Alarming articles about the "new crypto winter," i.e., multi-month bear market for Bitcoin (BTC) and major altcoins are popping up here and there. Crypto influencers and media outlets are reiterating that all signs of "winter is coming" are present. If true, which trading strategy can help holders to come through this painful prolonged correction? And is there a reliable service that can help in implementing such a strategy?

What is a bear market?

A bear market (“winter,” correction, recession) is a market situation in which the prices of the majority of assets are falling. It is accompanied by negative investing sentiment (from “fear” to “extreme fear”) and panic-driven selling. For stocks and index markets, analysts indicate the start of the bear market at which the rates are falling by 20% from the local peak. As crypto markets are far more volatile, bear markets start here only after a 45-55% decline.

Both traditional and cryptocurrency markets know long-term cycles: every market will go through a bullish and bearish stage. For instance, on Bitcoin (BTC) markets, a bearish recession followed 2013 and 2017 peaks. For the S&P 500 and Dow Jones Industrial Average (DJIA), the last prolonged bear markets took place in 2007-2009. Similar recessions were registered in March, 2020 but bulls managed to push prices higher.

Is the bear market already in for crypto?

While we cannot be sure about whether crypto markets are already in the “bear market” phase, there are some optimistic and pessimistic theories about this trend.

Bearish: Negative sentiment on social media and euphoria of illiquid NFTs

Mostly, analysts are sure that Bitcoin (BTC) and major altcoins have already dipped into bearish waters. Santiment statistics show that social media users have not been so bearish since mid-May 2021. As such, the “crowd wisdom” indicates a bearish correction. So does Chris Burniske, former ARK analyst and author of the most popular crypto asset valuation instruments. According to him, the surprising upsurge of the NFTs market is not good for Bitcoin as it siphons liquidity from digital gold and major altcoins. For Mr. Burniske, the entire situation looks like the “ICO boom” that ended with the “crypto winter” of 2018.

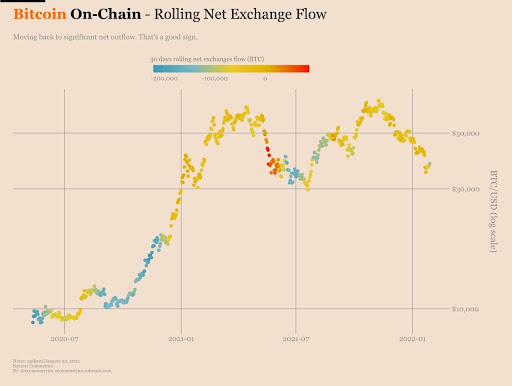

Bullish: Healthy on-chain metrics and RSI

At the same time, the data from many on-chain analytical instruments ‘screams’ that too many large-scale holders are aggressively increasing their bags. As per Coinmetrics, Bitcoin (BTC) holders are back to accumulating. So, the sell-off might be over which suggests the upsurge of price is on cards.

Also, Bitcoin Relative Strength Indicator dropped to extremely overbought levels unseen since Black Friday 2020 in Crypto.

Switching to more flexible trading strategy: Psychology and instruments

As the trading sphere has come through dozens of bear markets, there are a number of ready-made strategies that might prove helpful in overcoming a bearish recession with minimum losses.

Stablecoins

Increasing the share of stablecoins in the portfolio might also be a good solution for the bear market. When you are buying stablecoins, you do not need to “cash out” by withdrawing to SEPA, PayPal or other fiat accounts. With increased stablecoins bags, you will be able to either “buy the dip” in potentially promising assets or try “dollar-cost averaging” (DCA), which is generally considered as the go-to strategy for every bear market.

Diversification: Indexes, stocks, commodities

Last but not least, bear markets rarely target all types of markets simultaneously. So, the diversification of the portfolio should be increased. Bitcoiners can try adding ETFs and real world segment stocks, while “gold bugs” can experiment on ForEx markets.

CFDs on crypto: viable alternative for bear markets

Contracts for difference (CFDs) are contracts that allow traders to find potential benefits in volatility, while for others it might mean higher risks and potential losses as well. As crypto markets are the most volatile ones, trading CFDs here might bring significantly more benefits than that for stocks or commodities, but of course it might also bring losses as well considering the potential risks.

When you are certain that some of your assets have entered the bear market, switching to the strategy with dominant short positions might prove to be a smart move. By opening "shorts"and "longs", traders can benefit from price swings in either direction.

Libertex for crypto and Web3 enthusiasts

As the market recession after the 2020-2021 euphoria gains steam, stocks and crypto traders should adjust their strategies to new contexts. Diversification, a resource-efficient fee model and advanced trading UX/UI is one of the best choices for trading in a bear market.

As such, Libertex is quite possibly one of the best go-to solutions for all categories of traders due to its unmatched range of assets available, user-friendly interface and a large toolkit of deposits/withdrawals methods.