Copper is a widely used hard commodity that finds applications in various sectors, including technology, construction, plumbing, and wiring. While it may be less expensive compared to precious metals like silver and gold, copper’s exceptional properties as a conductor of heat and electricity make it an attractive asset for trading.

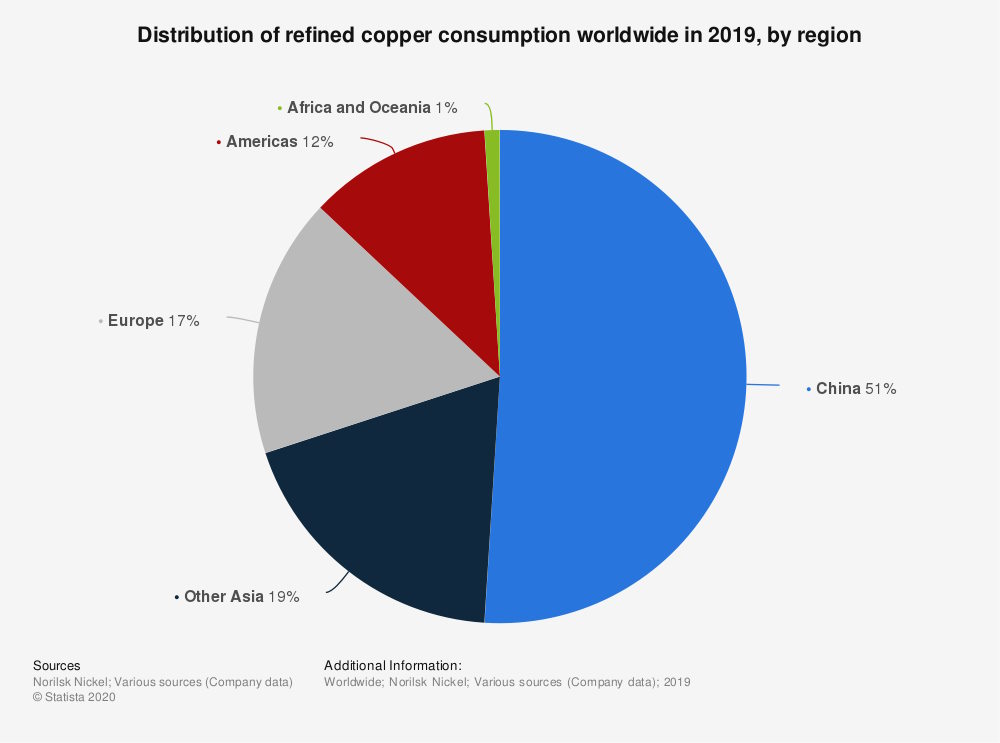

Major copper production is concentrated in South America, with Chile and Peru being the primary producers, followed by China as the world’s leading producer of refined copper. However, the global supply of copper can be easily disrupted due to its diverse geographic origins and the involvement of developing countries as key suppliers. This vulnerability, combined with high demand from various industries, contributes to the highly liquid and volatile nature of the copper market.

The Largest Copper Mines in the World by Capacity

What is Copper Trading?

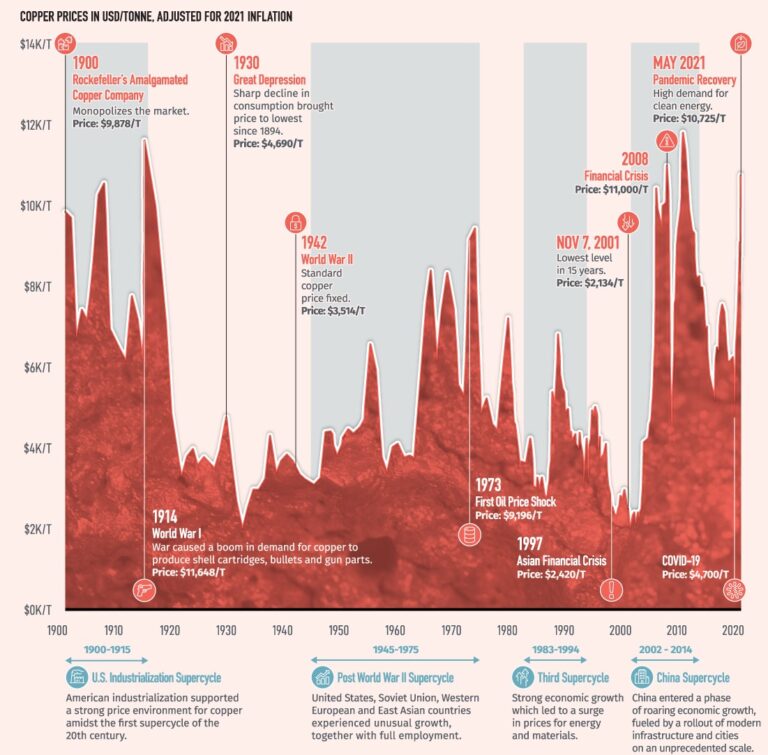

Copper trading capitalises on the market’s volatility and liquidity, offering opportunities for profit through speculation and price fluctuations. However, it’s crucial for traders to be aware of the factors that influence copper prices. Copper serves as a reliable indicator of global economic health due to its strong connection to infrastructure development. During periods of economic growth, investments in major infrastructure projects drive up the demand for copper. Conversely, economic downturns often result in a decline in copper prices as construction and infrastructure projects are put on hold.

In addition to global economic trends, several other factors impact copper trading prices:

- Supply disruptions: Since most copper production comes from developing countries, political, social, or economic upheavals in these regions can quickly disrupt global supply chains. Changes in labour laws or nationalization efforts, as observed in Bolivia in 2006, can lead to significant price fluctuations.

- Emerging markets: The rise of new markets with substantial investments in infrastructure development drives increased demand for copper. As these emerging markets experience growth, copper prices tend to rise. Conversely, when growth slows down, copper prices can predictably decline.

- Material substitutions: The market rarely tolerates a continuous rise in copper prices. As copper becomes more expensive, manufacturers and investors seek cheaper alternatives to reduce costs. Substitutes like aluminium, nickel, and lead are utilized until copper prices become more affordable. Traders should be cautious of potential shifts in demand caused by material substitutions.

- US housing market: The sheer scale of the US housing market plays a pivotal role in copper demand. Copper is extensively used in electrical wiring and plumbing for housing construction. Therefore, when the US housing market experiences growth, copper demand follows suit.

Advantages of Trading Copper

Traders choose to invest in copper for several reasons:

- Safe haven investment: Copper is considered a physical commodity that retains its value even during economic downturns. Consequently, it is often viewed as a safe haven investment alongside assets like gold.

- Portfolio diversification: Adding copper to an equity-focused portfolio helps diversify holdings and reduce overall volatility. By including a commodity like copper, traders can benefit from a more balanced investment approach.

- Inflation hedge: Copper’s value is not tied to any specific currency, allowing it to retain its worth in the face of inflation. Many traders utilize copper as a hedge against inflation, protecting their portfolios from the eroding effects of rising prices.

- Speculation opportunities: The liquidity and volatility of the copper market create opportunities for traders to profit through copper CFDs (Contracts for Difference). While high speculation can yield substantial rewards, it also carries inherent risks.

Getting Started with Copper Trading in Four Steps

If you are interested in trading copper, follow these four steps to get started:

- Step 1. Select the Copper Asset. While copper bullion and coins can be traded, most copper trading occurs through futures contracts, CFDs, and ETFs. You can choose from various copper futures markets, such as COMEX copper on the New York Mercantile Exchange or LME copper on the London Metal Exchange. Consider the trading hours of different exchanges when monitoring your positions.

- Step 2. Choose Your Trading Method. Copper futures typically involve physical delivery, which may not suit all traders. Derivative products like copper CFDs provide an alternative by allowing traders to speculate on the price difference between opening and closing positions without owning the underlying asset. Copper CFDs offer leverage, enabling traders to trade with a fraction of the total asset value and potentially amplify both profits and losses.

- Step 3. Establish a Risk Management Strategy. Given the potential for magnified losses in leveraged trading, it’s essential to have a risk management strategy in place. Utilise tools like stop-loss orders and limit close orders to automatically close positions when they reach predetermined thresholds for acceptable losses or profits.

- Step 4. Open Your First Copper Trade. Download a powerful trading platform like MetaTrader 4 or its upgraded version, MT5, to execute trades quickly and gain a transparent view of the market.

Understanding Different Copper Markets

The strategies employed in copper trading depend on the type of market you are dealing with. Generally, two types of markets exist: trending and consolidating. Trending markets are characterized by significant price fluctuations and volatility. These markets align with the beginning and end of copper market cycles, where increased demand or the completion of large infrastructure projects impact prices.

Consolidating markets, on the other hand, exhibit more stability. They indicate a balance between supply and demand and tend to keep prices within defined support and resistance levels. Despite the relative stability, consolidating markets still offer traders opportunities for profits through short-term movements.

Summary:

- Copper is a widely used commodity with applications in various sectors, known for its conductivity properties.

- Major copper production is concentrated in South America, primarily Chile and Peru, followed by China.

- Copper trading takes advantage of market volatility and liquidity, with prices influenced by factors such as global economic trends, supply disruptions, emerging markets, material substitutions, and the US housing market.

- Advantages of trading copper include its safe haven status, portfolio diversification, inflation hedge, and speculation opportunities.

- Different copper markets include trending markets (with significant price fluctuations) and consolidating markets (with more stability).

Getting started with copper trading involves selecting a copper asset, choosing a trading method (such as futures contracts or CFDs), establishing a risk management strategy, and using a trading platform like MetaTrader.