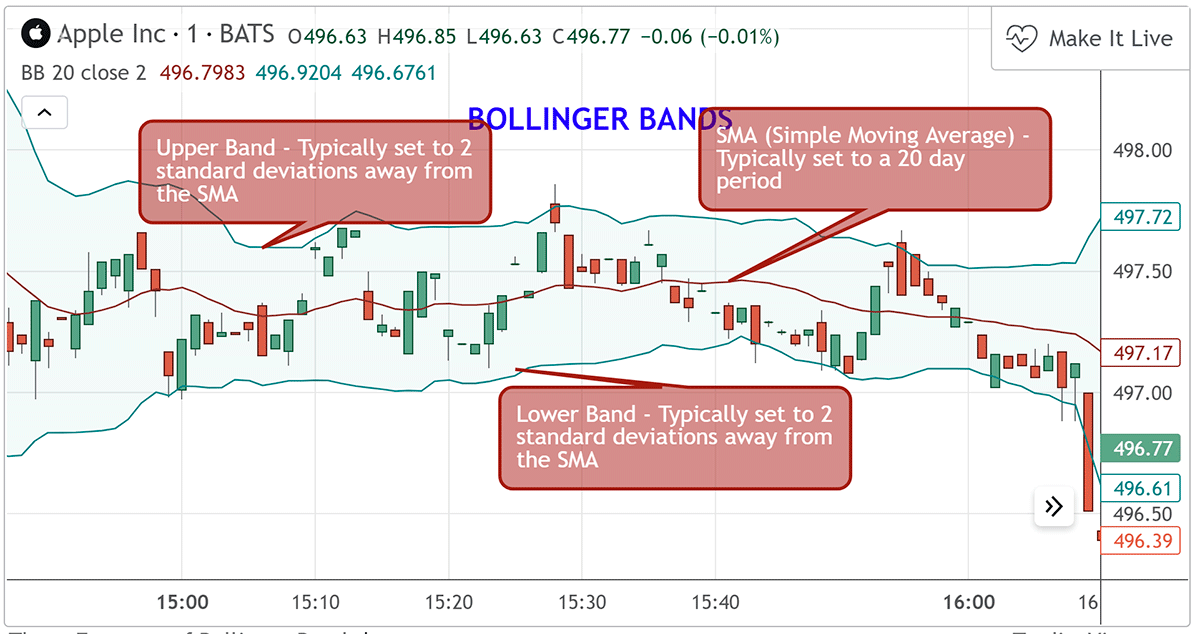

Bollinger Bands consist of three key components: a middle line, an upper band, and a lower band. The middle line is usually a Simple Moving Average (SMA) or Exponential Moving Average (EMA), representing the average price over a specific period. The upper and lower bands are positioned above and below the middle line, and they are typically calculated based on standard deviations.

Bollinger Bands Running Away Candle

Calculating Bollinger Bands

- Middle Line (SMA or EMA): The middle line acts as the baseline for the Bollinger Bands. It helps traders identify the general direction of the trend.

- Upper Band: The upper band is calculated by adding a certain number of standard deviations to the middle line's value. This band indicates potential resistance levels where prices might encounter selling pressure.

- Lower Band: The lower band is calculated by subtracting a certain number of standard deviations from the middle line's value. This band suggests potential support levels where prices might experience buying interest.

Three features of Bollinger Bands Indicator

Interpreting Bollinger Bands

Volatility Indication: When the Bollinger Bands expand, it indicates increased market volatility. Conversely, when the bands contract, it signifies decreased volatility. Volatility is often followed by price movements, and traders can use Bollinger Bands to anticipate potential breakout or reversal points.

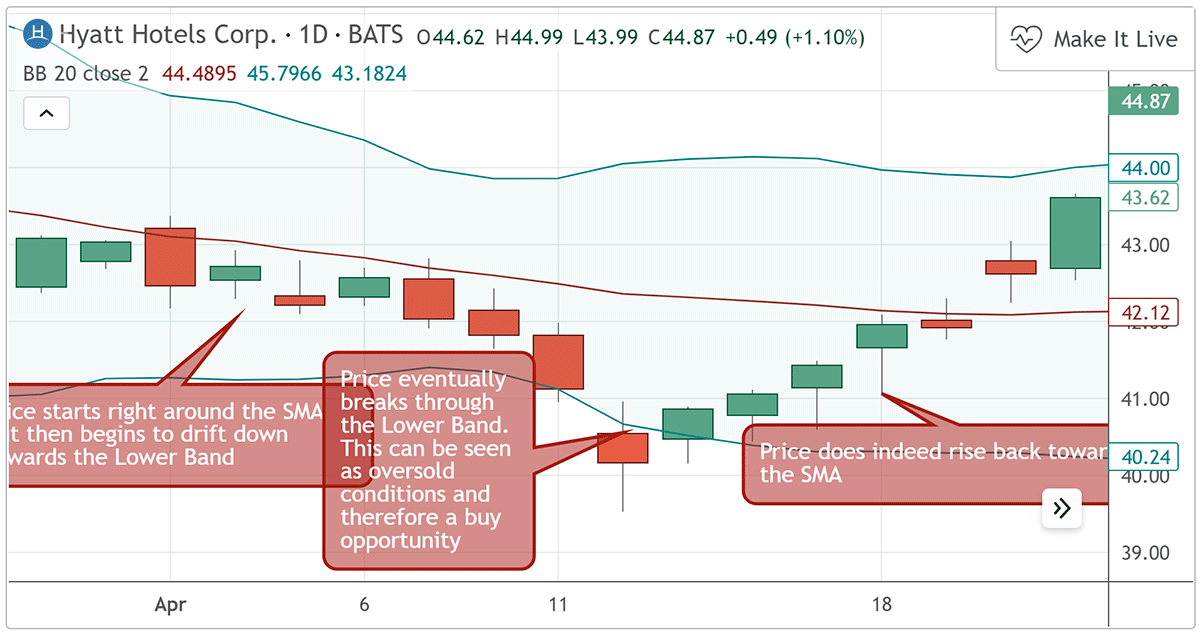

- Potential Price Reversals: Touching Bands: If the price touches or crosses the upper band, it suggests that the market might be overbought, potentially signaling an impending reversal or price correction. Similarly, when the price touches or crosses the lower band, it indicates potential oversold conditions and a possible price rebound.

- Price Consolidation: When prices trade within the bands, it suggests a period of price consolidation or ranging. Traders might expect a breakout when the bands begin to expand again.

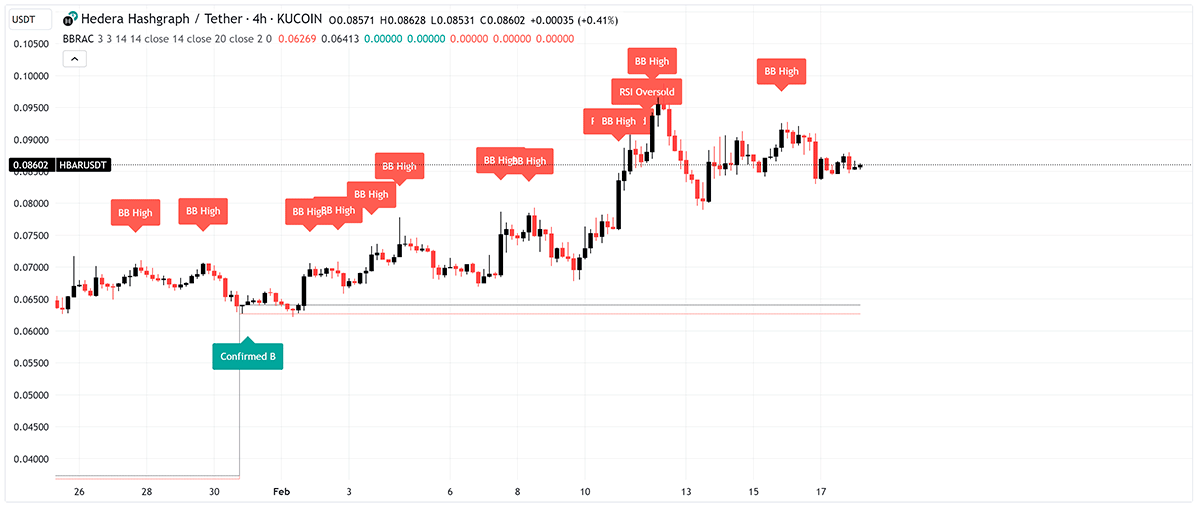

- Confirmation with Other Indicators: Traders often combine Bollinger Bands with other indicators, such as RSI or MACD, to confirm potential trading signals. For example, if prices touch the upper band while the RSI indicates overbought conditions, it strengthens the signal that a reversal might be imminent.

Bollinger Bands: prices move down near the lower band

Application of Bollinger Bands

- Trend Identification: Bollinger Bands can help traders identify trending and ranging market conditions. During trends, prices tend to hug one band, while during ranges, they move between the upper and lower bands.

- Breakout Strategies: Traders use Bollinger Bands to identify potential breakout points when volatility increases, and prices move outside the bands.

- Reversal Signals: Bollinger Bands can indicate potential reversal points when prices touch or cross the bands, especially in conjunction with other technical indicators.

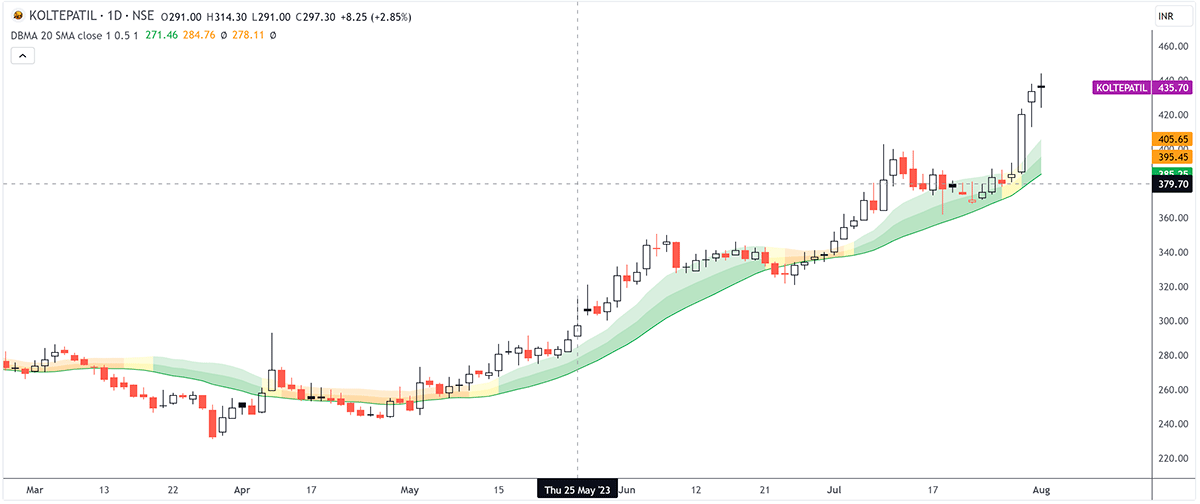

Dual Bollinger Moving Average

Conclusion

Bollinger Bands are a versatile technical tool that provides traders with insights into volatility, potential price reversals, and breakout points. They enhance trading strategies by helping traders identify market conditions and anticipate potential price movements. However, like any technical indicator, Bollinger Bands should be used in conjunction with other analysis methods to make well-informed trading decisions.

Discover how to interpret forex charts like a seasoned trader. We'll guide you through the anatomy of candlestick patterns, trend lines, and technical indicators that illuminate market trends. Learn how to spot potential breakouts, reversals, and trend continuations using chart patterns. With our expert insights, you'll have the tools you need to navigate the forex market with confidence.