Entering the world of Exchange Traded Funds (ETFs) trading might appear daunting to newcomers, but it's a surprisingly accessible endeavor, thanks to the abundance of online resources and tools available today. Unlike individual stocks that require extensive research for each company, ETFs provide traders with exposure to a diverse range of stocks or other securities through a single investment.

Let's delve into the fundamentals of ETF trading for beginners, unraveling the intricacies of this investment vehicle.

What is ETF Trading?

ETFs are investment funds managed by professionals who compile portfolios of financial securities. There's a broad spectrum of ETFs available for trading, including sector-specific ETFs, bond ETFs, commodity ETFs, and stock market index ETFs. ETF trading involves buying and selling these units on stock exchanges, much like trading individual stocks.

The price of an ETF is determined by market supply and demand, fluctuating throughout the trading day based on the combined value of its underlying assets. Traders can employ various strategies when trading ETFs, such as day trading, swing trading, or momentum trading.

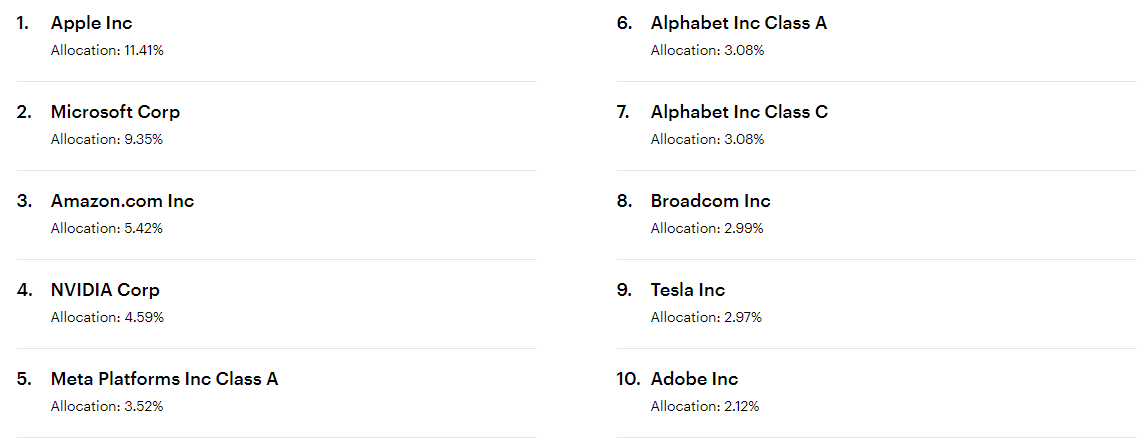

Top 10 holdings within QQQ

How Do ETFs Work?

An ETF operates as a diversified basket of securities. When traders purchase ETF units, their funds are pooled by a fund manager. This manager then utilizes these pooled funds to replicate the performance of a specific underlying index, often by purchasing the constituent stocks within that index. Essentially, when you buy an ETF, you're investing in a basket of securities, which can include stocks, bonds, or a mix of assets under the management of a fund manager.

These funds are frequently used to track market indices like the S&P 500 and the Dow Jones Industrial Average. For other types of ETFs, such as Bond ETFs, Stock ETFs, or sector-specific ETFs, the fund manager allocates the pooled funds to build a portfolio that reflects the ETF's designated theme. For instance, a bond ETF predominantly invests in bonds and other debt instruments, while a stock ETF focuses on a diverse or specific collection of stocks. A sector-specific ETF concentrates its investments on a particular industry or sector, such as technology, healthcare, or financial services. This allows traders to target their exposure to specific market sectors without the need to buy individual stocks or bonds within those sectors.

By trading ETFs with platforms like Vantage, traders can gain exposure to ETF price movements by trading Contracts for Differences (CFDs). Additionally, trading ETF CFDs enables participation in both rising and falling markets, a unique attribute of CFD trading.

Why Trade ETFs?

ETFs offer several distinctive advantages for traders, whether they are beginners or seasoned professionals. Here are three key reasons why some traders opt for ETFs:

- Diversification: ETFs enable traders to access a broad range of financial instruments through a single trade. Geographical or sector-specific ETFs provide an efficient way to diversify portfolios without the need for individual product selection. For example, trading the SPDR S&P 500 ETF (SPY) grants exposure to renowned stocks like Apple, Microsoft, Nvidia, and Tesla, all within a single trade.

- Trading Liquidity: ETFs can be traded on stock exchanges like any other listed stock. This liquidity feature allows them to be traded throughout market hours, offering a high degree of flexibility.

- Transparency: Most ETFs disclose their holdings daily. This transparency provides traders with a clear understanding of the ETF's complete portfolio, facilitating more informed decision-making based on the actual assets held within the ETF. This enhances risk management and strategic planning.

Understanding ETFs Trading

Here are some essential concepts for beginners to grasp when trading ETFs:

- Market Drivers: ETF prices are influenced by overall market supply and demand dynamics. The price of an ETF changes based on the balance of traders wanting to buy or sell it. Apart from supply and demand, macroeconomic factors such as interest rates, inflation, and geopolitical events can impact ETF markets by influencing trader sentiment and economic outlook.

- Chart Analysis: ETF charts visually depict the performance of an ETF's price over different timeframes, from minutes to years. Learning to read these charts allows traders to identify potential trends or patterns, aiding in strategic decision-making.

Ways to Trade ETFs

There are various methods for beginners to begin ETF trading. One direct approach is to buy and sell ETFs on stock exchanges. Alternatively, derivative instruments such as CFDs, futures, and options provide choices for traders interested in ETF trading. With platforms like Vantage, trading ETF CFDs allows traders to speculate on price differences without owning the actual ETF, offering the flexibility to go long (anticipating a rising market) or short (anticipating a falling market) to capitalize on bull and bear markets. However, leveraged ETFs come with higher risk and are not suitable for long-term trading, as they can lead to substantial losses rapidly.

Evaluating ETFs for Trading

Before selecting an ETF to trade, beginners should consider several factors:

- Underlying Index or Asset: Understand the underlying index or asset classes tracked or held by the ETF. This knowledge reveals the ETF's risk profile, potential returns, and correlation to the overall market.

- Expense Ratio: The expense ratio represents the cost of managing the ETF and is often expressed as a percentage of the ETF's total assets. Lower expense ratios are typically preferred since they can impact overall returns over time.

- Trading Activity: ETFs with higher average daily volumes often have more liquid markets, making it easier to buy or sell shares at prevailing market prices. Enhanced liquidity enables swift entry or exit from positions.

Beginner ETF Trading Tips

Beginners can employ various trading strategies when trading ETFs. Examples include swing trading, which capitalizes on ETF price fluctuations across sectors, and sector rotation, where traders focus on sectors experiencing robust demand and growth. These traders then purchase ETFs related to those sectors to potentially earn returns.

Having a well-planned trading strategy is crucial for beginners, offering direction and discipline. A clear strategy helps traders navigate the complexities of ETF trading, manage risk effectively, and avoid impulsive decisions driven by emotions.

Key Takeaways for ETFs for Beginners

ETFs offer diversification, enabling novices to include a broad range of assets in their portfolios. For those new to ETF CFDs trading, platforms like Vantage offer the opportunity to begin with a demo account, allowing exploration of ETF CFDs trading with virtual credits.

Alternatively, for those ready to commence trading ETF CFDs, opening a live account with Vantage provides the gateway to embark on a trading journey today.