Most beginners and intermediate traders when choosing financial instruments for trading limit themselves to currency pairs. Today, many Forex brokers offer a wide selection of assets:

- cryptocurrencies

- stock indices

- ETF

- currency pairs

- commodities

It is worth noting that of all the above tools, transactions with currency pairs and cryptocurrencies are the most risky. The fact is that the digital and fiat currency market is decentralized, which makes it difficult to analyze effectively. The key to the evaluating of any tradeable asset is its trading volume. Obtaining accurate information about changes in the mentioned factor is almost impossible when it comes to currencies and cryptocurrencies, since neither large banks nor liquidity providers have such information.

ETFs and stock indices should be considered for long-term investments. With the careful preparation of the investment portfolio, this will make it possible to annually profit at the level of 20-30% of the invested capital. This amount is clearly not enough for beginner traders, because few of them have several million dollars of free funds.

There remain commodities, the potential value of which can be relatively easily predicted based on fundamental factors. Today we will talk about ways to successfully trade gold in the OTC Forex market, namely, working with contracts for the difference in prices of this metal. This article provides all the information for novice traders.

Gold Facts Every Trader Should Know

It is important to know that gold is a fossil and non-renewable precious metal. The reserves of open mines are depleted every year, which leads to a constant increase in the value of this asset in the long term. Gold is also a kind of refuge for investor capital. Economic crises always lead to a massive outflow of capital from securities. Fearing ruin amid stock market crash, investors are transferring funds to more reliable assets, one of which is gold.

Pay attention to the dynamics of the pricing of this metal over the past 20 years:

The steady increase in gold prices can be explained by the annual depreciation of fiat money, in other words, inflation. Regardless of the macroeconomic situation, gold always grows in value in the long run.

Forex Gold Trading Specifics

When working with this precious metal in the OTC market, it is important to understand that 1 standard lot is 100 troy ounces. XAU - a symbol of gold in the Forex market. Brokers provide traders with the opportunity to earn money on the pricing of this asset through transactions on the XAU/USD pair. The graph displays the cost of 1 ounce of metal in US dollars. By the way, at the time of writing this article it is 1510.02 USD, therefore, to buy 1 standard lot without leverage, the trader will need 151 002 USD of their free funds. Brokers provide for a minimum contract amount of 0.01 from the lot, that is, for the start of gold trading you need to have 1,550 USD (including commissions). Leverage comes to the aid of novice traders, the maximum level of which is on average 1:1000, however, working with such a volume of borrowed funds creates serious trading risks. The optimal level of leverage is 1:100, that is, to open a transaction with a volume of 0.01 lots on a pair of XAU/USD, it will be enough to deposit an amount from 20 USD to the account.

When using leverage, it is extremely important to pay attention to the conditions of margin trading. Some companies set Stop Out (forced closing of a transaction with fixing a negative financial result) at the level of 60-70% of the trader's deposit, others - at 20-30%. In addition, do not forget about the rules of money management in financial markets. The risk per transaction should not exceed 5-10%. To follow these standards, you will need to replenish a trading account in the amount of 200 USD.

Attention! A good financial result for a forex trader is a stable income of 10-20% per month. To achieve such results in gold trading, you will only need to consider intraday trading. It is important to remember that the mentioned precious metal is a highly liquid exchange asset, therefore M15 and more will be the optimal timeframe for technical analysis. In shorter periods, market noise predominates.

Mid-term trading on the pair XAU/USD

Through medium-term trading, it is quite possible to profit from 80% to 150% per annum when using leverage. In this case, you will need to pay attention to fundamental factors, namely:

- The macroeconomic crisis and a significant decline in stock prices are forcing investors to invest in precious metals, which increases demand and, consequently, their value.

- The depreciation of national currencies of the countries of the Pacific region (NZD, JPY, AUD and others). There is an inverse correlation between gold and the assets mentioned. For example, a decrease in the value of JPY almost guarantees an increase in gold prices.

- Change in production volumes. This factor has a key effect on any commodity asset. Changes in precious metal production create an imbalance between supply and demand. An increase in volume indicates a possible decline in the value of gold and vice versa. The leading countries for the extraction of this metal are the United States, Australia and China. When analyzing volume changes, priority should be given to reports by US and Australian companies. China ranks first in gold mining, but not more than 20% of the metal is exported.

Best Gold Trading Strategies

The easiest way to trade this metal through Forex brokers is to buy a minimum volume and maintain an open position for several months. With a positive swap for long positions, making a profit of 100-120% per annum is almost guaranteed.

This method is definitely not suitable for all traders, because you can earn much more on the pricing of the most liquid precious metal. This will require intraday trading. The use of indicators, candlestick patterns and elements of technical analysis is acceptable, but not as effective as analyzing the XAU/USD chart for correlating assets. For the successful implementation of this strategy, it will be necessary to select a financial instrument with a negative correlation coefficient in relation to XAU/USD. The numerator must have a USD symbol.

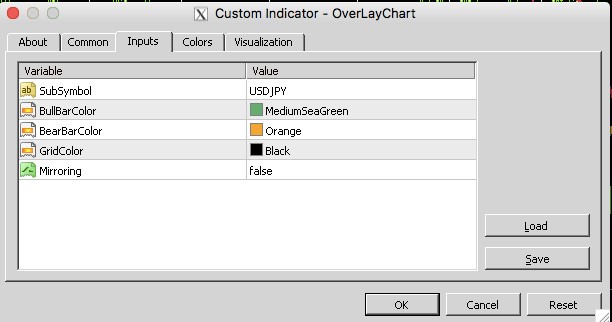

Important! For effective trading you will need to use 2 price charts. You can simply open 2 windows in the trading platform, but it is more convenient to monitor price changes using a special correlation indicator - OverLayChart. This is a custom analytical tool, so you will need to download it and install it in the root folder of the terminal yourself, and then restart the platform. OverLayChart is written in MQL4, so its correct operation is possible only in the MetaTrader4 terminal.

After installation, OverLayChart will be displayed in the menu of custom forex indicators. When transferring to the chart, the trader will need to select an asset that will be displayed in the terminal window in addition to the main tool:

Changing other input parameters is not required. The SubSymbol column shows the pair USD/JPY. This means that in addition to the main chart, the USD/JPY chart will also be displayed:

The main advantage of gold over other precious metals, like silver or platinum, for the trader is a slight delay. Pay attention to the screenshot provided. The jump in the USD/JPY pair affected gold quotes, but with a delay of 30 minutes. Similar situations in the OTC market are ongoing. To open an order, it is important to wait for an intensive change in the price of the correlating asset by 80-100 points, wait for the impulse to complete and open a trade in the opposite direction for the XAU/USD pair. Placing safety orders is required! The expiration period should be equal to the period of formation of the signal pulse.

In this situation, an order should be opened after the completion of the growth in the value of USD against JPY. Market entry and exit points are marked in the screenshot.

Pay attention to one more similar example:

The growth of USD/JPY caused a decline in quotations on the pair XAU/USD. The opening and closing points of the order are marked on the image.

Attention! When trading on this strategy, there are two kinds of take profit:

Fixed Take Profit equal to the range of the signal price impulse. Overcoming one of the local levels with a graph of the correlating asset (minimum with an uptrend and maximum with a downtrend).

It is strongly recommended to give preference to the first method. Pay attention once again to the screenshot presented earlier. The breakdown of the local minimum on the USD/JPY pair indicates a fast reversal of the trend on XAU/USD. At this point, you should close the Sell order and consider trading for an increase, however, it is worth noting that with fixing profit on Take Profit, the income would be 47 points more.

There is another way to trade XAU/USD in correlation with USD/JPY, in which the intersection of charts will be a signal to open a transaction. For example:

Please note that after the visual intersection of the charts, a pronounced trend is formed. This can be used in the short and medium terms gold trading on Forex.

Characteristics of the considered strategies:

- The optimal period is m15 or m30;

- Correlating pairs USD/JPY and XAU/USD;

- Placing a Stop Loss order at the last local level is mandatory;

- The risk on the transaction is not more than 10% of the deposit;

- The minimum deposit is 200 USD for standard accounts and 2 USD for cent account;

- The use of indicators, except OverLayChart, is unacceptable;

- The use of the Martingale method in combination with the considered strategies is not recommended, especially for beginners;

- Potential yield of up to 30-35% per month.

It is recommended that novice traders gain practical experience by trading virtual funds before applying the considered strategies in practice.

Conclusion

Gold trading in the OTC market is justifiably a worthy alternative to working with such traditional asset as currency pairs. This can be explained by dependence on macroeconomic factors, as well as a belated reaction to market events. The latter fully proves the high efficiency of the considered trading methods. The effectiveness of these strategies can be easily verified independently by studying the history of quotes.