: The divergent monetary policies post-2021 have magnified the zones, reflecting increased volatility.

Time Frames:

- Daily Charts (D1): Zones can fluctuate between 20 to 60 points.

- Hourly Charts (H1): Zones are comparatively compressed, varying from 10 to 30 points.

High volatility periods, often triggered by pivotal economic announcements, can escalate the width of the zones. These instances require traders to recalibrate their strategies dynamically, adapting to evolving market conditions.

Identifying Levels and Zones

The incorporation of psychological levels, high-volume trading points, and historical significance plays a crucial role in deciphering support and resistance points. Levels frequently tested and unbroken are deemed more reliable, serving as robust barricades against price movements in future scenarios.

Visual and Analytical Tools

Visual examination of price charts assists traders in pinpointing potential support and resistance points, with various graphical tools and specialized indicators like MetaTrader-4 aiding in constructing levels and channels effectively.

Deciphering Strength: Strong vs. Weak Levels

The robustness of a level is discerned through multiple confirmations, trading volume surges, historical relevance, and alignment with fundamental market indicators. Weak levels lack these reinforcing elements, often succumbing to price movements easily.

Employing Indicators for Enhanced Precision

- Moving Averages (MA). MA elucidates trends by aggregating and smoothing price data, serving as support or resistance zones based on the asset’s position relative to the moving average.

- Fibonacci Retracement. This tool utilizes the Fibonacci sequence to delineate potential support and resistance horizons, represented by horizontal lines on charts.

- Pivot Points (PP). PP is an established method, utilizing average values of high, low, and closing prices to identify pivotal levels.

- Bollinger Bands. The bands encompass a middle MA line and two outer lines, demarcating standard deviations and signaling support and resistance zones.

Understanding and leveraging support and resistance levels can optimize trading strategies like "Buy Low, Sell High," "Breakout/Breakdown Trading," "Bounce Trading," and "False Breakout Strategy," enhancing overall trading acumen and efficacy.

Inference and Strategic Deployment

A profound comprehension of support and resistance levels and zones, coupled with meticulous application and integration with other analytical tools, forms a lucrative trading arsenal. However, traders must remain cognizant that these tools aren’t infallible and necessitate meticulous analysis, harmonization with diverse tools, and prudent risk management to mitigate uncertainties inherent in financial markets.

The intricate weave of theoretical knowledge and practical acumen can empower traders to navigate the tumultuous seas of trading with enhanced precision and confidence.