In the dynamic world of trading, a trader's mental equilibrium is pivotal to decision-making and consistent profit growth. Here, we delve into the essence of trading psychology, the prevalent psychological barriers traders face, and how to transition to a success-oriented mindset. Understanding Trading Psychology Trading psychology revolves around a trader's responses to market fluctuations and external variables influencing their trades. It's not just raw intellect that paves the way to success but also attributes like patience, perseverance, discipline, and mental wellness.

Reactions to market shifts vary among traders. For example, when a stock price plummets, some may hastily sell, while others, seeing an opportunity, might buy, expecting a price rebound.

Broadly, traders fit into psychological categories:

- Impulsive Traders: These traders act without thorough planning, often making swift decisions that might result in emotional and potentially detrimental trades.

- Cautious Traders: They meticulously assess the market and their financial standing before trading. Generally emotionally stable, they sometimes might miss out on high-reward, high-risk opportunities.

- Pragmatic Traders: Striking a balance, they understand risk management and trade confidently.

Recognizing which category resonates with you can offer insights into your trading outcomes.

Consistently profitable trading requires mastery over one's emotions. Yet, many struggle to control their emotions and maintain optimism. So, what are the psychological pitfalls that hinder stable profits? The Psychological Hurdles in Trading Though traders are diverse, many face similar mental challenges owing to our shared human nature.

Here are the common mental pitfalls:

- Random Reinforcement: When novices unexpectedly profit and experts face consecutive losses, it might be mere luck. Yet, some attribute it to their skills or lack thereof, leading to overconfidence or crippling self-doubt.

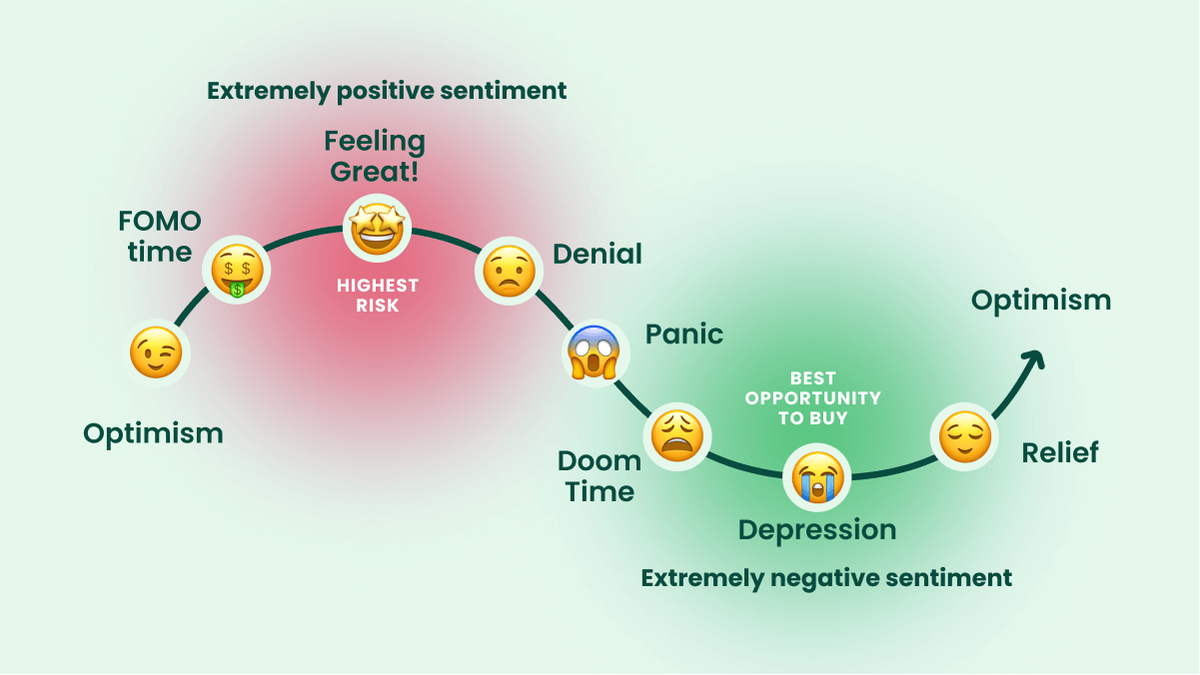

- Fear of Missing Out (FOMO): Nearly every trader has encountered FOMO. Lured by influencers and news, they can discard their trading strategies, resulting in panic trades, losses, and bewilderment.

- Revenge Trading: After a series of profitable trades, a sudden significant loss can spur traders to recklessly attempt to recover losses, often exacerbating their situation.

- Discipline Deficit: Properly timing market entry and exit is vital. Indiscipline can lead to premature decisions, preventing optimal profits.

- Trading as Gambling: Some approach trading like a game of chance rather than a calculated venture, leading to hasty decisions and significant losses.

- Herd Mentality: Many traders, fearing failure, base decisions on popular consensus rather than detailed market analysis, resulting in losses.

Navigating these challenges requires nurturing a robust trading psychology.

Cultivating a Prosperous Trading Mindset Given the weight of trading psychology, how can one remain buoyant amidst volatile markets?

Here's a toolkit:

- Stay Disciplined: Structure and discipline can temper emotions, fostering focus and strategy adherence.

- Establish Goals: Setting tangible targets, such as risk thresholds and profit goals, can guide and motivate traders.

- Adhere to Your Strategy: A comprehensive trading plan and strategy minimize impulsive decisions.

- Monitor Performance: A trading journal can offer valuable insights into past trades and guide future decisions.

- Engage in Thorough Analysis: Before trading, analyze the market using various tools to make informed decisions.

- Be Adaptable: Markets are fluid. Stay informed, be ready to modify strategies, and remain emotionally detached.

- Develop Risk Acumen: Accept that losses are part and parcel of trading, and refine your risk-taking approach.

- Prioritize Mental Health: Address psychological challenges, consider therapy, meditation, or other activities that enhance mental well-being.

- Continuously Learn: Stay updated with market trends, engage in research, and seek advice from seasoned traders.

Why Positive Trading Psychology Matters Trading, at its core, is predicting price movements. Given the unpredictability of markets, failures are inevitable. Understanding and accepting this uncertainty can alleviate the burden of blame, preventing negativity and burnout. Trading is fundamentally probabilistic. Life, too, has its uncertainties. Embrace setbacks, learn, and jump back into the fray. A positive outlook and acceptance are integral to success in trading and life.

In Conclusion

The psychological facets of trading are delicate yet paramount. Various challenges can hinder steady profits. For success, it's imperative to nurture mental resilience, remain disciplined, continuously learn, and adhere to trading strategies. Coupled with psychological self-care, these strategies can bolster positivity and facilitate financial growth.