The butterfly pattern… It sounds nice, doesn’t it? However, the real hides many difficulties for traders, especially for newbies. It’s not a common trading tool that appears on charts daily. To find the butterfly pattern, you need to practice a lot and put in some effort. In this article, we will try to uncover all pitfalls you can meet when trading the butterfly pattern.

What the Butterfly Patterns in Trading, and How It Works

Before we talk about the butterfly pattern, let’s start with the basics - harmonic patterns. The butterfly pattern is one of many harmonic patterns. Harmonic patterns are chart patterns that are formed in a specific shape. In their idea, they are similar to chart patterns such as head and shoulders or double top.

However, they are not as easy as basic chart patterns. Harmonic ones are built with Fibonacci retracements and expansions. The aim of any harmonic pattern is to define levels where the prevailing trend will resume after consolidation and the targets of this trend.

Why should you learn harmonic patterns if they are more complicated than standard chart patterns? Harmonic combinations provide more reliable trading signals.

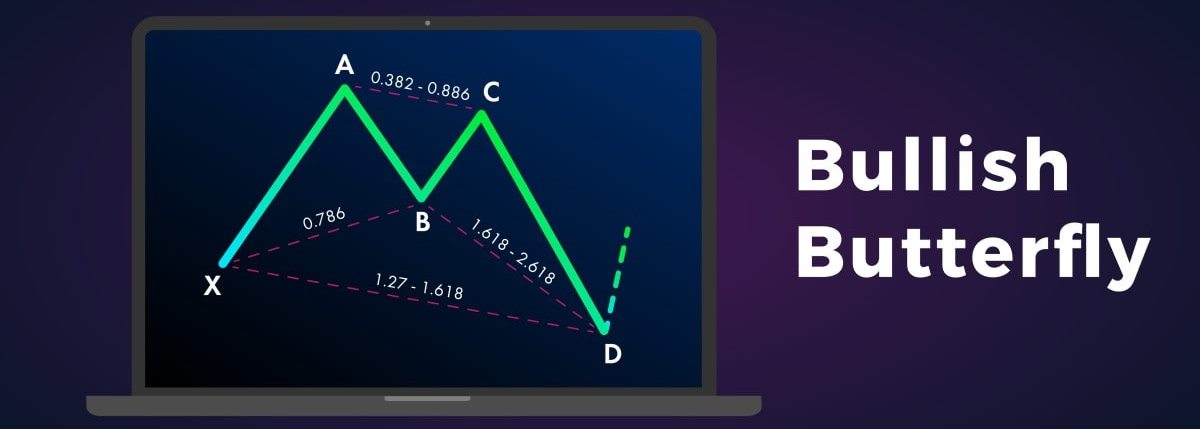

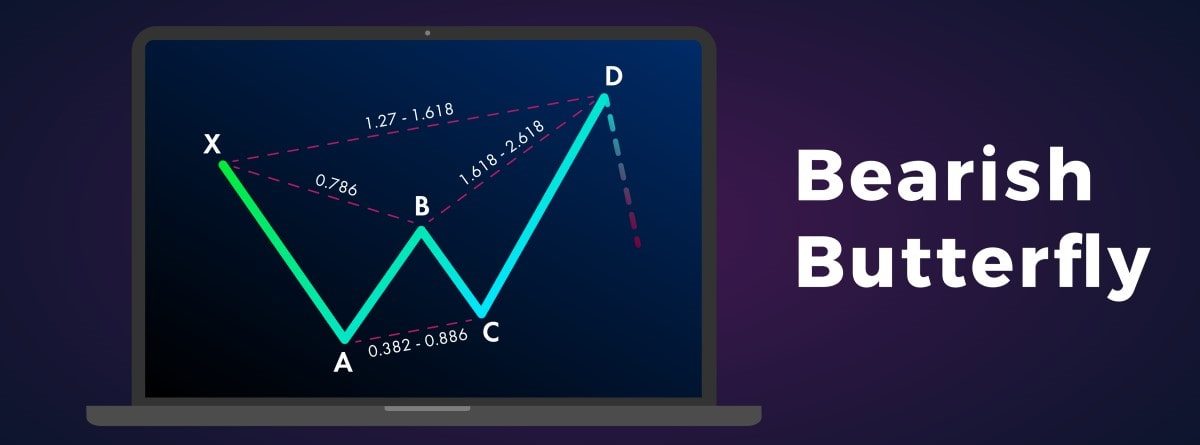

Now let’s return to our topic - the butterfly pattern. It is a form of Gartley pattern. Bryce Gilmore and Larry Pesavento developed it. The butterfly is a reversal pattern that occurs near the extreme lows and highs of the price. Traders use the butterfly to indicate the end of a current trend and an entry point during a correction or new trend phase. There are two types of butterfly patterns: bullish and bearish.

The butterfly is a reversal pattern that occurs near the extreme lows and highs of the price. It’s applied to the chart to identify the end of a current trend and an entry point during a correction or new trend phase.

The butterfly pattern is one of the harmonic patterns, which consists of four legs: XA, AB, BC, and CD and five points: X, A, B, C, and D. Also, the butterfly resembles the letters M (bullish) and W (bearish), Gartley, and Bat harmonic patterns.

Inexperienced traders mistake the butterfly for double top/bottom patterns. The whole shape of the butterfly pattern depends on the B point. It determines the butterfly’s structure. Also, it’s a start point for other measurements. The structure of the pattern defines trade opportunities within the pattern.

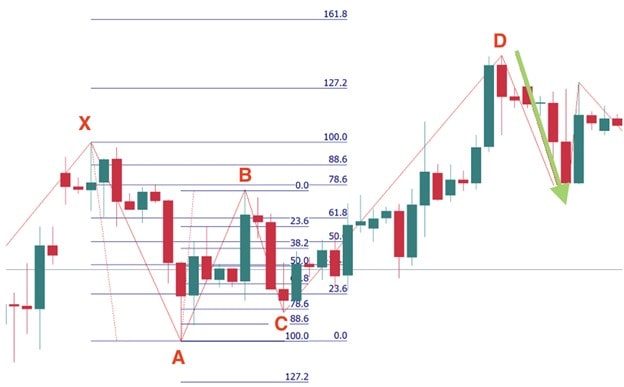

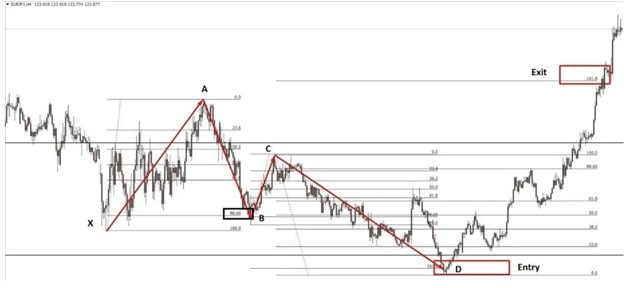

Butterfly Pattern: Forex Market Example

The butterfly pattern is hardly drawn in MetaTrader. To identify the pattern, you should use Fibonacci levels and trend lines.

Benefits and Drawbacks of Butterfly Pattern

As we have already mentioned, the butterfly is complicated. Still, there are other things you should know about this pattern that will prevent you from loss.

Although the butterfly pattern is complicated, it produces highly reliable signals.

|

Benefits |

Limitations |

|

It differs with the precision of signals. |

It’s hardly drawn on the MetaTrader platform. There is no specific tool for pattern’s drawing. |

|

It can be found on any timeframe. |

It’s complicated, especially for beginner traders. |

|

Although you should have knowledge of the Fibo tools when applying the pattern, the butterfly shape is easily recognized. |

It can be mistaken for double top/bottom chart patterns and Gartley/ Bat harmonic patterns. |

|

Although the butterfly pattern can be used as a core signal provider. You should always remember the signal’s confirmation. |

|

|

Requires knowledge of the Fibonacci tools. |

It seems the butterfly pattern has more limitations than advantages. Still, its benefits are more vital for traders than disadvantages.

Identifying the Butterfly Pattern

It’s not that easy to find the butterfly pattern on the price chart. Here are the parameters of it that will help you distinguish the butterfly from other harmonic patterns.

- The key point of this pattern is that the CD is bigger than XA;

- The XA leg is a starting point of the pattern;

- The AB leg shouldn’t be bigger than point X;

- The BC leg shouldn’t surpass A;

- The CD leg should exceed point X;

- Point D in the CD leg should be equal to or exceed point B;

- Point B should locate at up to 78.6% retracement of the XA line;

- Point C can be found at the 38.2%-88.6% retracement of the AB line;

- Point D should be at the 161.8%-261.8% extension of the AB line or the 127.2%-161.8% extension of the XA line.

The butterfly resembles the Gartley pattern. The main difference is that point D is not set at the retracement of the XA line but at its extension.

The butterfly and Gartley patterns look similar: they have four legs and five points. The main difference is that point D is not set at the retracement of the XA line but at its extension, so point D surpasses starting point X.

Trading Butterfly Pattern

Any harmonic pattern provides accurate entry, take profit, and stop-loss levels. We gathered the key rules of the butterfly’s trading.

- Enter the market at point D as it’s a potential reversal zone.

- When entering the market, you should have the potential take profit and stop-loss levels in mind. In the butterfly pattern, your first take profit order can be placed at 61.8% of the CD line; the second take profit level can be at 127.2% of CD. If you are a newbie trader, who has doubts, you can also set a take profit level at point B. If you are ready to handle risks, apply an aggressive approach and target the A point.

- A stop-loss level can be defined by the risk/reward ratio. The best ratios are 1:2 and 1:3.

Bearish and Bullish Butterfly Pattern

There are specific rules for bullish and bearish types.

- Bearish entry point. The sell order should be placed at D (a 127% extension of the XA leg).

- Bearish take profit. Take your profit at the A point (an aggressive movement) or B (a defensive move).

- Bearish stop loss. The stop-loss order should be above an extension of 161.8% of the XA leg.

- Bullish entry point. Open a buy trade at point D (a 127% extension of the XA leg).

- Bullish take profit. Take profit level should be counted according to your goals and market conditions.

- Bullish stop loss. The stop-loss order should be below an extension of 161.8% of the XA leg.

Best Butterfly Pattern Strategies

Let’s consider some effective butterfly strategies that will help you in trading.

Strategy 1: Bullish Butterfly

- Step 1. The bullish butterfly signals an upward reversal and forms at the end of the downtrend. Thus, the first step is to find a bearish trend. One important thing is that the market should be near a reversal point. A reversal can be found by applying technical indicators and finding candlestick reversal patterns.

- Step 2. Apply Fibonacci tools to the price chart. The Fibo levels are the key element of harmonic patterns.

- Step 3. Draw the butterfly pattern.

- Step 4. Enter the market at point D. However, it’s better to look for confirmation. Usually, traders use reversal candlestick patterns, for instance, bullish engulfing or hammer. If the reversal candlestick is found, you should enter the market at candle’s closing point.

- Step 5. As the butterfly pattern is tricky, there are risks of the fake signals if you define the pattern incorrectly. That’s why you should place a stop-loss order. When trading a bullish butterfly, the D point is the lowest point. Thus, you should place a stop loss 10-15 pips below the reversal candlestick. The size of the stop-loss order can be increased in case of high volatility to 20-25 pips.

- Step 6. Determine your profit before entering the market. Ideally, the take profit point is set at the level of point A. Still, you can close the trade earlier or increase the level depending on the market situation. If the market corrects at point C, you can close at least a part of your trade and apply the second take profit above. At the same time, the stop-loss order can be moved to a breakout level.

Strategy 2: Bearish Butterfly

- Step 1. Find a bullish trend that is close to reverse as the bearish butterfly occurs at the top of the rising trend and signals a price decline.

- Step 2. Apply Fibonacci levels to the price chart.

- Step 3. Draw a bearish butterfly.

- Step 4. Point D is an entry point. Again, you should look for a confirmation of the price reversal to avoid losses. Try to find reversal candlesticks, for example, a shooting star.

- Step 5. Now, you should calculate the risks you may handle. Place a stop-loss order 10-15 pips above point D. Same as in the bullish butterfly strategy - you can extend the size of the stop loss to 20-25 pips in case of high volatility.

- Step 6. The standard take profit is set at point A. Still, you should evaluate the current market conditions to set the correct take profit level. If the volume of the bearish momentum is high, the price may reach point A. In case the market corrects at point C, you better book some profit. The second take profit level can stay at point A. The stop-loss order should be moved to the breakout.

Key Tips About Butterfly Chart Pattern

Check the key tips about the butterfly pattern that you should remember when implementing the pattern on the price chart.

- Butterfly is a reversal pattern that occurs at the end of the trend.

- Reversals after the butterfly pattern are sharper.

- As the butterfly pattern is quite complicated, it’s mostly traded on big timeframes.

- When drawing the butterfly pattern, you should apply the Fibonacci indicator. The Fibo tool has specific levels. However, you should add 78.6%, 88.6%, and 127% levels to visualize the pattern in a better way.

- Point D serves as a confirmation point of the butterfly pattern if the price begins to reverse after it.

- The whole shape of the butterfly pattern depends on the B point. It determines the butterfly’s structure. Also, it’s a start point for other measurements. The structure of the pattern defines trade opportunities within the pattern.

Here are key parameters of the butterfly pattern:

- The XA leg can be any random move on the price chart.

- The AB line is supposed to be a 78.6% retracement of XA.

- The BC leg should be either a 38.2% or 88.6% retracement of AB.

- The CD line reaches 161.8% of the BC leg if BC has set at 38.2% of the AB leg, or it reaches 261.8% of the BC leg if BC is at 88.6% of AB.

Conclusion

Let’s sum up. The butterfly pattern is not an easy trading tool. However, if you know how to draw it, it will reward you with accurate signals.

Before you start applying the butterfly pattern in real trades, make sure to register a demo account. A Libertex demo account provides investors with a wide range of instruments such as currencies and CFDs along with real financial market conditions.

Why to trade with Libertex?

- access to a demo account free of charge

- technical assistance to the operator 5 days a week, from 8 a.m. till 8 p.m. (Central European Standard Time)

- leverage of up to 1:600 for professional Ñlients

- operate on a platform for any device: Libertex and Metatrader

FAQ

Check the answers to the following questions to structure the information you got in this article.

What Is the Pattern of Butterfly?

The butterfly pattern is one of the harmonic patterns, which incorporates four legs: XA, AB, BC, and CD and five points: X, A, B, C, and D. It signals a trend reversal and occurs near the extreme lows and highs of the price.

Which Harmonic Pattern Is the Best?

There is no best harmonic pattern. Each pattern is suitable for a certain market condition. However, statistics say the butterfly pattern provides a higher probability of a successful trade than Gartley.

How to Trade the Butterfly Chart Pattern?

There are specific rules of butterfly trading. Check the “Trading the Butterfly Pattern” section.

How Do You Identify the Butterfly Pattern?

Here are the most vital requirements for identifying the butterfly pattern. Point B should locate at up to 78.6% retracement of the XA line. Point C can be found at the 38.2%-88.6% retracement of the AB line. Point D should be at the 161.8%-261.8% extension of the AB line or the 127.2%-161.8% extension of the XA line.

Does Harmonic Trading Really Work?

The harmonic patterns provide accurate and reliable signals, which are even stronger than those of usual chart patterns.