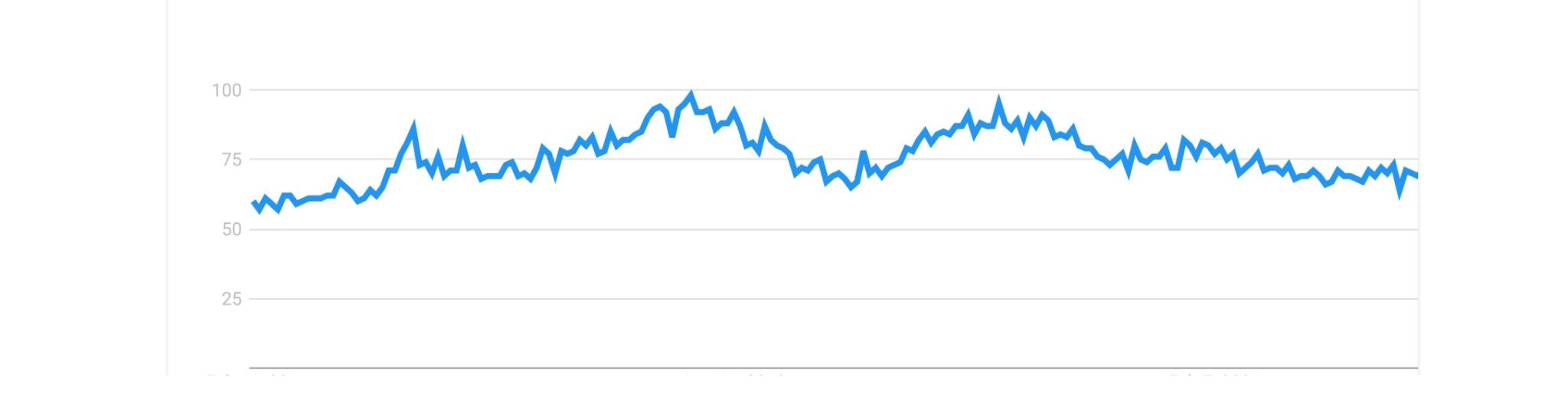

Forex trading has been around since the 1970s but with the advancement of technology, and the advent of online trading platforms across the years, its popularity has been growing exponentially. This can be evidenced by the topic of Forex peaking in popularity globally every year according to Google Trends.

As interest in Forex trading continues to grow, this article will serve as an introductory guide for new aspiring traders.

What is Forex?

So, let’s begin with a simple question, what is Forex? Forex (FX) is short form for foreign exchange which represents the global currency markets. There is an array of entities that participate within the FX markets, and they include central banks, financial institutions, hedge funds, and individual investors or traders.

Hence, Forex trading refers to market participants buying or selling different currencies mostly to seek monetary gain. Through the fluctuations in exchange rates, market participants will speculate if one currency will increase or decrease in value compared to another.

Even though there are more than 160 official currencies globally [3], only 4 are widely traded. These currencies are:

- US Dollar (USD)

- Great British Pound (GBP)

- Japanese Yen (JPY)

- Euro (EUR)

Why Trade Forex?

As the largest financial market in the world in terms of trading volume, liquidity, and value, the FX market provides countless of trading opportunities for traders to take advantage of. Through the years, the total value of the FX market has been increasing with no signs of stopping. As of 2022, the average daily trade volume is USD$6.6 trillion. The increasing liquidity equates to quicker and easier transactions with low spreads for traders.

The trading hours of the FX markets is another good reason to be trading Forex. Open for 24 hours throughout all 5 weekdays, this gives traders the convenience to select a timing suitable for them. The ability to both buy and sell also allows for increased trading opportunities under various market conditions. Not only can traders take advantage on the rising currency prices, we can also make a winning trade by selling when one currency depreciates against another.

Last but not least, you can employ leverage when trading forex in order to make larger trades with a smaller amount of capital. When used properly, coupled with adequate risk-management tools, leverage can potentially magnify your returns. However, you should keep in mind that leverage works as a double-edged sword, which could also lead to great losses.

Interested in trading with the best conditions a broker can offer? Vantage offers forex spreads as low as 0.0, with $0 deposit fees, and a leverage of up to 500:1. Sign up with a demo account here.

When Can You Trade Forex?

The FX markets are available 24 hours a day, open 5 days of the week. Each day is dissected into four major sessions; Sydney, Tokyo, London, and New York. Table 1 below goes into the specific opening and closing timings for each respective session.

Forex Market Session Timings

| Session | Timing (UTC / GMT +0) |

| Sydney | 0800 to 1700 |

| Tokyo | 1200 to 2100 |

| London | 2000 to 0500 |

| New York | 0100 to 1000 |

Traders would usually correlate the session timings to the currency pairs they trade. For example, if one were to trade the pair USDJPY, the Tokyo or New York session would fit perfectly.

Conclusion

As an individual trader, it may seem daunting going against other market participants such as huge institutions but fret not. The opportunities available within the FX market will never run short and through constant practise and discipline, traders can potentially excel under different market conditions.

Now that you have learned about the basics of Forex trading, let’s dive into the types of Forex markets available next.