The risk/reward ratio tells you how much risk you are taking for how much potential reward. Good traders and investors choose their bets very carefully. They look for the highest potential upside with the lowest potential downside. If an investment can bring the same yield as another, but with less risk, it may be a better bet. Whether you’re day trading or swing trading, there are a few fundamental concepts about risk that you should understand.

These form the basis of your understanding of the market and give you a foundation to guide your trading activities and investment decisions. Otherwise, you won’t be able to protect and grow your trading account.

Interested to learn how to calculate this for yourself? Let’s read on.

What is the risk/reward ratio?

The risk/reward ratio marks the prospective reward an investor can earn for every dollar they risk on an investment. Many investors use risk/reward ratios to compare the expected returns of an investment with the amount of risk they must undertake to earn these returns. Consider the following example: an investment with a risk-reward ratio of 1:7 suggests that an investor is willing to risk $1, for the prospect of earning $7. Alternatively, a risk/reward ratio of 1:3 signals that an investor should expect to invest $1, for the prospect of earning $3 on their investment.

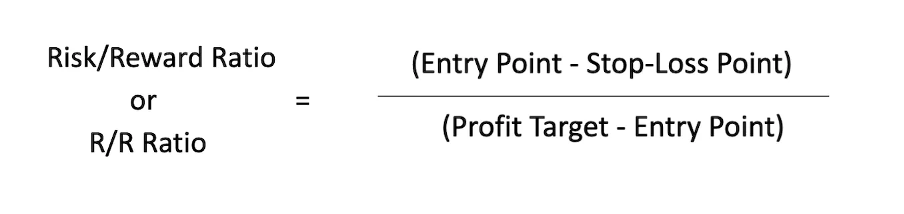

The calculation itself is very simple. You divide your maximum risk by your net target profit. How do you do that? First, you look at where you would want to enter the trade. Then, you decide where you would take profits (if the trade is successful), and where you would put your stop-loss (if it’s a losing trade). This is crucial if you want to manage your risk properly. Good traders set their profit targets and stop-loss before entering a trade.

Now you’ve got both your entry and exit targets, which means you can calculate your risk/reward ratio. You do that by dividing your potential risk by your potential reward. The lower the ratio is, the more potential reward you’re getting per “unit” of risk. Let’s see how it works in practice. It’s worth noting that many traders do this calculation in reverse, calculating the reward/risk ratio instead. Why? Well, it’s just a matter of preference. Some find this easier to understand. The calculation is just the opposite of the risk/reward ratio formula. As such, our reward/risk ratio in the example above would be 15/5 = 3. As you’d expect, a high reward/risk ratio is better than a low reward/risk ratio.

Limitations of the Risk/Reward Ratio

A low risk/reward ratio does not tell you everything you need to know about a trade. You also need to know the likelihood of reaching those targets. A common mistake for day traders is having a certain R/R ratio in mind before analyzing a trade. This can lead traders to establish their stop-loss and profit targets based on the entry point, rather than the value of the security, without taking into account the market conditions surrounding that trade.

Choosing the best risk/reward ratios is a balancing act between taking trades that offer more profit than risk while ensuring the trade still has a reasonable chance of reaching the target before the stop loss.

What Does the Risk/Reward Ratio Tell You?

The risk/reward ratio helps investors manage their risk of losing money on trades. Even if a trader has some profitable trades, they will lose money over time if their win rate is below 50%. The risk/reward ratio measures the difference between a trade entry point to a stop-loss and a sell or take-profit order. Comparing these two provides the ratio of profit to loss, or reward to risk.

Investors often use stop-loss orders when trading individual stocks to help minimize losses and directly manage their investments with a risk/reward focus. A stop-loss order is a trading trigger placed on a stock that automates the selling of the stock from a portfolio if the stock reaches a specified low. Investors can automatically set stop-loss orders through brokerage accounts and typically do not require exorbitant additional trading costs.

Conclusion

We’ve looked at what the risk/reward ratio is and how traders can incorporate it into their trading plan. Calculating the risk/reward ratio is essential when it comes to the risk profile of any money management strategy. What’s also worth considering when it comes to risk is keeping a trading journal. By documenting your trades, you can get a more accurate picture of the performance of your strategies. In addition, you can potentially adapt them to different market environments and asset classes.