It’s this time of the year where businesses and individuals begin to power down and ready themselves for the arrival of Santa and his reindeer. However, many traders continue keeping an eye on their portfolio and the gyrations of the stock market. With people running around to buy presents, we tend to see a surge in revenues for businesses within the retail and technology sectors, which filters into the performance of the stock market.

Indeed, the so-called Santa Rally begins to take effect at this time of the year and generally runs from the tail-end of December to the beginning of January.

Throughout this article, we will touch on some key points to keep in mind while trading this holiday period and certain sectors to keep a close eye on.

Is the Stock Market Open on Christmas?

There are only a handful of days in which the stock market is closed. Christmas Day is one of them. However, as Christmas Day falls on a Sunday in 2022, the stock market will also be closed on Boxing Day on Monday the 26th. Generally, when markets are closed for greater than a two-day period we tend to see a decline in asset prices leading into the break. This is mainly caused by investors closing their positions and reducing their portfolio exposure.

After all, anything could happen over the three-day period that could ignite a marked sell-off.

Sectors to Keep an Eye-On This Christmas

There are three main sectors to keep a close eye on this festive season.

Travel Industry

First and foremost is the travel industry. After two years of severe limitations to international travel due to Covid-19 restrictions, most countries have opened up their borders and welcome back tourists. Indeed, surging demand for both domestic and international flights has seen the price of airfares storm back to the highest levels in over five years.

Some key airlines to stick on the watchlist are:

- American Airlines (AALG)

- Qantas (QAN)

- Southwest Airlines (LUV)

- Spirit Airlines (SAVE)

Retail Industry

The second sector that could be an outperformer this holiday season shouldn’t come as much of a surprise given this is the season of giving. The retail sector has been under pressure for much of the year as a significant cost-of-living increase depressed consumer spending on discretionary items. However, the rate of inflation has moderated notably over recent months and could give households more room to spend on retail products to put under the Christmas tree.

Some key retail stocks to keep in your crosshairs over the next few weeks are:

- Target (TGT)

- Walmart (WMT)

- Amazon (AMZN)

Food and Produce Industry

Finally, the last sector that could outperform over the tail-end of this year and into the New Year are those businesses within the food and produce sector. It is no secret that families spend a boatload on food for Christmas breakfast, lunch and dinner. Especially with input costs rising, which allows producers and suppliers to charge a little more this holiday season and pump up their revenue numbers.

Some food and producer stocks that may perform well this Christmas season are:

- Tyson Foods (TSN)

- Mondelez International (MDLZ)

- PepsiCo (PEP)

- Check our Share CFDs specifications from below pages:

- US Share CFDs specification

- Australian Share CFDs specification

- UK & EU Share CFDs specification

What We Can Learn from Previous Christmas Periods

2022 may be a completely different Christmas period in comparison to recent years, for a variety of reasons. One of the main being that Covid-19 is no longer as big an impediment to our lives as it was in the previous two years. Secondly, inflation rates globally have surged to the highest levels in decades, causing consumers to cut discretionary spending and global central banks to hike interest rates aggressively. That said, seasonally the latter half of the year is bullish for equities.

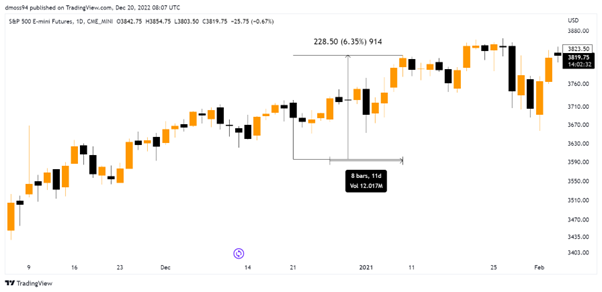

This seasonal effect can be seen in the three charts below, with the S&P 500 climbing an average of 4.5% higher in the days leading up to Christmas through to the New year.

Granted this is a sample of only three years. Nevertheless, this seasonal effect known as the “Santa Claus Rally” has been seen frequently since the early 1970s.

2019 Christmas Period Rally

2020 Christmas Period Rally

2021 Christmas Period Rally

The Santa Claus Rally and How it Impacts the Stock Market

The Santa Claus rally is a phenomenon that frequently occurs from the tail-end of December into the start of January, which generally sees stock prices increase in value during the period. Views are split as to the myriad of reasons why this positive sentiment comes about, but December is historically a good time of the year for stock market bulls. To learn more about the variety of reasons that could contribute to the Santa Claus rally, read our dedicated article via this link.