What is your angle when trading in the financial markets? Do you opt for the technical analysis strategy or are you a "fundamentalist" when it comes to trading? To be in a better position to control your trades, it’s important to keep improving both your technical analysis and your fundamental analysis skills. This can give you a more holistic picture of the markets and eventually give you the edge you need to seize the moment.

If you continue reading below, this article will offer you a better understanding of technical analysis and the benefits of implementing it into your trading strategies.

What is Technical Analysis?

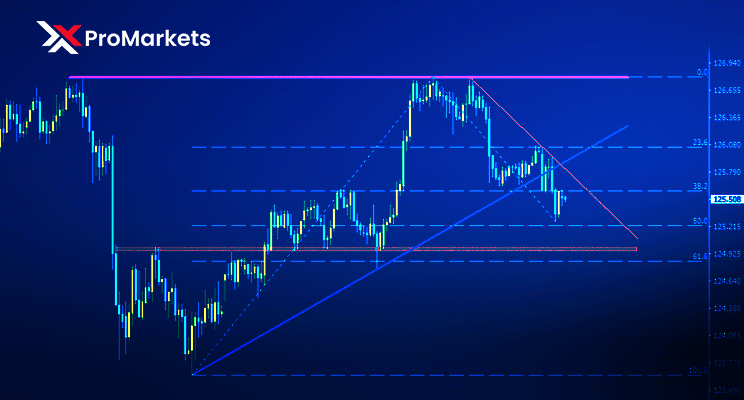

In technical analysis, price patterns and trends are observed on charts to evaluate investments and identify trading opportunities. Technical analysts monitor past trading activity and price changes and utilize them as effective indicators of a security's future price. In other words, this type of analysis is all about looking closely at charts and price movements with the aim to have a better picture of what is to come in the future.

Technical VS Fundamental Analysis

The basic principle that will help you remember the difference between these two main schools of thought when it comes to trading analysis is that one analyzes data and the other analyzes the news. Technical analysis looks at data gathered from price movements and trends of CFDs in an attempt to predict future price movements.

On the other hand, fundamental analysis focuses on economic news and market updates that impact your assets. Every economic event has the power to change the market overview.

This is why traders need to stay up to date with everything that has to do with the global economy because this can help them think out their next move more easily and effectively.

Basic Technical Analysis Indicators

Technical analysis trading can be supported by a wide range of patterns and signals developed through research. Various types of trading systems have also been developed by technical analysts to help them forecast price movements. There are many indicators available for identifying current market trends, including support and resistance areas, as well as those that assess the strength and longevity of a trend.

The following are some of the most common technical indicators and chart patterns: Trendlines, Channels, Momentum Indicators, and Moving Averages.

Level up your Trades

Want to build your ultimate trading strategy? Focus on combining technical and fundamental analysis so you can increase your confidence in the markets. Your XPro Markets account grants you access to Trading Central’s cutting-edge technical indicators and your real-time economic calendar to keep track of your trades. Log in now to find out more!