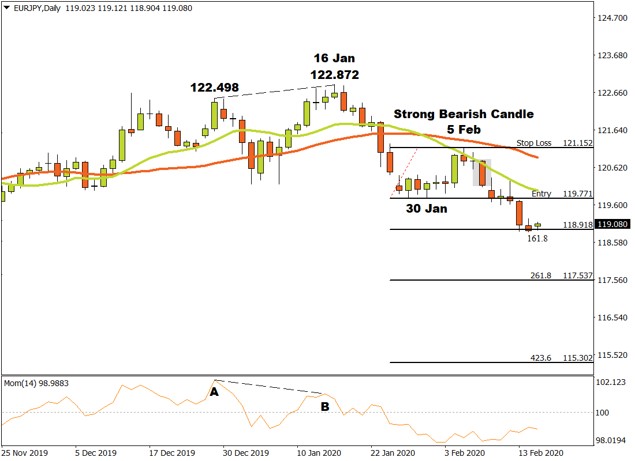

The EURJPY currency pair, on the D1 time-frame, was in an uptrend until January 16 when a higher top was recorded at 122.872. Supply overwhelmed demand and the upward momentum was negated.

A closer look revealed that the Momentum Oscillator displayed negative divergence between point A and B, compared to the price at 122.498 and 122.872. This could have alerted technical traders to a potential technical reversal in the making.

After the top at 122.872, the market broke through the 15 and 34 Simple Moving Average and the Momentum Oscillator broke through the zero baseline into negative territory. This further confirmed the possible price reversal or initial stages of a new trend.

A possible critical support level formed when a bottom was recorded on January 30 at 119.771. Buyers tried to pull the market higher but the price found resistance on February 5 at 121.152 and sellers pressed the price lower again. The new bearish momentum was confirmed with a Strong Bearish Japanese Candlestick that formed two days later.

On February 10 the EURJPY broke through the critical support level at 119.771 with a short position ensuing. Three possible price targets were projected from there. Attaching the Fibonacci tool to the bottom at 119.771 and dragging it to the top of the last pullback at 121.152, the following targets were calculated. The first target was estimated at 118.918 (161 %) and was reached on February 13. The second price target was forecast at 117.537 (261.8%) and the third and final target might be anticipated at 115.302 (423.6%).

At this point in time, as always in the market, anything can happen and we need to effectively manage our risk. As long as sellers maintain a negative sentiment and supply overcomes demand, the outlook for the EURJPY currency pair on the Daily time-frame will remain bearish. If the resistance level at 121.152 is broken, the above anticipated scenario is no longer valid.