In the vast and intricate world of Forex trading, the presence of order blocks plays a crucial role in shaping market dynamics. Introduced by large financial institutions and central banks, these order blocks represent a significant volume of transactions that can profoundly influence currency pair prices. This article delves into the concept of Forex order blocks, exploring their nature, how to spot them on a price chart, and strategies to leverage them for trading success.

Understanding Forex Order Blocks

Forex order blocks are essentially concentrated clusters of buy or sell orders placed by major market players like central banks and large financial institutions. These entities, equipped with substantial capital, strategically divide their large orders into smaller segments to avoid market destabilization. This practice results in creating order blocks, which are areas on a price chart where significant buying or selling activity occurs without drastically impacting market prices.

The Genesis and Significance of Order Blocks

The emergence of order blocks can be traced back to the unique motivations and strategies of these large market players. Central banks might engage in Forex transactions to regulate national currency prices, while corporations and financial institutions often use Forex markets for hedging purposes. Their substantial market entries carry significant weight, subtly yet effectively influencing currency pair prices.

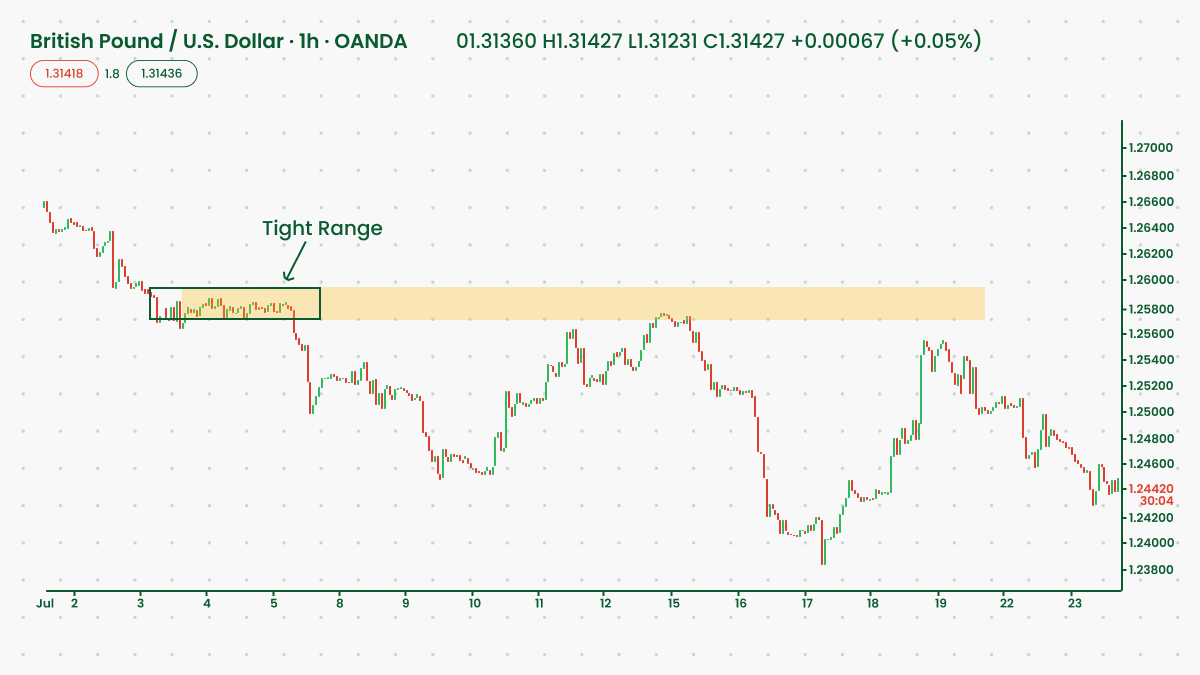

Unmasking Order Blocks on Price Charts

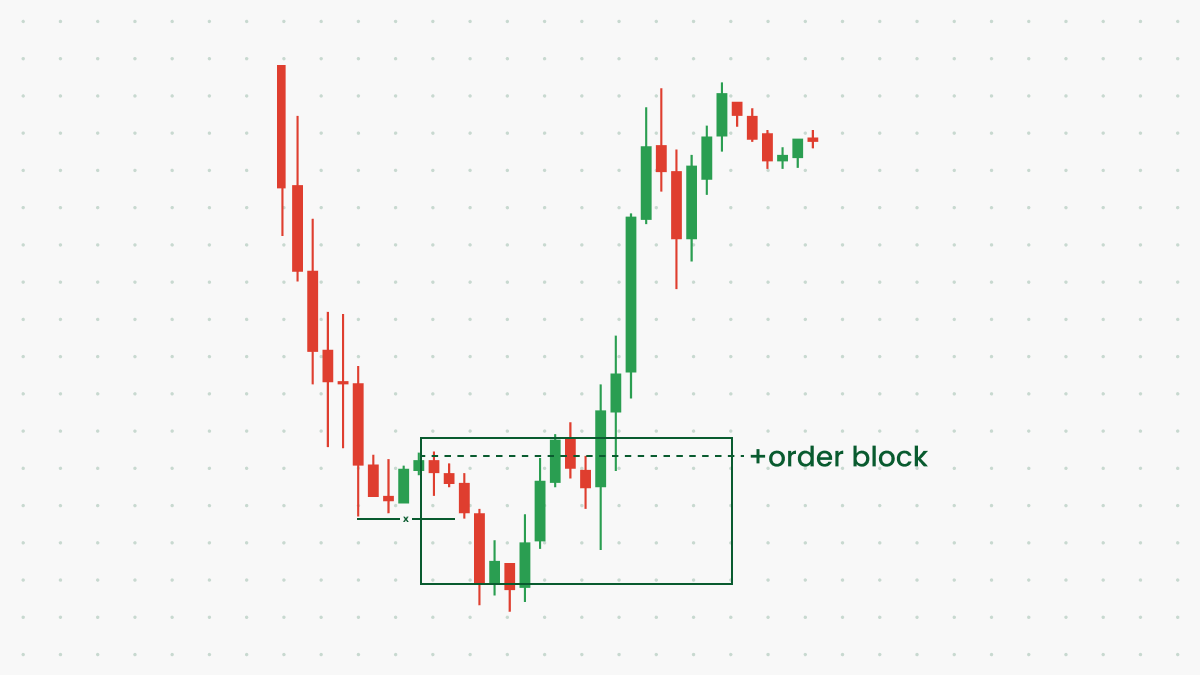

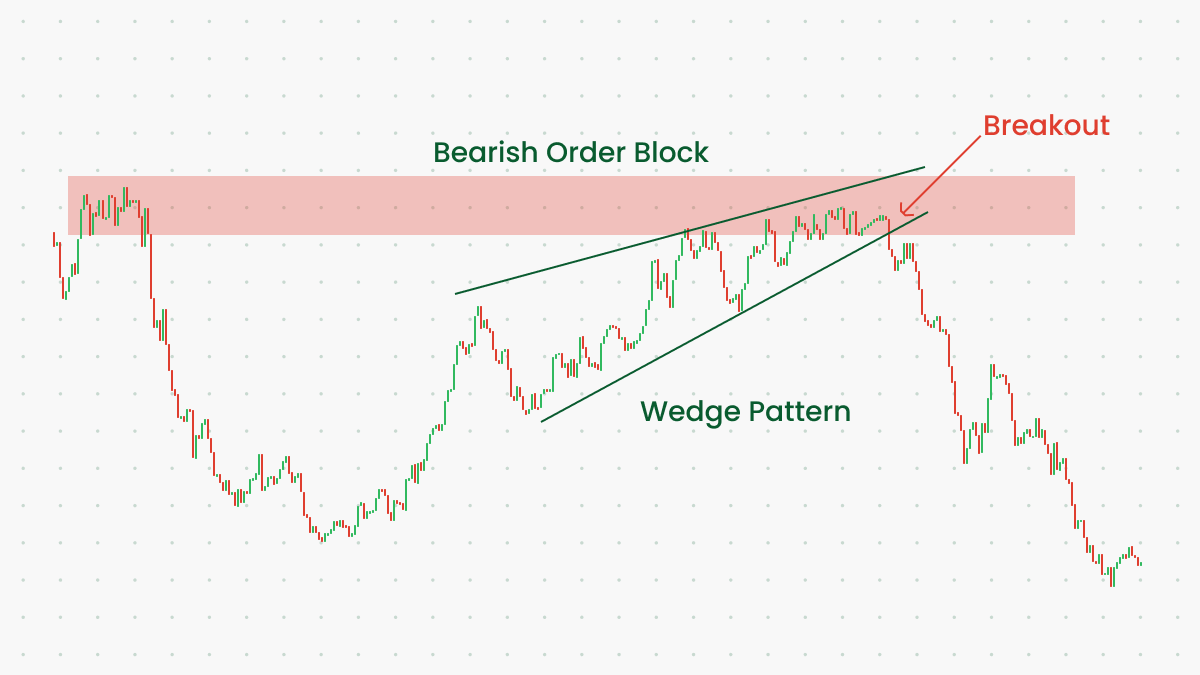

Order blocks can be identified on price charts as areas where there is a flurry of trading activity concentrated around a specific price level. These zones often serve as key support and resistance levels, acting as pivotal points for market reversals and breakouts. It's crucial to recognize that not every congregation of candlesticks constitutes an order block. Traders must employ additional tools like volume indicators (e.g., On-Balance Volume, Volume Price Trend Indicator, Klinger Oscillator) to confirm the presence of an order block.

Implications of Order Blocks for Retail Traders

While order blocks are tailored to minimize market impact, their existence can significantly sway market sentiment and direction. Retail traders, aware of the informational advantage held by large institutions, often align their strategies to follow these market giants. This imitation can alter market sentiment entirely, leading to significant price movements.

Strategies for Trading with Order Blocks

Recognizing and interpreting order blocks can be a valuable skill for traders.

Here are some strategies to consider:

Identifying Support and Resistance Levels: The boundaries of an order block can act as strong support or resistance levels. Traders might look for opportunities to enter trades when the price breaks these levels, setting stop-loss orders just beyond the breached boundary.

Trading Breakouts: Order blocks often precede significant market trends. Identifying a breakout from an order block can signal the onset of a new bullish or bearish trend, offering a potential entry point for traders.

Spotting Reversal Signals: In some cases, order blocks coincide with reversal patterns on price charts. Recognizing these patterns can provide an opportunity to trade in the direction opposite to the prevailing trend.

Navigating the Rarity of Order Blocks

It's important to note that order blocks are relatively rare occurrences in the Forex market. Successful identification requires a combination of technical analysis, volume indicators, and market knowledge. Patience and diligence in analysis are key to accurately spotting these influential market elements.

Conclusion

Order blocks represent a strategic element in Forex trading, driven by the actions of major market players. While challenging to identify, these blocks offer retail traders a unique opportunity to align their strategies with the movements of influential market participants. Understanding and leveraging order blocks require a blend of technical analysis, market awareness, and strategic execution. As we continue to witness the evolving dynamics of the Forex market, the role of order blocks remains a vital aspect for traders to consider and capitalize on.