In the Olymp Trade platform, traders can choose Stocks or Forex trading mode, each optimized for their respective trading instruments. The fundamental difference between the two is the potential risks and profits. Understanding that difference may help traders know when and why they should choose one or another to fit their financial objectives.

Pros and Cons of Stocks Mode

The mechanics of Stocks trading mode on the Olymp Trade platform focuses on long-term trading, which is closer to investing. Assembling a portfolio of large company stocks is at its core.As long-term investing relies on fundamental analysis, those who trade on Stocks mode need to know how to choose the right companies based on a global or fundamental business valuation. That may not be easy as it requires training, knowledge, and experience.

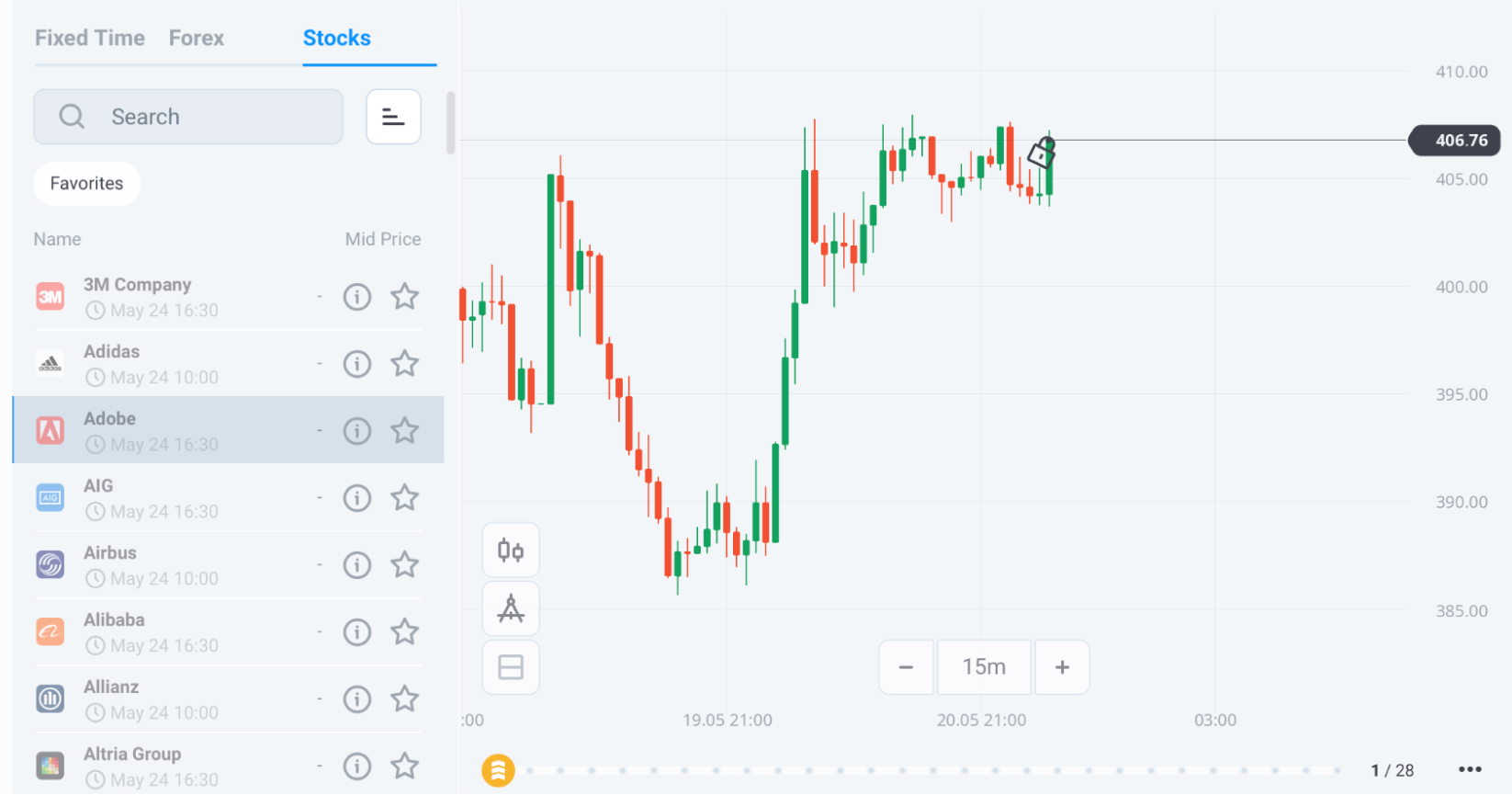

Stocks trading mode on the Olymp Trade platform

On the other hand, this approach will almost certainly be a success. The reason is that globally, in the long term, stock markets only grow. In the modern, fast-paced world, most businesses can either develop and expand or stagnate and perish. Therefore, as long as you choose stock in a growing company, the gain is almost inevitable in the long term because that company’s shares will gain value as the company expands.

Now, some stocks can grow faster and stronger than others. Facing this question, traders have to individually decide which ones they are ready to invest in and why.

Finally, the Stocks mode doesn’t use multipliers. Therefore, it provides a lower potential of risk together with a lower profit potential. At the same time, it offers a unique opportunity to hold trading positions indefinitely open without incurring associated commission costs.

So, here are some considerations of the Stocks mode:

- To trade on the Stocks mode most effectively, traders need to be familiar with fundamental analysis and know the basics of business evaluation.

- Traders have a lower profit potential on this trading mode because it doesn’t use multipliers. That comes together with lower risk and higher financial safety.

- Trading on the Stocks mode best works with long-term strategies that require extended periods to make profits.

- Mechanics of the Stocks mode are not speculative. That’s why this mode offers no Demo.

Clear advantages of the Stocks mode are:

- The commission is only charged if traders close positions with profit. Therefore, traders can keep their positions open as long as they want without paying a commission.

- Fractional shares trading is available in this mode. That means traders can assemble a healthy portfolio of the largest global company stocks and profit from their movement even with very low initial funds.

- If you choose stocks well, the portfolio you make will almost certainly grow in value as long as you wait long enough. Therefore, with careful selection and patience, this trading approach is an almost certain victory.

Pros and Cons of Forex mode

Quite differently from the investment style approach of the Stocks mode, the Forex mode is designed for speculative trading. Forex mode offers various trading instrument types such as stocks, indices, currency pairs, commodities, ETFs, and cryptocurrencies.

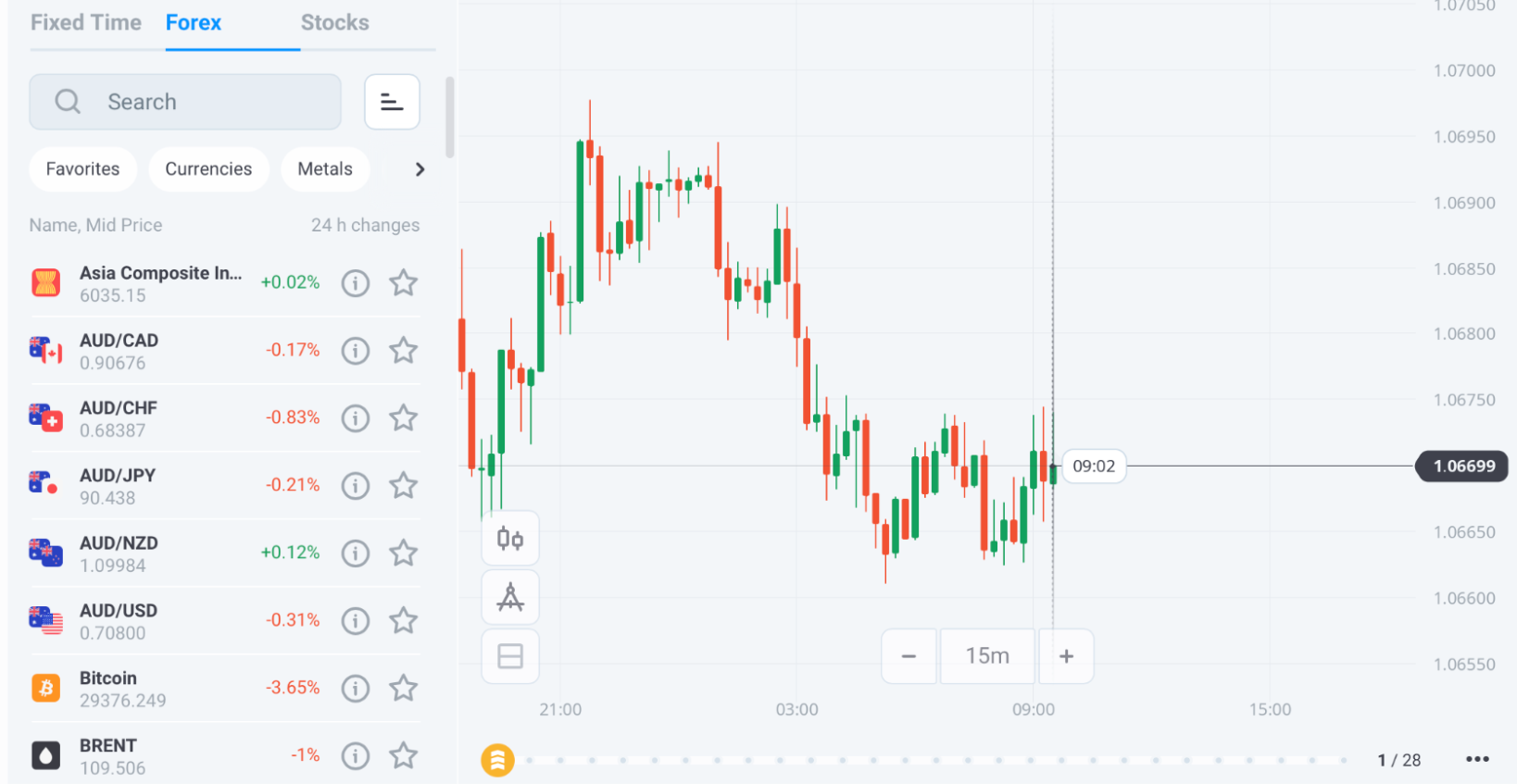

Forex trading mode on the Olymp Trade platform

Also, Forex mode allows using multipliers. This feature can significantly expand the profit opportunities but also increases risks and the commission on transactions. With regards to the latter, traders pay a commission for opening a transaction and for keeping it open into the next day in Forex mode.

Importantly, Forex mode allows opening trades both Up and Down. Therefore, traders can use price uptrends, downtrends, and reversals to make profits. Together with the significantly higher trade values made accessible by multipliers and a flexible trading instrument choice, that makes short term profit much more likely.

At the same time, risk mitigation tools such as Stop-Loss help reduce the risk and make the fast-paced Forex mode trading safer.

Here is a summary of Forex mode considerations:

- Trading on the Forex mode relies on using multipliers which increase the risk of a loss in proportion to the chosen multiplier.

- In this mode, traders pay a commission for opening a transaction and for extending it every time into the next market day.

Here are the definite advantages of Forex mode:

- There is a wide choice of trading instruments.

- There is a higher probability of short term profit with a correctly chosen multiplier and a sound trading strategy.

- Traders can open Up and Down trades, earning in either direction the market is moving with their chosen instruments.

- The Stop Loss tool helps reduce the risks.

- Traders can try this mechanic on the Demo account to polish their skills.

- Forex is a more speculative mode, which is sometimes more suited to using technical rather than fundamental analysis. The basics of technical analysis are easier for many traders, and it offers many ready-to-use tools such as indicators, advisors, strategies, and signals.

Fusion is Best

We have briefly examined the differences between Stocks and Forex trading modes on the Olymp Trade platform. While each may be used as a platform for an independent trading approach, using both in combination is often the best way to take advantage of Stocks and Forex trading and balance out the risks.