Touch trading, a strategy employed in the volatile world of forex trading, is a sophisticated approach that requires traders to enter the market at a precise intersection of live price impact with a predetermined price level, typically a horizontal support or resistance. This strategy, while offering unique advantages, also presents notable challenges. Its effectiveness hinges on a trader's ability to swiftly adapt to market movements and accurately anticipate market reactions at critical points. Below, we delve into the details of touch trading, examining its mechanics, advantages, and potential risks.

Definition and Mechanics of Touch Trading

Touch trading is characterized by its emphasis on quick adjustments in response to market fluctuations. This approach is rooted in the trader's ability to predict market reactions at key interest points, allowing for prompt exits to mitigate losses when initial analyses fall short. This strategy often involves using floating stop-loss orders or tight fixed placements, banking on the market's quick reversal from significant support levels. Employing a tighter stop-loss can enhance the risk-to-reward ratio, and early entry at the source point potentially amplifies profit growth.

In contrast, more traditional price action trading methods typically require broader stop-loss placements, as entries further from the point of origin must account for the possibility of benign pullbacks against the anticipated trend.

Despite the allure of increased trading opportunities and potential for greater profits, it’s crucial to scrutinize the drawbacks of touch trading. We outline three key considerations for traders contemplating this strategy.

The Role of Support and Resistance in Touch Trading

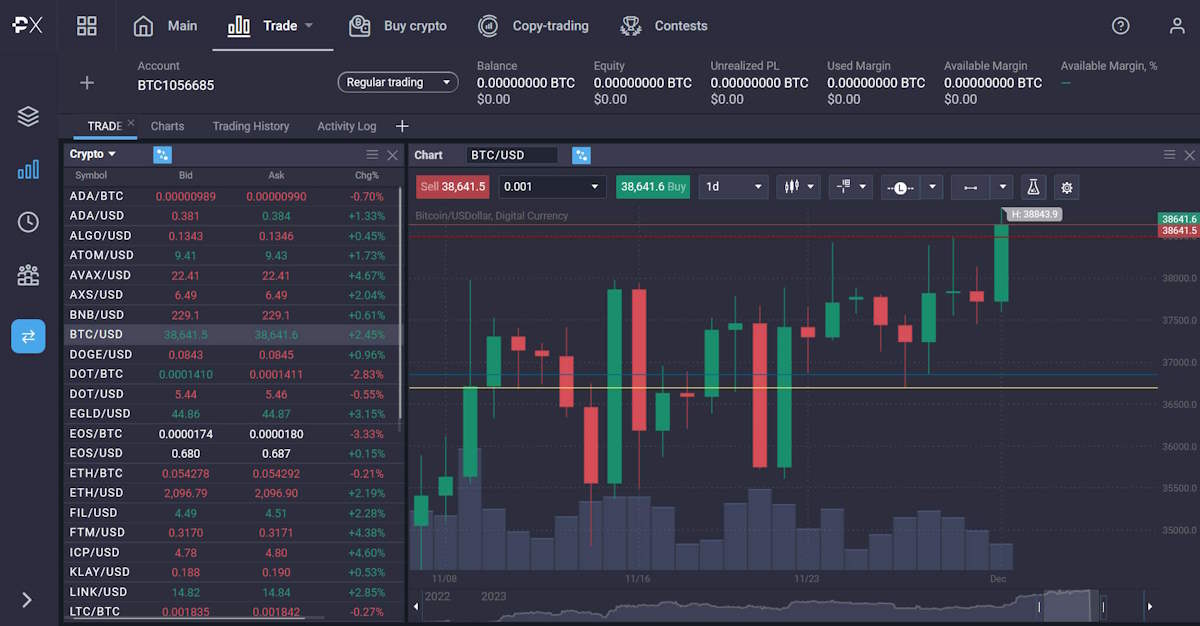

Support and resistance levels are crucial in touch trading, as they form the foundation of this method. A position is typically entered when the opening price action hits or touches a predefined point, such as a support or resistance level.

Advantages of Touch Trading

- Early Market Entry and Potential for Greater Profits Touch trading demands a high level of experience and stringent trade management. It leverages increased trading frequency (volatility) during market openings. Entering at a resistance or support breakout moment, without waiting for price action confirmation, can lead to capturing the full extent of a trend. However, this also carries a higher risk of encountering a reversal leading to losses.

- Increased Trading Opportunities The aggressive nature of touch trading allows for market entry at its origin, potentially increasing profit opportunities. While waiting for price action confirmation can offer added confidence, it may not always facilitate early entry.

Challenges and Risks of Touch Trading

- Lower Hit Rate and Increased Risk The increase in trading opportunities does not guarantee a high success rate. The aggressive nature of touch trading entails a higher per-trade risk, potentially leading to a lower hit rate for profitable trades compared to more conservative techniques.

- Not Suitable for Beginners This strategy requires an in-depth understanding of market rhythm, price action, order flow dynamics, and the reasons behind typical price behaviors. It extends beyond identifying key support and resistance areas, demanding active market analysis and opportunity identification.

- Trade Management in Touch Trading Touch trading in volatile markets necessitates dynamic and rapid adjustments. It requires intense concentration, emotional stability, and the ability to move out of comfort zones.

Who Should Consider Touch Trading?

Touch trading is best suited for traders with extensive experience and emotional resilience. It is ideal for those who are comfortable with both winning and losing and can recover quickly from losses. Traders using leverage must ensure sufficient margin to protect their trades from margin stop-outs.

Alternatives to Touch Trading

A viable alternative to touch trading, breakout trading involves using indicators to predict price range breakouts through support or resistance levels. With the right mix of indicators, traders can estimate the length of the breakout trend. This strategy typically carries less risk and offers a more generous margin for error.

In conclusion, touch trading is a complex and demanding strategy, suitable for experienced traders who can adeptly navigate its inherent risks and challenges. It requires a profound understanding of market dynamics, swift decision-making, and emotional fortitude. As with any trading strategy, it’s crucial to thoroughly understand its nuances before implementation, ensuring alignment with one’s trading style and risk tolerance.